Converting PayPal Balance to Cash App: Complete Guide

In recent years, the use of digital wallets such as PayPal and Cash App has increased rapidly. These two platforms allow users to carry out financial transactions online easily and safely. However, sometimes users want to convert their PayPal balance to Cash App. This article will help you understand how to convert your PayPal balance to Cash App easily and safely.

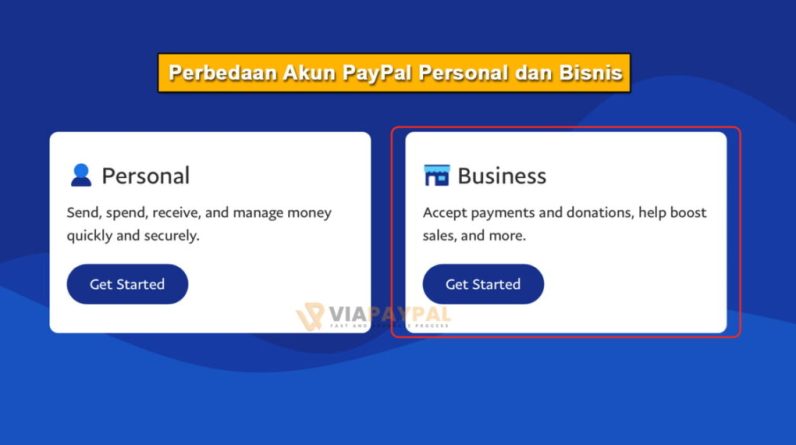

What is PayPal?

PayPal is one of the largest online payment platforms in the world. Founded in 1998, PayPal has become one of the most popular ways to conduct financial transactions online. With PayPal, users can make payments, send and receive money online easily.

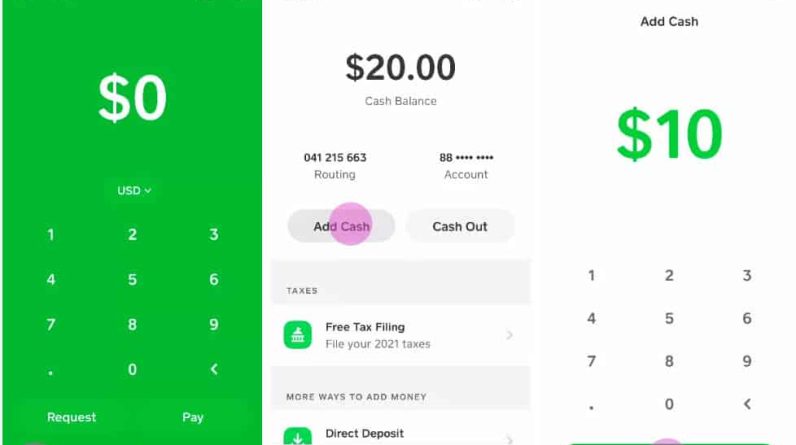

What is Cash App?

Cash App is a mobile payment application launched in 2013. This application allows users to carry out financial transactions online easily and safely. With Cash App, users can make payments, send and receive money online.

Why Change PayPal Balance to Cash App?

There are several reasons why users want to convert their PayPal balance to Cash App. Here are some of the main reasons:

- Excess balance : If you have a sizable PayPal balance, you may want to convert it to Cash App to avoid overdrawing your PayPal balance.

- Need for money : If you have an emergency money need, you may want to convert your PayPal balance to Cash App to make payments or send money.

- Comfort : Changing your PayPal balance to Cash App can make it easier for you to carry out financial transactions online.

How to Change PayPal Balance to Cash App

Here are several ways to convert PayPal balance to Cash App:

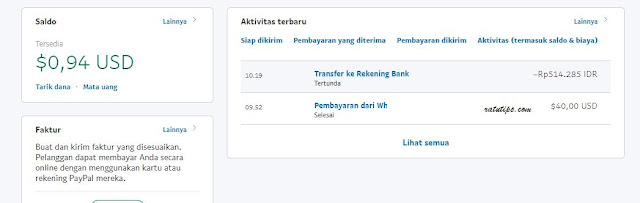

Method 1: Using a Bank Account

- Open the PayPal app and log in to your account.

- Click the “Balance” button and select “Withdraw Funds”.

- Select the bank account associated with your PayPal account.

- Enter the amount of money you want to withdraw.

- Click the “Withdraw Funds” button to submit the request.

- Wait a few working days for the funds withdrawal process to complete.

