PayPal: What is a Bank?

PayPal is one of the world’s largest online payment platforms, but is it a bank? The answer to this question is not entirely simple. In this article, we’ll explore what PayPal is, how it works, and whether it can be considered a bank.

What is PayPal?

PayPal is an online payment service company founded in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was intended as a peer-to-peer (P2P) payment platform that allowed users to send and receive money online. However, over time, PayPal evolved into a broader online payment platform, allowing users to make online transactions more easily.

How Does PayPal Work?

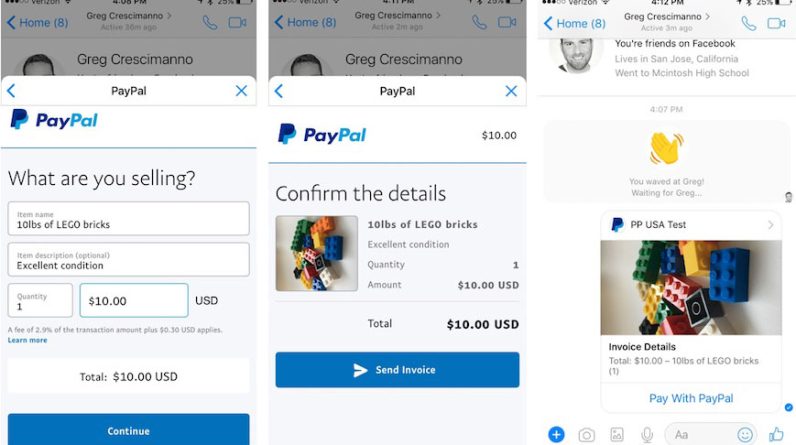

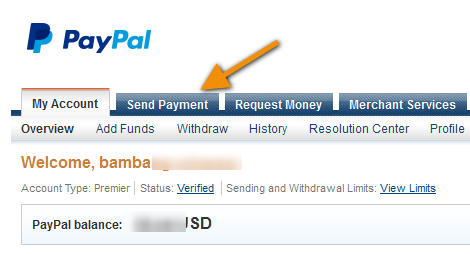

PayPal works by allowing users to link their bank accounts or credit cards with their PayPal account. Then, users can use their PayPal account to make online transactions with merchants that accept PayPal as a payment method. The transaction process involves several steps:

- Users send payment requests to merchants via PayPal.

- Merchants receive payment requests and process transactions.

- PayPal processes the transaction and sends the money to the merchant’s bank account.

- Users can view their transaction history in their PayPal account.

What is a Bank?

Banks are financial institutions that allow users to store, send, and receive money. Banks also offer a variety of other services, such as loans, credit cards, and investments. Banks are regulated by the government and must meet strict security and compliance standards.

Is PayPal a Bank?

PayPal is not a bank in the traditional sense. PayPal does not have a bank license and is not regulated by a banking institution. However, PayPal has several features similar to banks, such as:

- Users can deposit money in their PayPal account.

- Users can send and receive money via PayPal.

- PayPal offers a variety of other services, such as debit cards and loans.

However, PayPal does not offer some services that banks typically offer, such as:

- Savings guaranteed by the government.

- Mortgage loans.

- Investment.

Difference Between PayPal and Bank

Here are some differences between PayPal and banks:

- Permission : Banks have permission from the government to carry out banking activities, while PayPal does not have this permission.

- Regulations : Banks are regulated by strict banking institutions, while PayPal is regulated by looser online banking institutions.

- Savings : Banks offer deposits that are guaranteed by the government, while PayPal does not offer such a guarantee.

- Service : Banks offer a wider range of services, such as mortgage loans and investments, while PayPal offers more limited services.

Advantages and Disadvantages of PayPal

Here are some of the advantages and disadvantages of PayPal:

Excess:

- Easy to use : PayPal is easy to use and can be accessed via any device.

- Fast : PayPal allows users to make transactions quickly and easily.

- Safe : PayPal has a strict security system to protect users from fraud.

Lack:

- Cost : PayPal allows higher fees compared to banks.

- Limitations : PayPal has limitations in terms of the services it offers.

- Not guaranteed : PayPal does not offer government-guaranteed deposits.

Conclusion

PayPal is a popular online payment platform, but it cannot be considered a bank in the traditional sense. PayPal has some features similar to banks, but does not have a bank license and is not regulated by a banking institution. PayPal has advantages such as easy to use, fast, and secure, but it also has disadvantages such as higher fees, service limitations, and is not guaranteed. Therefore, PayPal can be considered an alternative to banks, but it cannot be considered a replacement for banks.