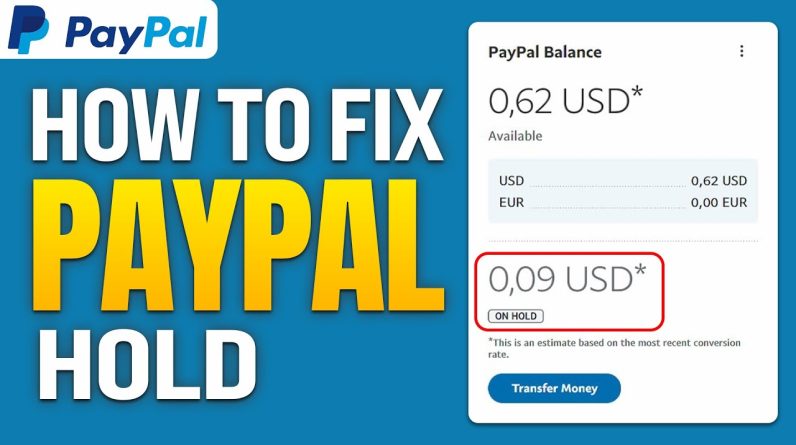

PayPal Nearing a Hold on Available Money: What You Need to Know and How to Avoid It

If you are one of the millions of PayPal users around the world, then you are probably familiar with the “hold on available money” feature used by this company. This feature allows PayPal to hold a certain amount of available funds in a user’s account, usually for a certain period of time, to process transactions or resolve security issues.

However, some PayPal users have reported that they experienced problems with this feature, as their available funds in the account became too low. This situation can cause inconvenience and confusion for users, especially if they have plans to use the funds for important transactions.

In this article, we’ll discuss what you need to know about PayPal’s “hold on available money” feature, how it works, and some tips for avoiding it.

What is Hold on Available Money on PayPal?

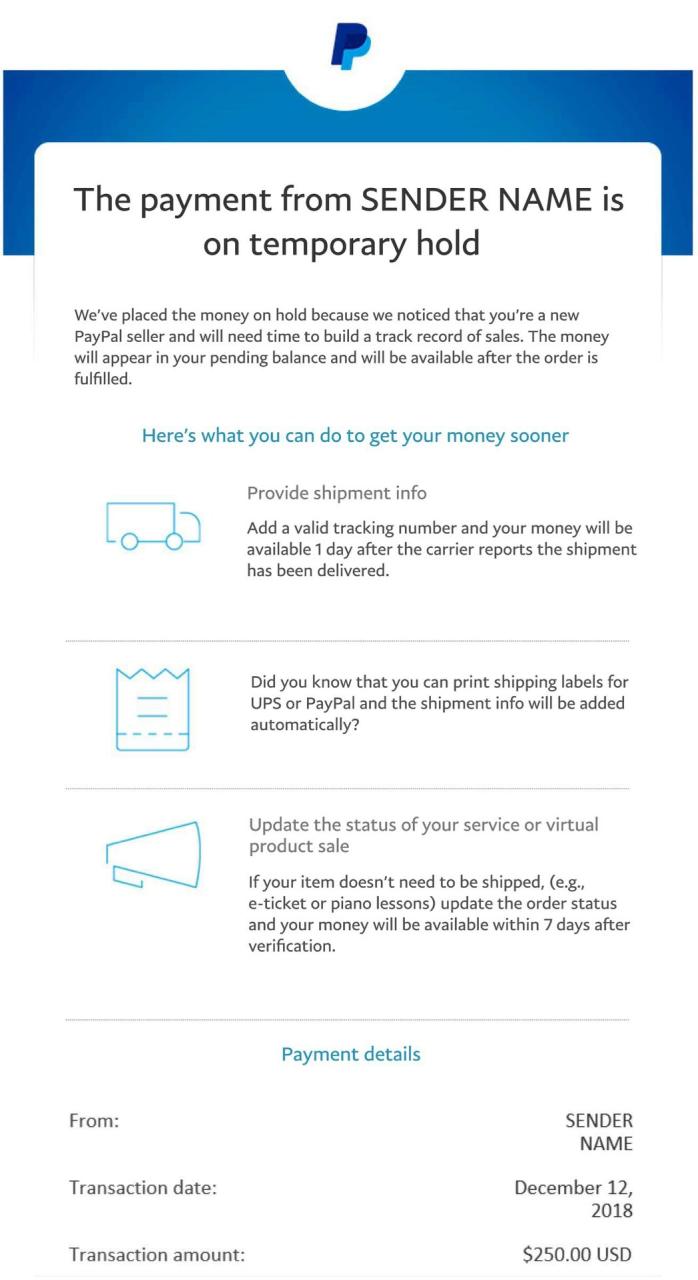

The “hold on available money” feature in PayPal is a security mechanism used by the company to protect user accounts from potential security risks. When PayPal detects suspicious or unusual transaction activity in a user’s account, the company may place a hold on the funds available in that account.

This fund hold usually applies to transactions involving large amounts of funds or transactions carried out with new merchants. The purpose of this feature is to give PayPal time to verify the user’s identity and ensure that the transactions made are legitimate.

How Does the Hold on Available Money Feature Work?

