Requirements for opening a PayPal business account.

Hello everyone, want to open a PayPal business account? Follow this practical guide to find out the important requirements you need to meet.

First and foremost, you’ll definitely need a business address and phone number. This address must match the one listed on your business documents. You must also have a valid email address that you can contact.

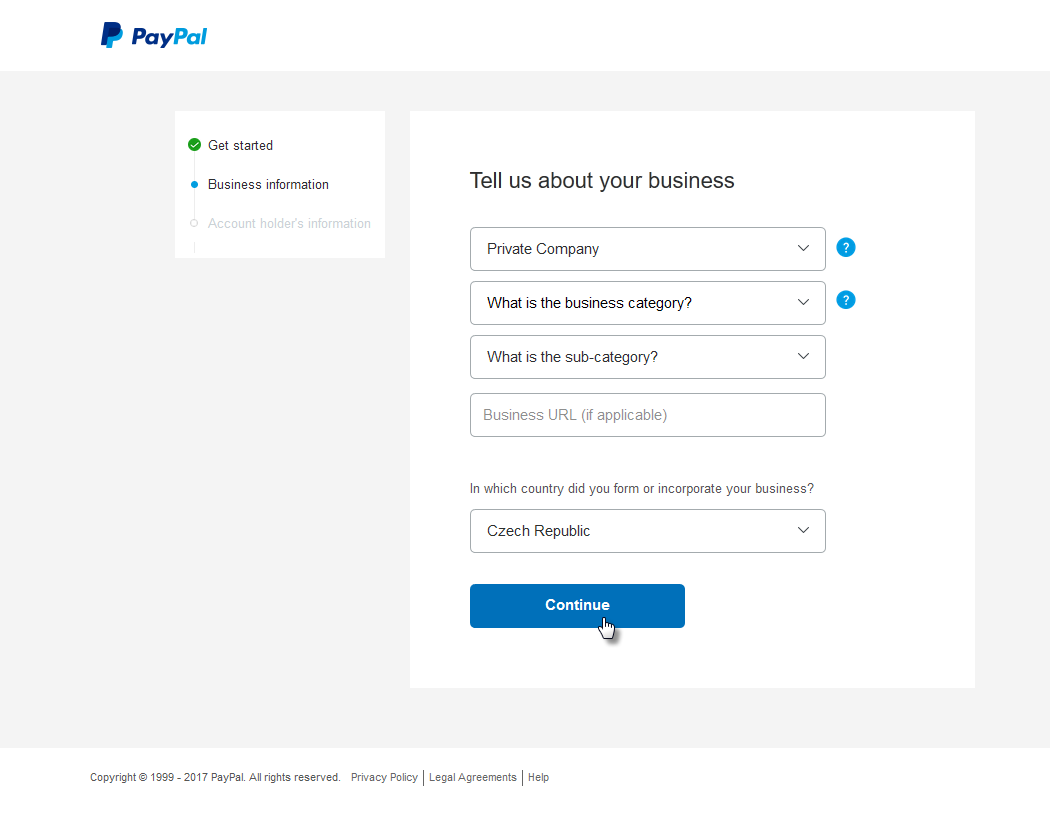

Next, you need to prepare your business information. This includes the business name, business type, and tax identification number (if applicable). PayPal also asks you to provide a brief description of your business.

The next requirement is an identity document. You must provide a copy of a valid identity card, such as a driver’s license or passport. You may also need to provide additional documents, such as a utility bill or bank statement, to verify your identity.

If your business is already registered, you will be asked to provide business registration documents. This may be a certificate of formation, business license, or similar document. Make sure to provide clear, easy-to-read copy.

