Title: Opening a PayPal Account: A Promising Alternative for Online Transactions

Summary:

In this digital era, online transactions are becoming increasingly popular. One of the most commonly used payment tools is PayPal. In this article, we will discuss how to open a PayPal account, the advantages and disadvantages, as well as tips for using PayPal safely.

Introduction:

PayPal is one of the world’s largest online payment platforms, with more than 400 million active users worldwide. Opening a PayPal account can help you make online transactions more easily and safely. In this article, we will discuss how to open a PayPal account, as well as the advantages and disadvantages of using PayPal.

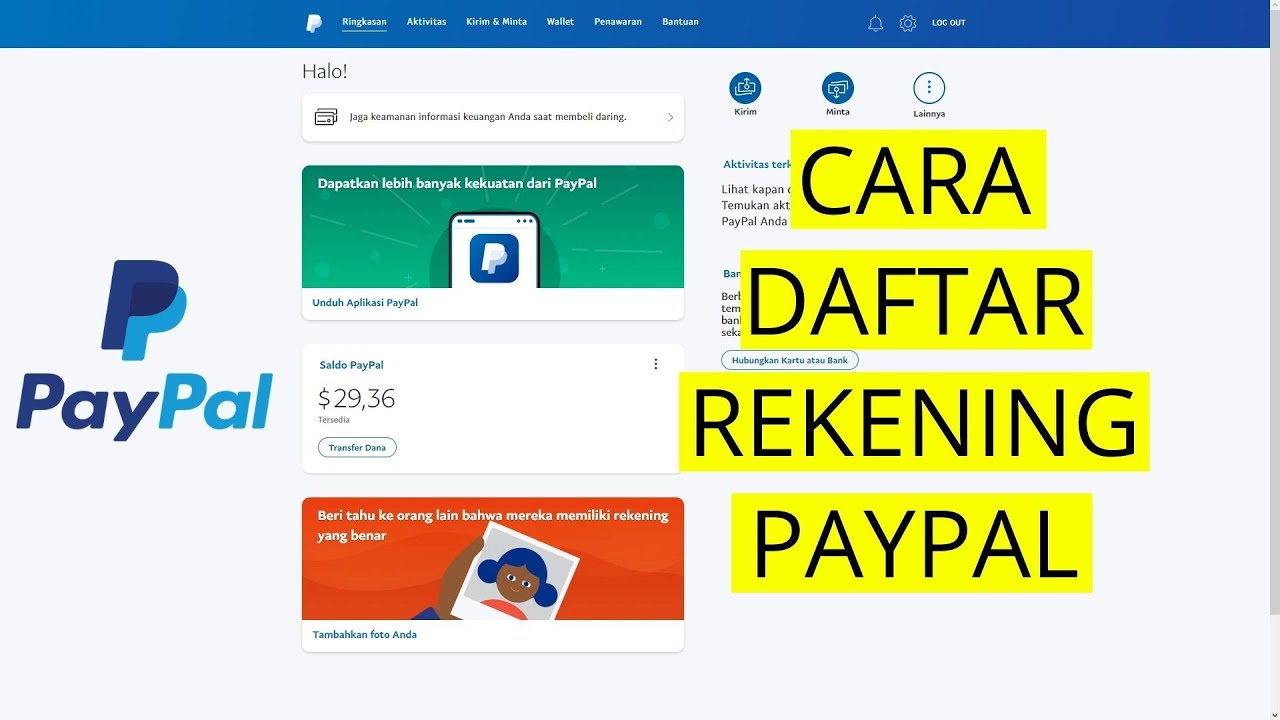

How to Open a PayPal Account:

Opening a PayPal account is very easy and fast. Following are the steps you must take:

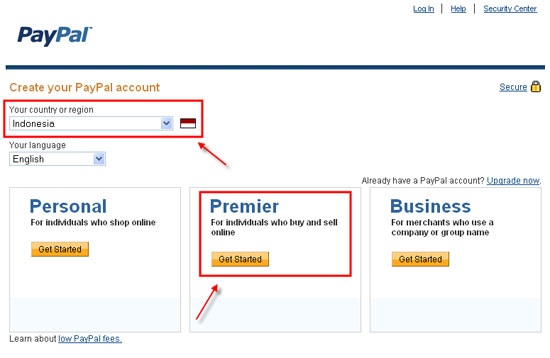

- Visit the PayPal website at www.paypal.com .

- Click the “Register” button in the top right corner of the page.

- Select the type of account you want to open, namely a personal account or a business account.

- Fill out the form with your personal information, such as name, email address, and password.

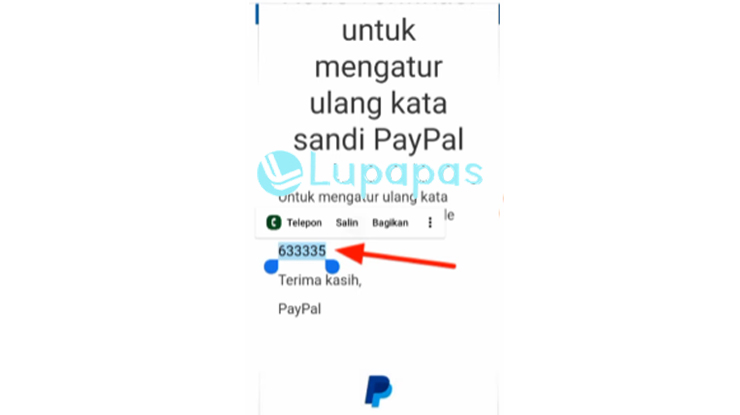

- Verify your email address by clicking the link sent by PayPal to your email address.