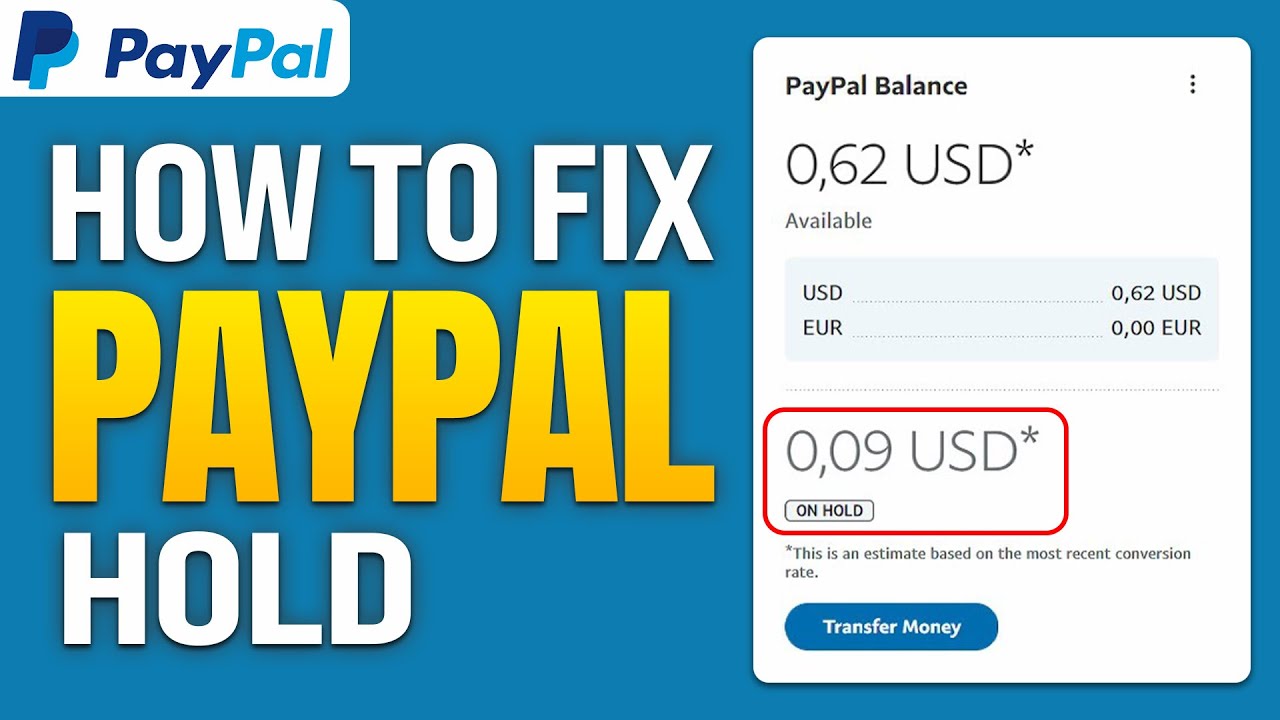

The “hold on available money” feature in PayPal works by reducing the amount of funds available in a user’s account. When PayPal holds funds, users cannot use those funds for other transactions until the hold is removed.

Here’s an example of how this feature works:

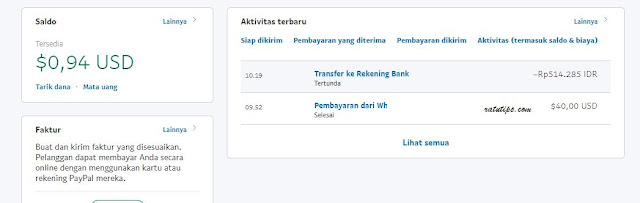

- You have a balance of IDR 1,000,000 in your PayPal account.

- You make a transaction of IDR 500,000 with a new merchant.

- PayPal detects a suspicious transaction and decides to withhold the amount of funds available in your account, namely IDR 200,000.

- The amount of funds available in your account now is IDR 800,000.

- You cannot use the held funds (Rp. 200,000) for other transactions until the hold is removed.

Why Does PayPal Hold Funds?

PayPal holds funds for several reasons, including:

- Identity verification : PayPal may withhold funds if the company cannot verify the user’s identity.

- Suspicious transactions : PayPal may withhold funds if transactions are suspicious or unusual.

- New merchant : PayPal may withhold funds if a transaction is made with a new merchant that does not have a good reputation.

- Verification failure : PayPal may withhold funds if users fail to verify their identity or email address.

How to Avoid Fund Holds on PayPal?

Avoiding holding funds on PayPal is not difficult, but it does require some steps to be taken. Here are some tips to avoid holding funds:

- Identity verification : Make sure you have verified your identity and email address in your PayPal account.

- Use a valid email address : Make sure you use a valid email address and do not use a fake email address.

- Use a well-known merchant : Make sure you use a well-known and reputable merchant.

- Don’t make suspicious transactions : Do not make suspicious or unusual transactions.

- Don’t use funds that are too large : Do not use funds that are too large for transactions, because this can trigger funds being held.

Conclusion

The “hold on available money” feature in PayPal is a security mechanism used by the company to protect user accounts from potential security risks. However, this feature may cause inconvenience and confusion for users. By understanding how this feature works and following some tips to avoid it, you can use the funds in your PayPal account more safely and comfortably.