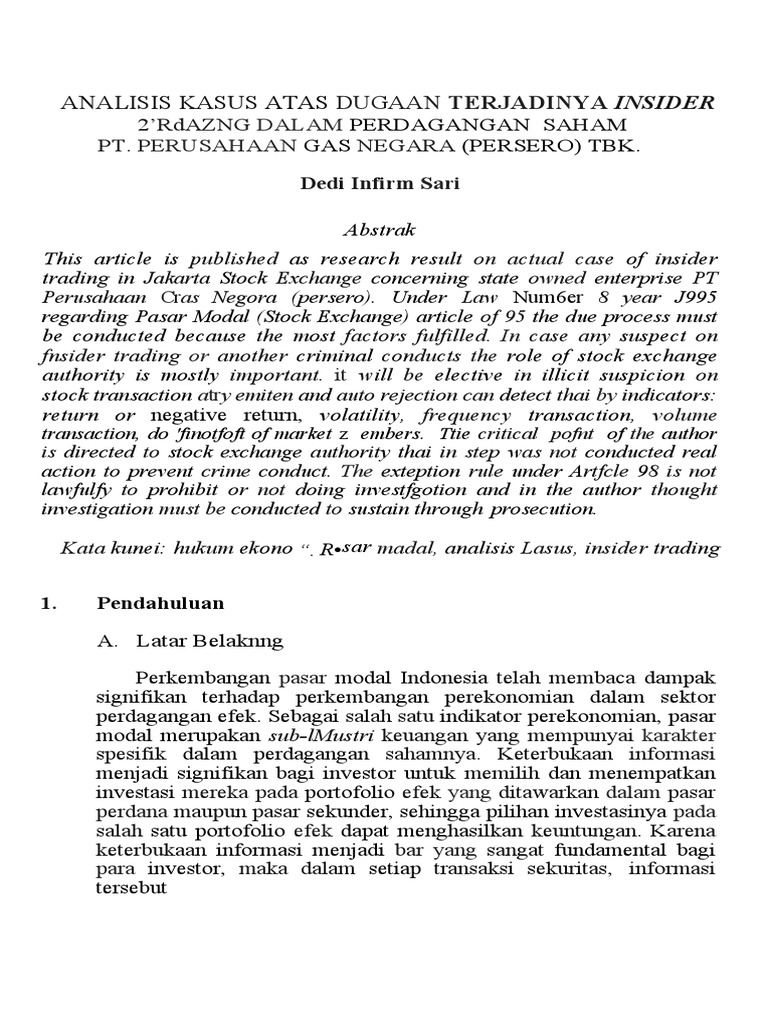

The Case of Insider Trading on PayPal: Important Lessons in Ethics and Compliance

Have you heard about the insider trading case at PayPal? This case involved the misuse of confidential information in stock trading and had a significant impact on financial markets. In this article, we’ll discuss the PayPal case, the important lessons learned, and how to avoid similar cases in the future.

PayPal Case Background

PayPal is a leading fintech company founded in 1998. The company was originally called Confinity and was founded by Peter Thiel and Max Levchin. PayPal allows users to make online transactions easily and safely. In 2002, PayPal was acquired by eBay and became one of eBay’s main subsidiaries.

In 2015, PayPal broke away from eBay and became an independent company. Since then, PayPal has continued to grow and become one of the largest fintech companies in the world. However, in 2020, PayPal was involved in an insider trading case involving one of the company’s former employees.

The Case of Insider Trading on PayPal

The insider trading case at PayPal involved a former company employee named Gregory Kreuzberger. Kreuzberger worked as an analyst in PayPal’s Finance and Strategy division since 2016. In 2020, Kreuzberger decided to leave PayPal and join another company.

However, before leaving PayPal, Kreuzberger had access to confidential information about the company. This information includes the company’s plans to carry out acquisitions and suspension of shares. Kreuzberger used this information to trade PayPal shares and make huge profits.

Investigation and Penetration

This case was first reported by the United States Securities and Exchange Commission (SEC) in August 2020. The SEC launched an investigation into Kreuzberger and found that he had made trades in PayPal shares based on confidential information.

The SEC also discovered that Kreuzberger had shared confidential information with his friends and that they had also traded PayPal shares. The total profit earned by Kreuzberger and his friends was approximately $230,000.

Case Impact

The insider trading case at PayPal had a significant impact on financial markets. This case shows that misuse of confidential information can occur in any company, even in large and reputable fintech companies like PayPal.

This case also shows the importance of ethics and compliance in business. Misuse of confidential information can damage investor confidence and harm the company. Therefore, companies must have a strong compliance system to prevent similar cases in the future.

Important Lessons

The case of insider trading at PayPal provides some important lessons about ethics and compliance in business. Here are some of them:

- Confidential information must be protected : Confidential information about the company must be properly protected. Companies must have a strong compliance system to prevent misuse of confidential information.

- Ethics and compliance are important : Ethics and compliance are important in business. Companies must have a strong ethical culture and ensure that all employees understand the importance of ethics and compliance.

- Investors must be alert : Investors must be alert to misuse of confidential information. Investors should do good research before making an investment and ensure that the company they invest in has a good reputation.

- Companies must have a strong compliance system : Companies must have a strong compliance system to prevent misuse of confidential information. This compliance system must include employee training, monitoring, and action against violations.

Avoiding Similar Cases in the Future

To avoid similar cases in the future, companies must have a strong compliance system and ensure that all employees understand the importance of ethics and compliance. Here are some steps that companies can take:

- Employee training : Companies should provide good employee training on ethics and compliance. This training should cover the importance of ethics and compliance, as well as ways to prevent misuse of confidential information.

- Monitoring : Companies must carry out good monitoring of employee activities. This monitoring must include monitoring stock trading and misuse of confidential information.

- Action against violations : Companies must have firm action against ethical and compliance violations. These actions should include disciplinary action and suspension of employees who violate ethics and compliance.

- Ethical culture : Companies must have a strong ethical culture. This ethical culture must include strong ethical values and ensure that all employees understand the importance of ethics and compliance.

By having a strong compliance system and ensuring that all employees understand the importance of ethics and compliance, companies can avoid similar cases in the future.