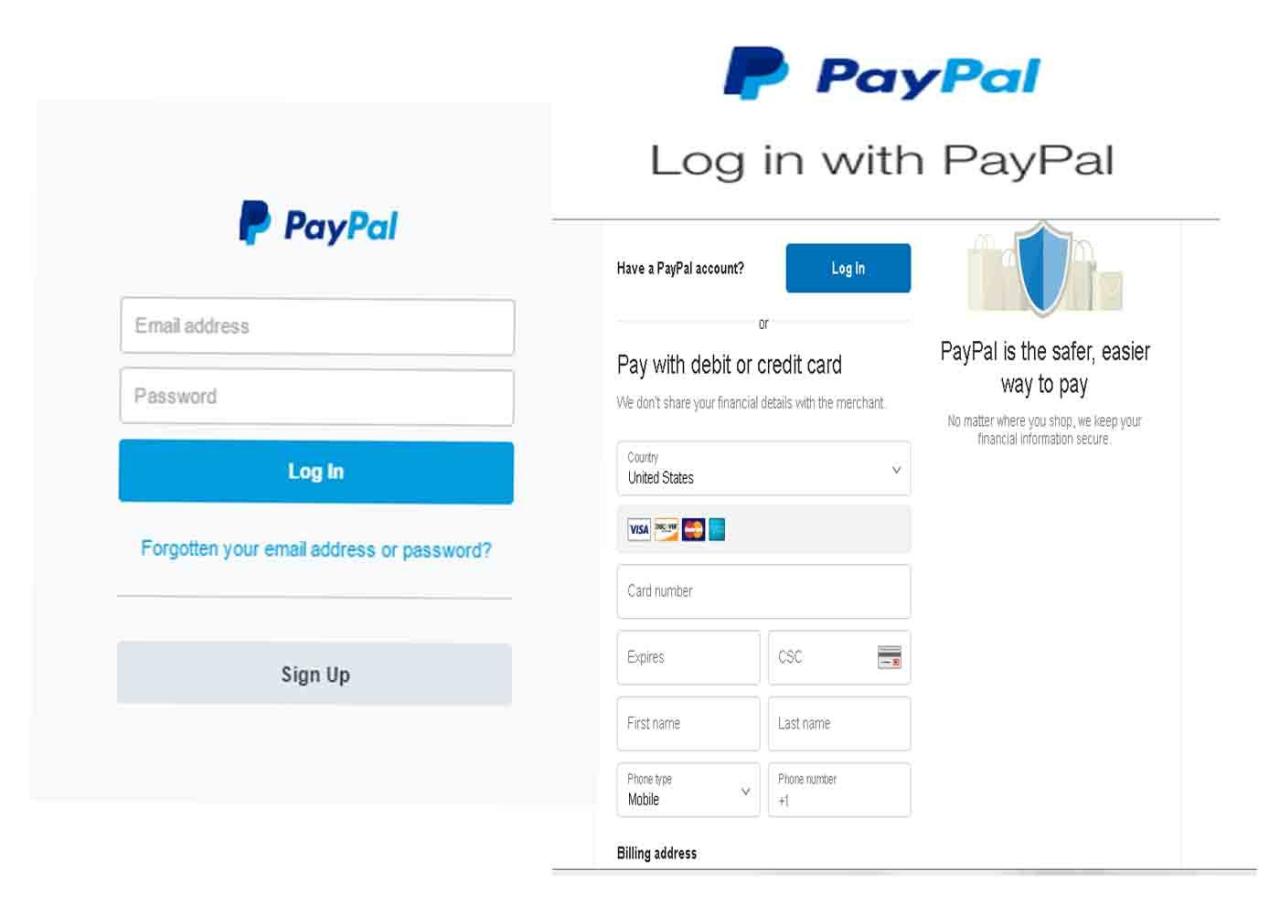

To open a PayPal business account, you must link a bank account or credit card to it. You can use a business bank account or a personal account. Make sure to provide correct and accurate information so that the transaction runs smoothly.

Additionally, PayPal requires you to agree to their Terms and Conditions and Privacy Policy. Take the time to read these documents carefully before checking the approval box.

Once you have provided all the necessary requirements, your PayPal business account will be reviewed. The review process usually takes several business days. If everything goes well, you will be notified via email that your account is ready to use.

Opening a PayPal business account is relatively easy if you have the necessary documentation. By following these terms carefully, you can quickly start accepting and sending payments for your business through this secure and reliable platform.

Using a personal account for business purposes.

