PayPal Outside the United States: History, Features, and Security

PayPal is one of the world’s largest online payment services, created in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was only available to users in the United States, but over time, the service has expanded to countries around the world. In this article, we’ll talk about PayPal outside the United States, including its history, features, and security.

History of PayPal Outside the United States

In the early 2000s, PayPal began expanding its network outside the United States. In 2001, PayPal opened branch offices in the UK and Canada, and then launched services in Australia, Japan and Germany in 2002. In 2003, PayPal expanded its network to Asia Pacific by launching services in Singapore, Hong Kong and Taiwan.

In 2004, PayPal expanded its network to Europe by launching services in France, Germany, Italy and Spain. In 2005, PayPal expanded its network to Latin America by launching services in Brazil, Mexico and Argentina.

PayPal Features Outside the United States

PayPal outside the United States offers many of the same features as PayPal in the United States, including:

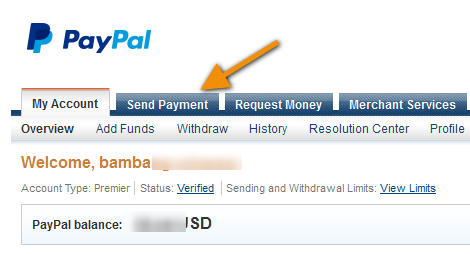

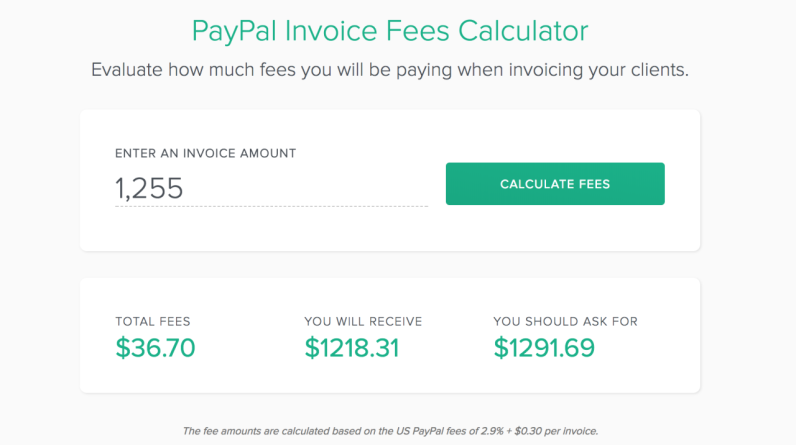

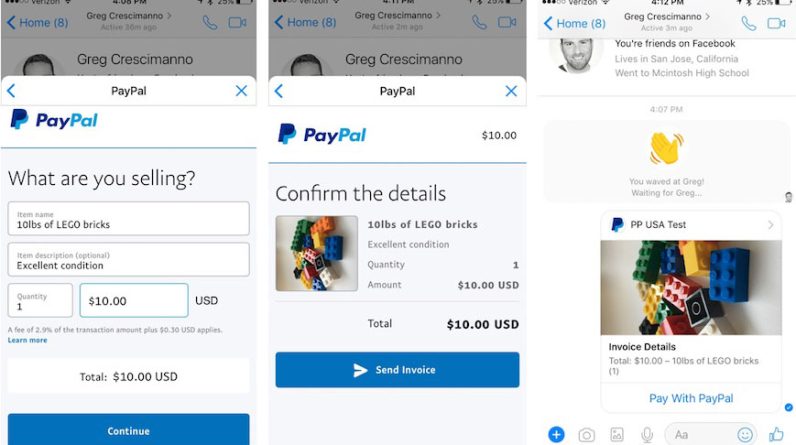

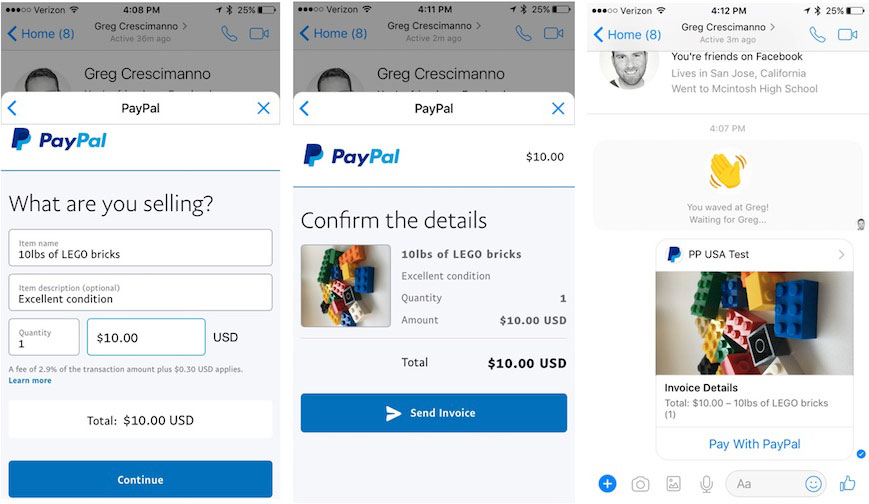

- Online Payment : PayPal allows users to make online payments safely and easily.

- Money Transfer : PayPal allows users to send money to other people around the world.

- Receipt of Money : PayPal allows users to receive money from other people around the world.

- Credit card : PayPal allows users to use credit cards to make payments.

- Recurring Payments : PayPal allows users to make recurring payments automatically.

However, keep in mind that PayPal features may vary depending on the country. For example, in some countries, PayPal does not offer an international money transfer feature.

PayPal Security Outside the United States

PayPal prioritizes user security and has taken steps to protect users’ financial information. Some of the security measures taken by PayPal include:

- Encryption : PayPal uses encryption to protect users’ financial information.

- Two Factor Authentication : PayPal offers two-factor authentication to increase user security.

- IP blocking : PayPal can block suspicious IPs to prevent unauthorized access.

- Transaction Supervision : PayPal continuously monitors transactions to detect suspicious activity.

However, keep in mind that no security system is 100% safe. Therefore, users should remain vigilant and follow the security measures recommended by PayPal.

PayPal Employees and Collaborations Outside the United States

PayPal has dedicated employees worldwide, with more than 20,000 employees in more than 30 countries. PayPal also has collaborations with various companies and financial institutions around the world, including large banks and other financial companies.

PayPal Regulation and Compliance Outside the United States

PayPal must comply with regulations and compliance that vary by country. PayPal has taken steps to ensure that its services comply with applicable regulations and compliance in each country.

Conclusion

PayPal outside the United States is a secure and easy-to-use online payment service. With features like online payments, sending money, and receiving money, PayPal is a popular choice all over the world. However, keep in mind that PayPal’s features and security may vary depending on the country. Therefore, users should always be vigilant and follow the security measures recommended by PayPal.

Reference List

- PayPal. (n.d.). History of PayPal.

- PayPal. (n.d.). PayPal Features.

- PayPal. (n.d.). PayPal Security.

- PayPal. (n.d.). PayPal Employees and Collaboration.

- PayPal. (n.d.). PayPal Regulation and Compliance.

With that said, we’ve covered PayPal outside the United States, including history, features, security, employees and partnerships, and regulations and compliance. We hope this article helps you understand more about PayPal outside the United States.