Sending Money from PayPal to Zelle: Complete Guide

In recent years, digital payment technology has developed rapidly. One example is PayPal and Zelle, two popular online payment platforms used by millions of people around the world. However, there are times when we need to send money from one platform to another. In this article, we will talk about how to send money from PayPal to Zelle.

What is PayPal?

PayPal is an online payment platform that allows users to send and receive money electronically. Founded in 1998, PayPal has become one of the largest online payment platforms in the world. Users can send money to bank accounts, credit cards, or also to other PayPal accounts.

What is Zelle?

Zelle is an online payment platform that allows users to send money electronically to other bank accounts. Founded in 2016, Zelle has become one of the most popular online payment platforms in the United States. Zelle allows users to send money to other bank accounts quickly and securely.

Why Send Money from PayPal to Zelle?

There are several reasons why we need to send money from PayPal to Zelle. Here are some examples:

- Limitations of payment methods : PayPal has some payment method limitations, such as not being able to send money directly to certain bank accounts. By sending money to Zelle, users can send money to other bank accounts more easily.

- Lower costs : The cost of sending money from PayPal to Zelle can be lower compared to other payment methods.

- Transfer speed : Zelle allows users to send money quickly and securely.

How to Send Money from PayPal to Zelle

Sending money from PayPal to Zelle is relatively easy. Here are the steps:

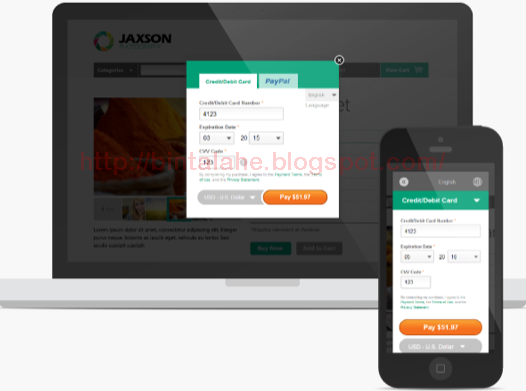

- Open the PayPal application : Open the PayPal app on your mobile device or access it via the website.

- Select a payment method : Select the payment method you want to use, namely a bank account or credit card.

- Add a Zelle account : Add Zelle account as destination bank account.

- Enter the amount of money : Enter the amount of money you want to send.

- Confirmation : Confirm the transaction and wait a few moments until the money is transferred to the Zelle account.

Fees for Sending Money from PayPal to Zelle

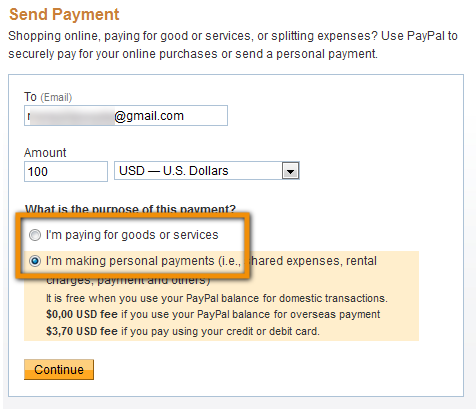

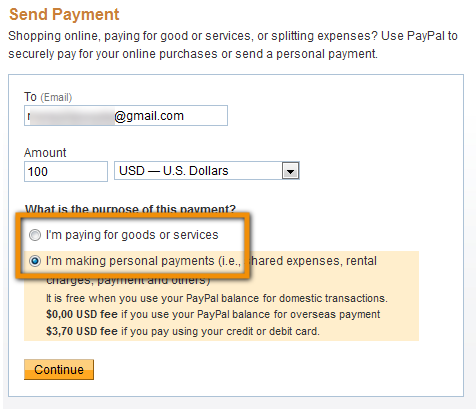

The cost of sending money from PayPal to Zelle can vary depending on the payment method used. Here are some examples of costs:

- Fee for sending money from a PayPal account to a Zelle account: 2.9% + 0.30 USD

- Fee for sending money from a PayPal credit card to a Zelle account: 3.9% + 0.30 USD

Security Sending Money from PayPal to Zelle

Sending money from PayPal to Zelle is relatively safe. Both platforms have strong security systems to protect user transactions. However, there are several things that need to be considered to increase transaction security:

- Use a strong and unique password.

- Enable two-factor authentication (2FA).

- Check the destination account before sending money.

Conclusion

Sending money from PayPal to Zelle is relatively easy and safe. By fulfilling several conditions and necessary steps, users can send money quickly and with low fees. However, keep in mind that transaction fees and security may vary depending on the payment method and destination account.

FAQs

Q: Can I send money from PayPal to Zelle without fees?

A: No, the cost of sending money from PayPal to Zelle can vary depending on the payment method used.

Q: How long does it take to send money from PayPal to Zelle?

A: The time it takes to send money from PayPal to Zelle may vary depending on the payment method used. However, transactions can usually be processed within a few minutes.

Q: Can I send money from PayPal to Zelle if I don’t have a bank account?

A: Yes, you can send money from PayPal to Zelle using a credit card or other PayPal account.

Q: Can I send money from PayPal to Zelle abroad?

A: Yes, you can send money from PayPal to Zelle abroad, but you need to make sure that the destination Zelle account can receive money from abroad.