PayPal International Transaction Fees: A Complete Guide for Users

PayPal is one of the most popular online payment services in the world. With more than 430 million active users, PayPal allows us to carry out financial transactions easily and safely, both domestically and internationally. However, like other services, PayPal also has international transaction fees that users need to understand. In this article, we’ll cover PayPal’s international transaction fees in full, including what international transaction fees are, how they work, and how to save on fees.

What are PayPal International Transaction Fees?

PayPal international transaction fees are fees charged to users when conducting financial transactions with recipients located in other countries. These fees are usually charged as a percentage of the transaction value, and usually include currency conversion fees.

How PayPal International Transaction Fees Work

PayPal’s international transaction fees can be divided into several components, namely:

- Transaction Fees : This is the fee charged by PayPal for each international transaction. This fee is usually 0.3% to 2% of the transaction value.

- Currency Conversion Fees : When making international transactions, you may need to convert currencies. PayPal will charge a currency conversion fee of 2.5% to 4.5% of the transaction value.

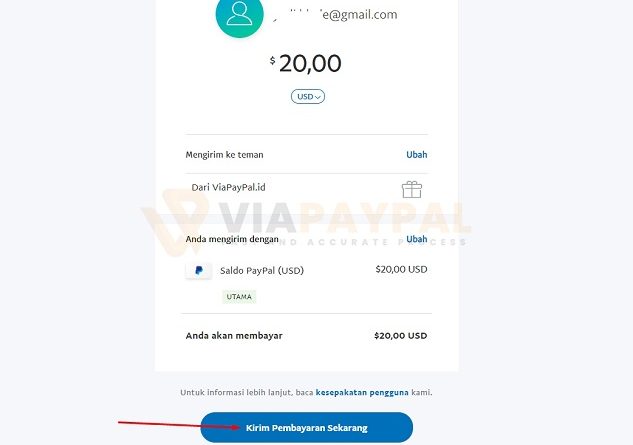

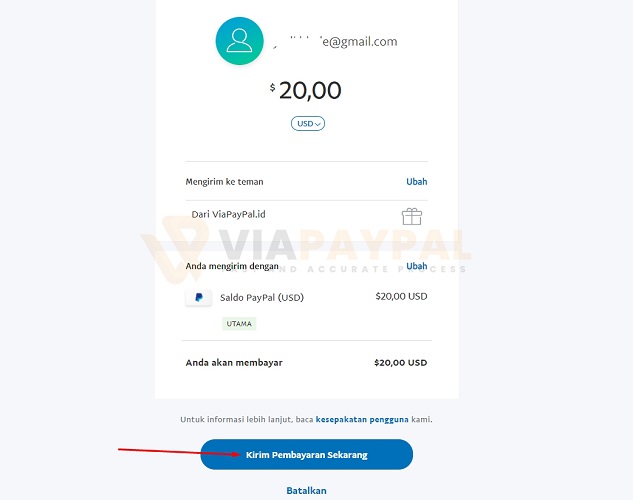

- Money Transfer Fees : If you want to send money to a recipient in another country, PayPal will charge a remittance fee of 0.3% to 2% of the transaction value.

How to Save on PayPal International Transaction Fees?

Although PayPal’s international transaction fees can be quite substantial, there are several ways to save on fees. Here are some tips that can help:

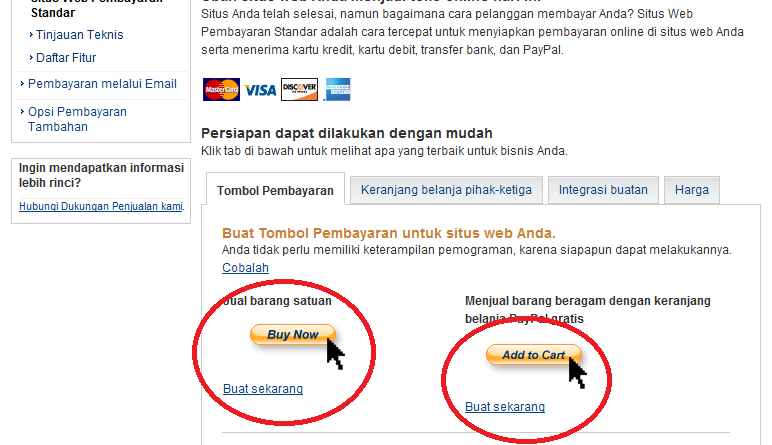

- Use a Business PayPal Account : If you have a business PayPal account, you can enjoy lower transaction fees of 0.3% to 1.5% of the transaction value.

- Use the Right Payment Method : Make sure you use the correct payment method for international transactions. For example, if you want to send money to a recipient in another country, use the cheapest money transfer method.

- Convert Currency Wisely : If you need to convert currency, make sure you use the cheapest currency conversion service.

- Avoid Small Transactions : If you want to make international transactions, make sure you make large transactions to save costs.

- Use Alternative Services : If you want to send money to a recipient in another country, you can use alternative services such as TransferWise or Revolut which offer lower transaction fees.

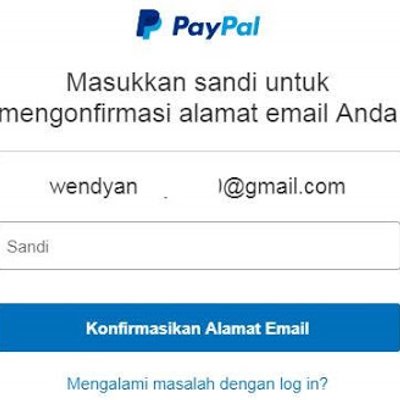

PayPal International Transaction Fees for Indonesian Users

If you are a PayPal user from Indonesia, you need to know that PayPal international transaction fees can vary depending on the type of transaction and payment method used. Here are some examples of PayPal international transaction fees for Indonesian users:

- International transaction fees for online payments: 0.3% to 2% of transaction value

- International transaction fees for remittances: 0.3% to 2% of the transaction value

- Currency conversion fee: 2.5% to 4.5% of transaction value

Conclusion

PayPal’s international transaction fees can be a significant expense if you make international transactions regularly. However, by understanding how PayPal’s international transaction fees work and using the tips mentioned above, you can save on fees and make international transactions more efficiently. Don’t forget to check PayPal’s international transaction fees before making a transaction, and make sure you use the cheapest and most secure service.