PayPal Life, a “Buy Now, Pay Later” Payment Alternative like Affirm

In recent years, payment technology has advanced rapidly, giving consumers more choices in making online transactions. One example of a popular payment technology is “Buy Now, Pay Later” (BNPL), which allows consumers to purchase products or services online and pay for them in multiple payments. Affirm is one company that offers BNPL services, but now PayPal is also launching a similar service called PayPal Pay in 4.

What is PayPal Pay in 4?

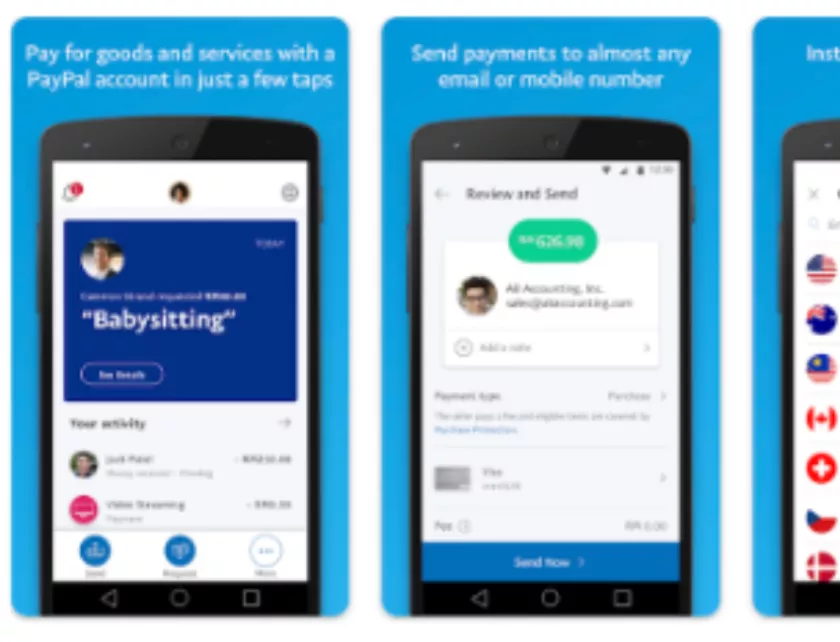

PayPal Pay in 4 is a “Buy Now, Pay Later” service that allows consumers to purchase products or services online and pay for them in four payments. The service is free, there is no interest or additional fees, and consumers can set a payment schedule that suits their needs. PayPal Pay in 4 can be used for online transactions at various online stores that accept PayPal.

How PayPal Pay in 4 Works

Here’s how PayPal Pay in 4 works:

- Select Services : When making an online transaction, select the PayPal Pay in 4 option as the payment method.

- Transaction Confirmation : Confirm your transaction and enter payment information.

- Select Payment Schedule : Choose a payment schedule that suits your needs, namely four payments at the same time interval.

- Pay : Pay your bill on the schedule you have chosen.

Advantages of PayPal Pay in 4

Here are some of the advantages of PayPal Pay in 4:

- Free : PayPal Pay in 4 has no additional fees or interest.

- Flexible : Consumers can set payment schedules that suit their needs.

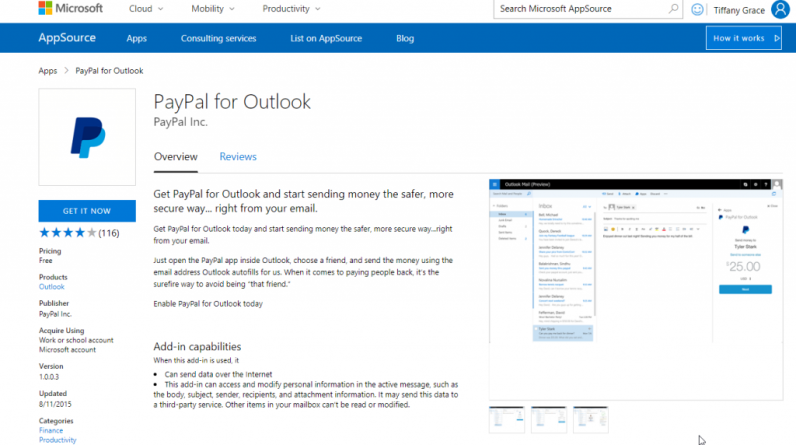

- Safe : Transactions are carried out safely and protected by PayPal technology.

- Easy : Simple and easy to use payment process.

Disadvantages of PayPal Pay in 4

Here are some disadvantages of PayPal Pay in 4:

- Credit Limit Limitations : PayPal Pay in 4 credit limit is lower than Affirm.

- Seller Limitations : PayPal Pay in 4 can only be used in online stores that accept PayPal.

Comparison with Affirm

Here is a comparison between PayPal Pay in 4 and Affirm:

- Credit Limit : Affirm has a higher credit limit than PayPal Pay in 4.

- Cost : Affirm has additional fees for late payments, while PayPal Pay in 4 has no additional fees.

- Seller’s Choice : Affirm can be used in more online stores than PayPal Pay in 4.

Conclusion

PayPal Pay in 4 is a “Buy Now, Pay Later” alternative that offers flexibility and security in conducting online transactions. Although it has some drawbacks, such as limited credit limits and sellers, PayPal Pay in 4 can be a good choice for consumers who want to buy products or services online in a more flexible way. With PayPal Pay in 4, consumers can set payment schedules that suit their needs and carry out transactions safely and securely.