PayPal: Undervalued Stock?

PayPal, the world’s largest online payments company, has seen its share price decline since the start of 2022. However, is this decline an opportunity for investors to buy undervalued shares? In this article, we’ll discuss PayPal’s capabilities, the challenges it faces, and whether its stock is currently undervalued.

Background

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, the company focused on P2P (Peer-to-Peer) payments via email. However, it later developed into a broader online payment platform, including payments for e-commerce transactions, international money transfers, and others.

PayPal is one of the world’s largest online payment companies, with more than 400 million active users worldwide. The company also owns several other brands, such as Venmo, Xoom, and Braintree.

PayPal capabilities

PayPal has several advantages that make it one of the largest online payment companies in the world. Here are some of them:

- Wide User Network : With more than 400 million active users worldwide, PayPal has a very wide user network. This allows companies to offer faster and more secure payment services.

- Perfect Integration with E-commerce : PayPal has integrated with more than 25 million e-commerce merchants worldwide. This allows companies to offer easier and faster payment services to users.

- Complete Payment Services : PayPal offers complete payment services, including payments for e-commerce transactions, international money transfers, and more.

- High Security : PayPal has very high security, with advanced encryption technology and an effective fraud detection system.

Challenges Faced

While PayPal has several advantages, the company also faces several challenges. Here are some of them:

- Tight Competition : The online payments industry is very competitive, with several other companies such as Stripe, Square, and Apple Pay.

- High Transaction Fees : PayPal has higher transaction fees than some other companies, which can make the company less competitive.

- Strict Regulations : The online payments industry is closely regulated by several government agencies, which can cost companies more to meet regulatory requirements.

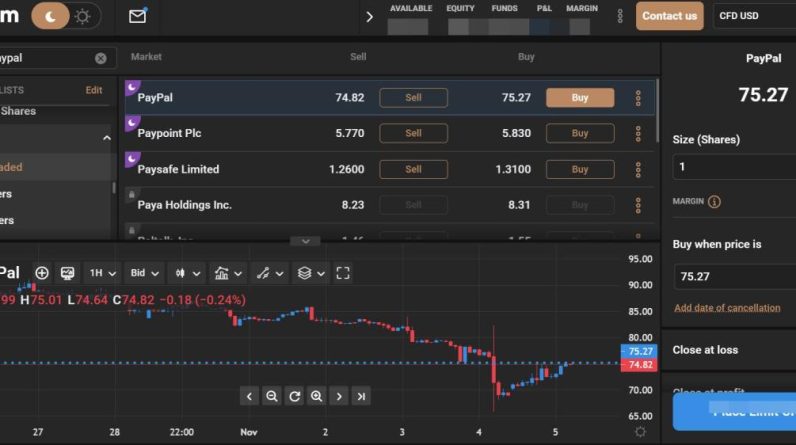

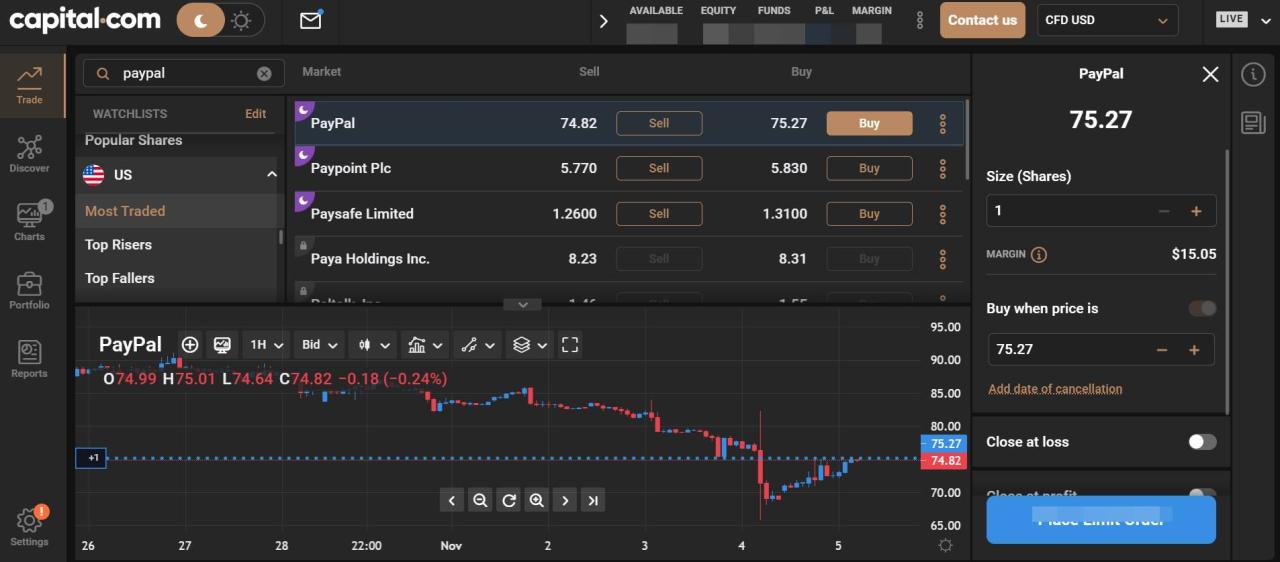

Decrease in Share Prices

PayPal’s share price has declined since the start of 2022, from around $300 per share to around $100 per share. This decline can be attributed to several factors, including:

- Growth Decline : PayPal’s revenue growth has been declining since 2020, which could make investors lose confidence in the company.

- Tight Competition : The online payments industry is increasingly competitive, which can make companies less competitive.

- High Transaction Fees : PayPal’s higher transaction fees than some other companies may make the company less competitive.

Is PayPal Stock Undervalued?

With the share price dropping significantly, some investors may be wondering whether PayPal stock is undervalued. Here are some arguments for and against:

Supporting Arguments :

- Low Prices : PayPal’s share price is currently very low compared to the price at the start of 2022.

- Company Capabilities : PayPal still has excellent capabilities, including a wide user network, seamless integration with e-commerce, and complete payment services.

- Stable Growth : Although PayPal’s revenue growth has slowed, the company is still experiencing steady growth.

Arguments Against :

- Tight Competition : The online payments industry is highly competitive, which can make companies less competitive.

- High Transaction Fees : PayPal’s higher transaction fees than some other companies may make the company less competitive.

- Strict Regulations : The online payments industry is closely regulated by several government agencies, which can cost companies more to meet regulatory requirements.

Conclusion

In conclusion, PayPal’s share price decline can be attributed to several factors, including declining growth, intense competition, and high transaction costs. However, the company still has excellent capabilities, including a wide user network, seamless integration with e-commerce, and complete payment services.

Is PayPal stock undervalued? The answer depends on the perception and analysis of each investor. However, given the low price and excellent performance of the company, some investors may see a drop in share price as an opportunity to buy undervalued shares.