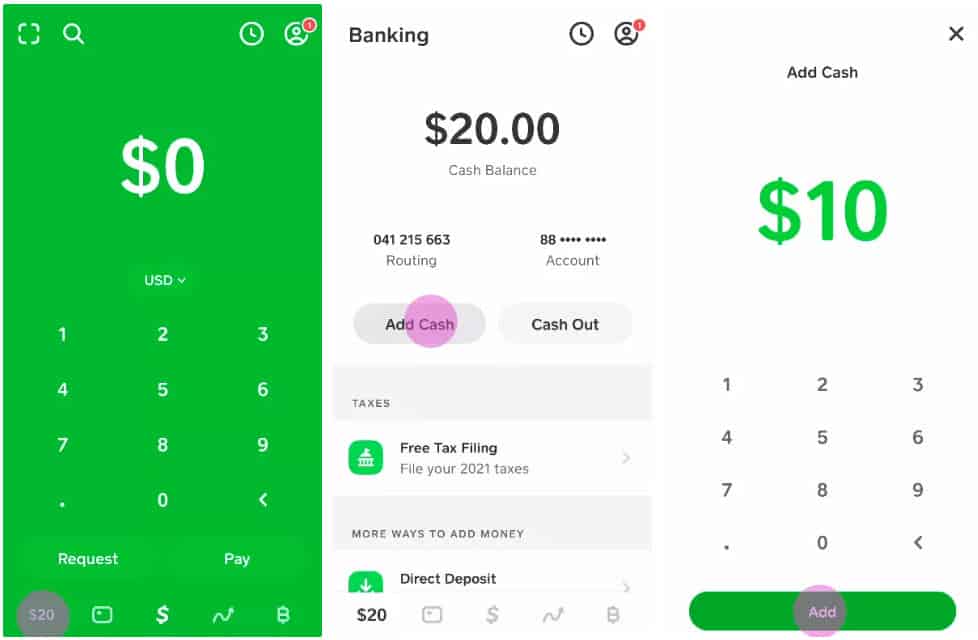

- Once your PayPal balance has been withdrawn to your bank account, you can send it to Cash App using the “Add Balance” feature in the Cash App application.

Method 2: Using a Debit Card

- Open the PayPal app and log in to your account.

- Click the “Balance” button and select “Withdraw Funds”.

- Select the debit card associated with your PayPal account.

- Enter the amount of money you want to withdraw.

- Click the “Withdraw Funds” button to submit the request.

- Wait a few minutes for the funds withdrawal process to complete.

- Once your PayPal balance has been withdrawn to your debit card, you can send it to Cash App using the “Add Balance” feature in the Cash App app.

Method 3: Using Third Party Services

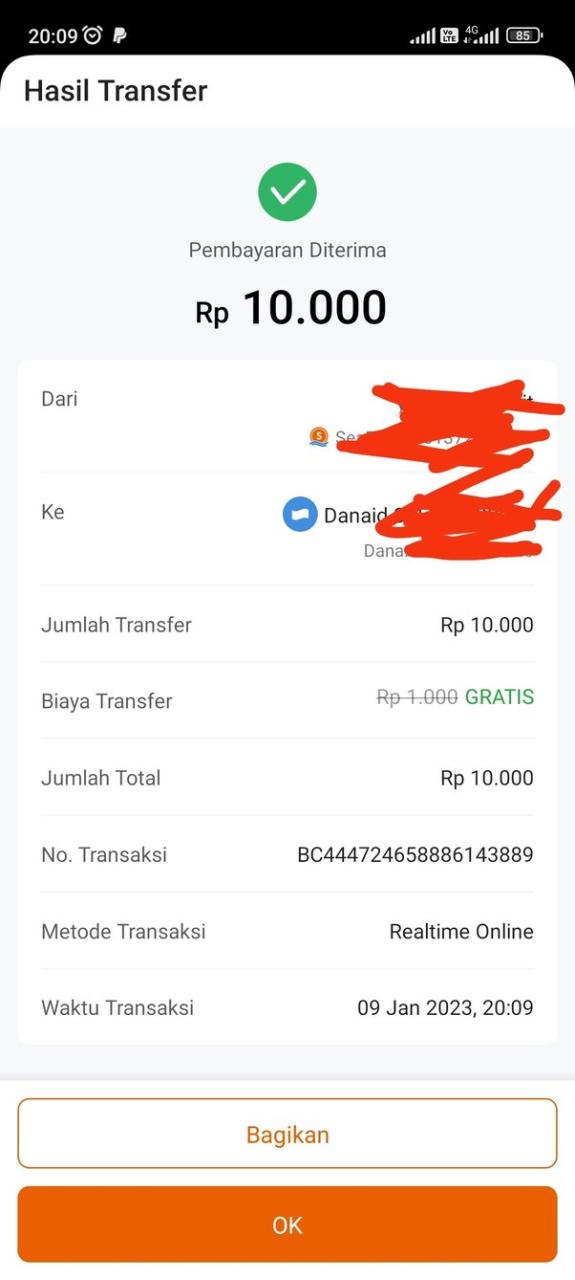

- Open the third-party service application or website that provides money transfer services.

- Enter your PayPal and Cash App account information.

- Select the amount of money you want to send.

- Click the “Submit” button to submit the request.

- Wait a few minutes for the money transfer process to complete.

Advantages and Disadvantages of Converting PayPal Balance to Cash App

Excess:

- Easy and safe

- Many choices of shipping methods

- Can be done online

Lack:

- Transaction fees may apply

- Processing time can be long

- Security risks may occur when using third party services

Conclusion

Changing your PayPal balance to Cash App can be done easily and safely using several methods that have been discussed. However, keep in mind that transaction fees may apply and processing times can be lengthy. Make sure you choose the right method according to your needs. If you have any questions or difficulties, please do not hesitate to contact the PayPal or Cash App support team.