PayPal via Venmo: How to Manage Finances Easily and Safely

In recent years, technology has made major changes in the way we conduct financial transactions. One of the most significant examples is the emergence of digital financial services such as PayPal and Venmo. These two services allow users to carry out financial transactions easily and safely, without having to use cash or credit cards.

In this article, we will discuss how to use PayPal via Venmo, as well as some of the advantages and benefits that can be gained from using this service.

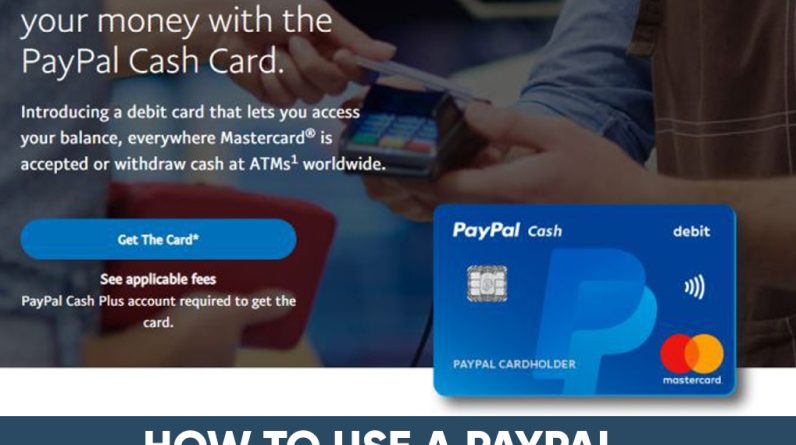

What is PayPal?

PayPal is a digital financial service that allows users to carry out financial transactions easily and safely. This service was founded in 1998 and has now become one of the largest digital financial services in the world. PayPal allows users to carry out financial transactions such as money transfers, online payments, etc.

What is Venmo?

Venmo is a digital financial service that allows users to make financial transactions easily and safely. This service was founded in 2009 and has now become one of the most popular digital financial services in the United States. Venmo allows users to carry out financial transactions such as money transfers, online payments, etc.

How to Use PayPal via Venmo

To use PayPal via Venmo, users must have both a Venmo account and a PayPal account. Following are the steps that can be followed:

- Open the Venmo app : Users must open the Venmo app on their device.

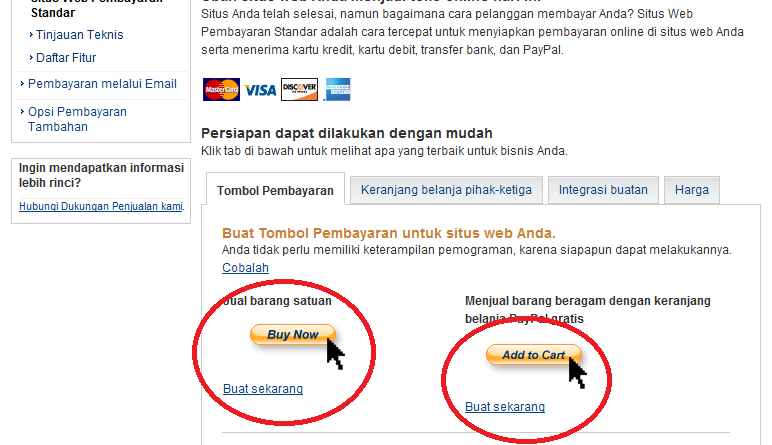

- Determine the purpose of the transaction : Users must specify the purpose of their transaction, such as money transfer or online payment.

- Select a payment method : Users must select the payment method they want to use, such as a Venmo balance or credit card.

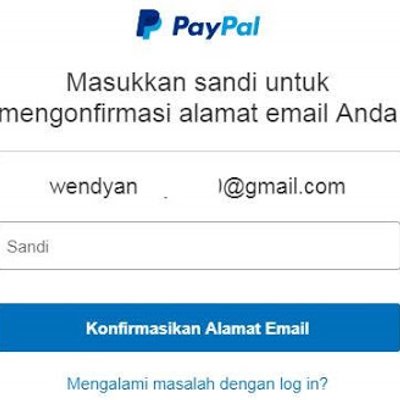

- Enter PayPal information : Users must enter their PayPal account information, such as email address and password.

- Confirm transaction : Users must confirm their transactions by pressing the “Submit” button.

Benefits of Using PayPal over Venmo

Here are some of the benefits of using PayPal over Venmo:

- Easy and safe : Financial transactions can be done easily and safely via the Venmo application.

- Save time : Users can carry out financial transactions quickly and efficiently.

- Cost effective : Users do not need to pay additional fees to carry out financial transactions.

- Can be accessed from anywhere : The Venmo application can be accessed from anywhere, so users can make financial transactions anytime and anywhere.

Benefits of Using PayPal over Venmo

Here are some benefits of using PayPal over Venmo:

- Increase transaction security : Financial transactions can be carried out more safely through the Venmo application.

- Increase transaction efficiency : Users can carry out financial transactions more quickly and efficiently.

- Increase ease of access : The Venmo application can be accessed from anywhere, so users can make financial transactions anytime and anywhere.

- Increase transaction flexibility : Users can carry out financial transactions in various ways, such as money transfers, online payments, etc.

Conclusion

In conclusion, using PayPal over Venmo can help users make financial transactions easily and safely. This service allows users to carry out financial transactions such as money transfers, online payments, and others. By using PayPal over Venmo, users can increase transaction security, increase transaction efficiency, increase ease of access, and increase transaction flexibility.

FAQs

Here are some frequently asked questions about PayPal over Venmo:

- What are the advantages of using PayPal over Venmo?

The advantages of using PayPal over Venmo are that it is easy and safe, time-saving, cost-effective, and can be accessed from anywhere. - How do I use PayPal over Venmo?

The way to use PayPal via Venmo is to open the Venmo application, determine the transaction destination, select a payment method, enter PayPal information, and confirm the transaction. - What are the benefits of using PayPal over Venmo?

The benefits of using PayPal over Venmo are increasing transaction security, increasing transaction efficiency, increasing ease of access, and increasing transaction flexibility. - Is PayPal over Venmo safe?

Yes, PayPal via Venmo is a safe and reliable digital financial service.