PayPal: Introduction, History, and Features

PayPal is one of the largest and most popular online payment services in the world. With more than 400 million active users, PayPal has become an integral part of e-commerce and online transactions. In this article, we will discuss an overview of PayPal, its history, features, and benefits.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, this company was called Confinity, which focused on payment technology via PalmPilot devices. However, in 2000, Confinity merged with X.com, an online financial company founded by Elon Musk. After the merger, the company changed its name to PayPal.

In 2002, PayPal was acquired by eBay for 1.5 billion US dollars. eBay uses PayPal as the primary payment method for transactions on its platform. In 2015, eBay spun off PayPal into an independent company, which it later sold to stock activist Carl Icahn.

PayPal Features

PayPal offers various features that make it easier for users to carry out online transactions. Here are some of PayPal’s main features:

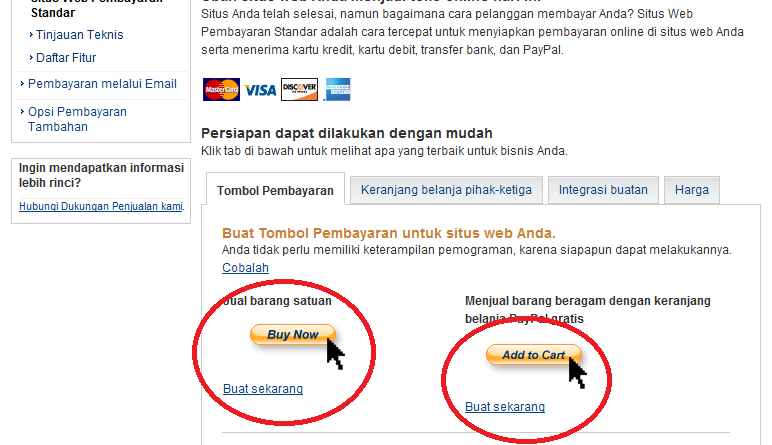

- Instant Payments : PayPal allows users to make instant payments to online sellers or to friends and family.

- Money Transfer : Users can transfer money from a bank account or credit card to a PayPal account.

- Recurring Payments : PayPal allows users to make recurring payments, such as subscription payments or monthly bills.

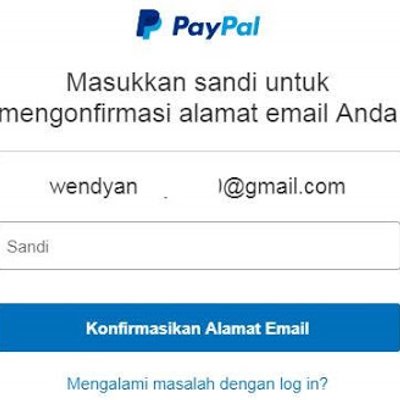

- Transaction Security : PayPal offers strict transaction security, including data encryption and identity verification.

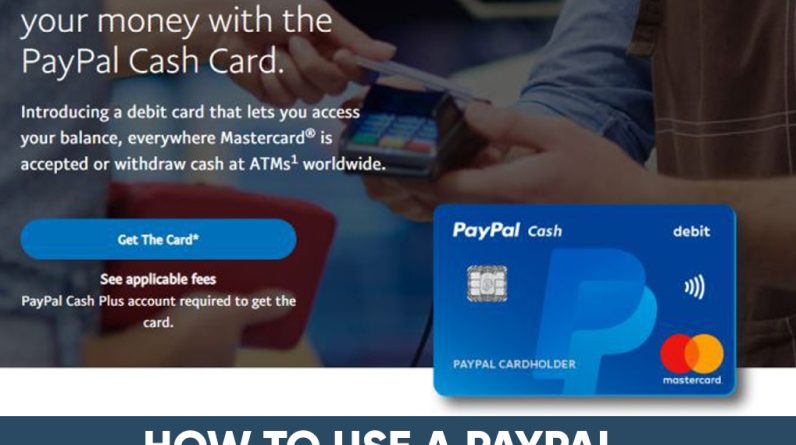

- PayPal Debit Card : Users can order a PayPal debit card that can be used to make online or offline payments.

- Mobile Application : PayPal has a mobile app that allows users to make transactions and monitor their accounts anywhere.

Advantages of PayPal

Here are some of the advantages of PayPal:

- Convenience : PayPal is very easy to use, even for those who have no experience with technology.

- Security : PayPal offers strict transaction security, so users can feel safe when making transactions.

- Flexibility : PayPal allows users to make payments using a variety of methods, including credit cards, debit cards, and bank transfers.

- Global : PayPal can be used worldwide, so users can make transactions with sellers from other countries.

- No Fees : PayPal does not charge fees for users who make payments to online sellers.

Disadvantages of PayPal

Here are some of the disadvantages of PayPal:

- Cost : PayPal charges a fee for users who transfer money to a bank account or credit card.

- Limitation : PayPal has a limit on the amount of money that can be transferred, so users have to make multiple transfers if they want to transfer a large amount of money.

- Dependence : PayPal relies heavily on an internet connection, so users cannot make transactions if they do not have an internet connection.

- Lack of Privacy : PayPal may provide information about user transactions to third parties, so users must be careful when making transactions.

Conclusion

PayPal is a very popular online payment service and has many features that make it easier for users to carry out online transactions. With the convenience, security and flexibility it offers, PayPal has become an integral part of e-commerce and online transactions. However, like any other service, PayPal also has its drawbacks that users should consider. By understanding PayPal’s features, advantages, and disadvantages, users can make wiser decisions when making online transactions.