Using a personal PayPal account for business purposes is tempting, considering the ease and convenience. However, it is important to be aware of the risks and limitations associated with this practice. PayPal strictly prohibits the use of personal accounts for business transactions.

If you are caught using your personal account for commercial purposes, PayPal may limit or close your account, freeze funds, and charge additional fees. Additionally, using a personal account for business can create tax issues, as PayPal will report your income to the IRS as personal income.

To avoid this problem, it is recommended to use a dedicated PayPal business account. PayPal business accounts offer a number of advantages over personal accounts, including:

Higher transaction limits

Access to additional services, such as bulk processing and data reporting

Protection from personal liability

Opening a PayPal business account is easy and only requires a few simple steps. You must provide your business information, such as your business name, address, and telephone number. You must also provide proof of your identity and business ownership.

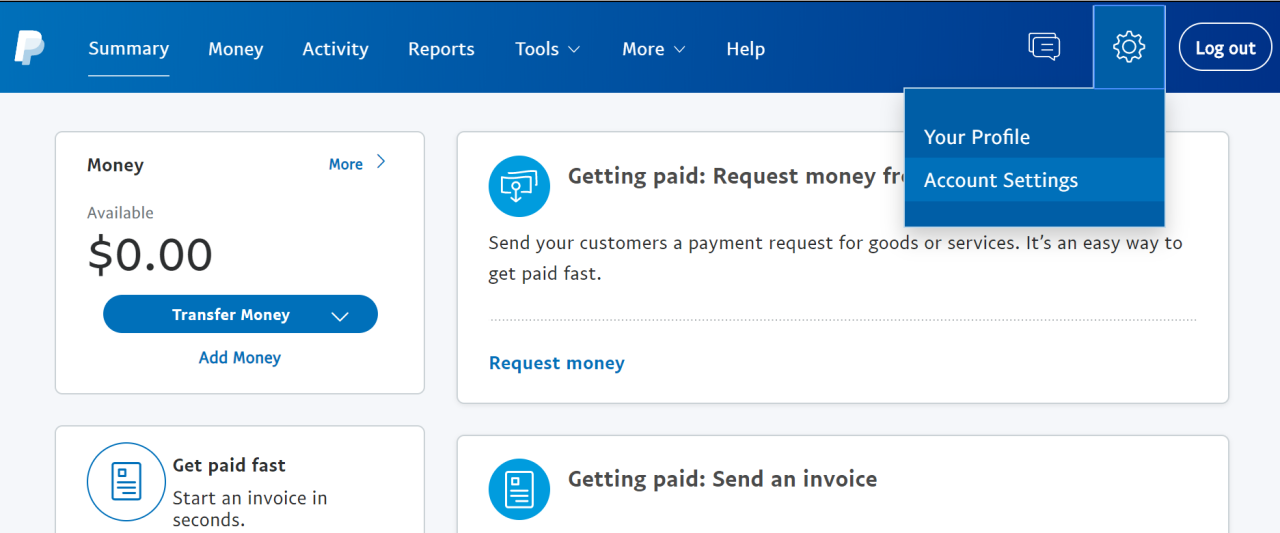

Once your business account is verified, you can start accepting payments from customers. PayPal offers a variety of payment options, including PayPal buttons, PayPal invoices, and PayPal credit card readers.

Using a PayPal business account will ensure that you comply with PayPal’s terms of service and avoid potential risks associated with using a personal account for business purposes. Additionally, a PayPal business account will give you access to features and services that can help you grow your business.

Risks and limitations of using a personal account for business transactions.

Lured by PayPal’s convenience for personal transactions, some business owners are tempted to use their personal accounts for business purposes. However, this is a risky zone that is best avoided.

PayPal does allow personal accounts to accept some business payments, but there are limitations and risks to be aware of. First, personal accounts have lower transaction limits, limiting the sales volume of your business. Second, PayPal may freeze or restrict your account if it detects business activity on a personal account, resulting in loss of access to your funds.

Additionally, personal accounts lack important business features, such as the ability to accept credit card payments or comprehensive tax reporting features. You also risk losing the buyer protection and transaction guarantees available for business accounts.