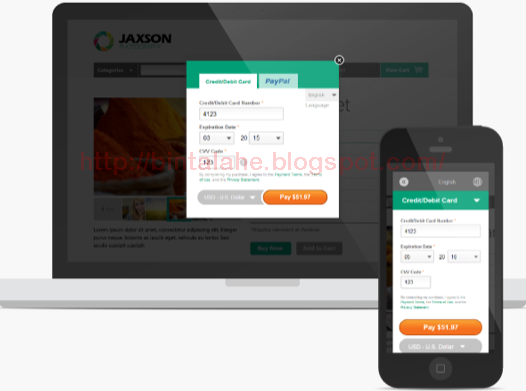

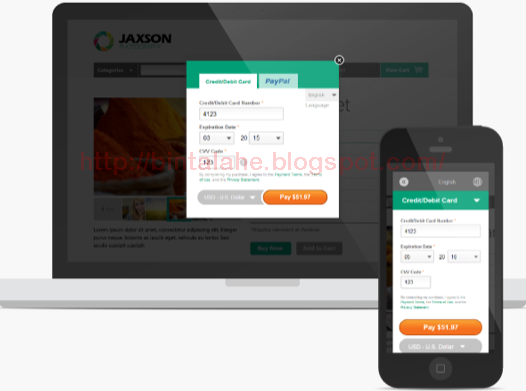

- Add your credit or debit card to make a transaction.

- Verify your bank account by clicking the link sent by PayPal to your bank account.

Pros of Using PayPal:

Here are some of the advantages of using PayPal:

- Safety : PayPal offers excellent security features, such as data encryption and account language identification.

- Easy to use : PayPal is very easy to use, even for those who have no experience with online transactions.

- Flexibility : PayPal can be used to make transactions with merchants all over the world.

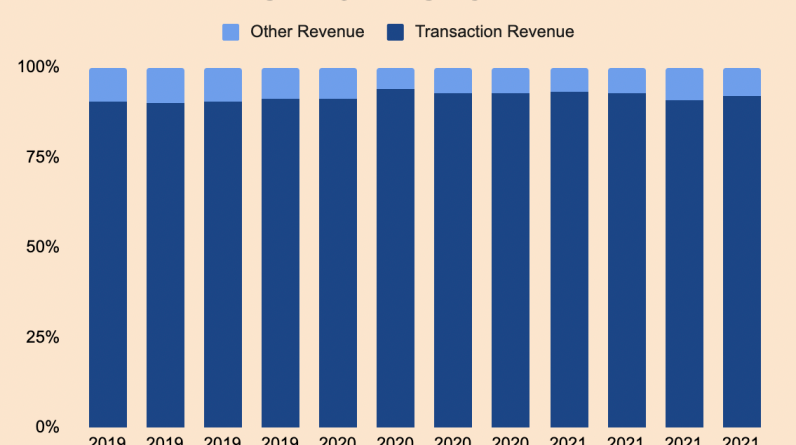

- Low cost : PayPal offers relatively low fees compared to other payment methods.

- Buyer protection : PayPal offers protection for buyers, so if you don’t receive the item you purchased, you can request a refund.

Disadvantages of Using PayPal:

Here are some disadvantages of using PayPal:

- Cost : Even though PayPal fees are relatively low, there are still fees you have to pay to make transactions.

- Limitations : PayPal cannot be used to make transactions with merchants who do not have a PayPal account.

- Limitation : PayPal has a daily transaction limit, so if you want to make a large transaction, you have to wait a few days before you can make another transaction.

- Usage policy : PayPal has strict usage policies, so if you violate these policies, your account may be blocked.

Tips for Using PayPal Safely:

Here are some tips for using PayPal safely:

- Use a strong password : Use a strong and unique password for your PayPal account.

- Transaction verification : Verify every transaction you make to ensure that it is valid and safe.

- Check transaction reports : Check your transaction reports regularly to ensure that there are no unauthorized transactions.

- Use a secure credit or debit card : Use a safe and reliable credit or debit card to make transactions.

- Don’t share account information : Do not share your PayPal account information with others.

Conclusion:

PayPal is one of the most commonly used online payment tools. By opening a PayPal account, you can make online transactions more easily and safely. However, there are still some drawbacks that you should consider before using PayPal. By following the tips mentioned above, you can use PayPal safely and effectively.

FAQs:

Q: How do I open a PayPal account?

A: You can open a PayPal account by visiting the PayPal website and filling out the form with your personal information.

Q: What are the advantages of using PayPal?

A: The advantages of using PayPal are safety, ease of use, flexibility, low fees, and buyer protection.

Q: What are the disadvantages of using PayPal?

A: The disadvantages of using PayPal are fees, limitations, daily transaction limits, and strict usage policies.

Q: How to use PayPal safely?

A: You can use PayPal safely by using a strong password, verifying transactions, checking transaction statements, using a secure credit or debit card, and not sharing account information.