Therefore, it is very important to open a PayPal business account. PayPal Business Accounts are specifically designed to meet business needs, offering higher transaction limits, expanded payment facilities and advanced financial management features.

By keeping your personal and business transactions separate, you not only minimize risk, but also simplify financial record-keeping and optimize your business cash flow. PayPal provides a step-by-step guide to opening a business account quickly and easily.

Remember, using a personal account for business can cause problems and harm your business. On the contrary, by opening a PayPal business account, you secure your business operations, increase customer confidence, and pave the way for sustainable business growth.

Can I have a PayPal business account without a business?

What is a PayPal Business Account?

PayPal is one of the world’s largest online payment platforms, allowing users to carry out financial transactions online easily and safely. One of the features offered by PayPal is a business account (PayPal Business Account), which is designed specifically for entrepreneurs and small and medium businesses.

What is a PayPal Business Account?

PayPal Business Account is a type of PayPal account designed specifically for businesses and entrepreneurs. With a business account, you can carry out financial transactions online more easily and efficiently. Some of the features offered by PayPal Business Account include:

- Ability to accept payments from customers online

- Ability to manage financial transactions online

- Access to financial reports online

- Ability to monitor and manage cash flow online

- Better customer support

Can I Create a Business PayPal Account Without a Business?

This question is often asked by users who want to create a business PayPal account without having an established business. The answer is yes, you can still create a business PayPal account without having an established business. However, there are a few things to consider:

- The reason you created a business PayPal account without a business

- The type of business you plan to do

- Your need to use a business PayPal account

Reasons to Create a Business PayPal Account Without a Business

Here are some reasons why someone might want to create a business PayPal account without having an established business:

- Prepare yourself to start a business in the future

- Create a business PayPal account for personal purposes, such as receiving payments from friends or family

- Use a business PayPal account to make financial transactions online more easily and efficiently

Types of Business You Can Do with a Business PayPal Account

Here are some types of business that can be done with a business PayPal account:

- Online sales

- Freelance services

- Small and medium business

- E-commerce business

Your Need to Use a Business PayPal Account

Before creating a business PayPal account, you need to consider the following things:

- Do you need a business PayPal account to accept payments from customers online?

- Do you need a business PayPal account to manage financial transactions online?

- Do you need access to financial reports online?

How to Create a Business PayPal Account

Here are the steps to create a business PayPal account:

- Go to the PayPal website and click the “Register” button in the top right corner of the page.

- Select the type of account you want to create, namely a business account.

- Fill out the registration form with the required information, such as name, address and telephone number.

- Verify your email address by clicking the confirmation link sent by PayPal to your email.

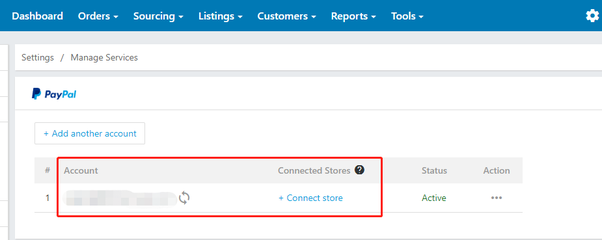

- Add your business information, such as business name, business address, and business phone number.

- Add your bank account information to make financial transactions online.

- Verify your bank account by clicking the confirmation link sent by PayPal to your email.

Advantages and Disadvantages of a Business PayPal Account

Here are the advantages and disadvantages of a business PayPal account:

Advantages of a Business PayPal Account

- Ability to accept payments from customers online

- Ability to manage financial transactions online

- Access to financial reports online

- Better customer support

Disadvantages of Business PayPal Accounts

- Higher transaction fees compared to a personal PayPal account

- The need to have an established business to make the most of the business PayPal account features

- The need to have a bank account to carry out financial transactions online

Conclusion

A business PayPal account can be created without having an established business, but there are several things to consider, such as the reason for creating a business PayPal account, the type of business to be conducted, and the need to use a business PayPal account. With these things in mind, you can create a business PayPal account that suits your needs.