Getting to Know the 3.5% Paypal Fee: How to Use It Effectively

Paypal is one of the most popular online payment methods in the world. With more than 400 million active users, Paypal has become the main choice for many people to make online transactions. However, as with all payment methods, Paypal also has fees that users must pay. The 3.5% Paypal fee is one of the most common fees paid by Paypal users. In this article, we will discuss the 3.5% Paypal fee and how to use it effectively.

What is the 3.5% Paypal Fee?

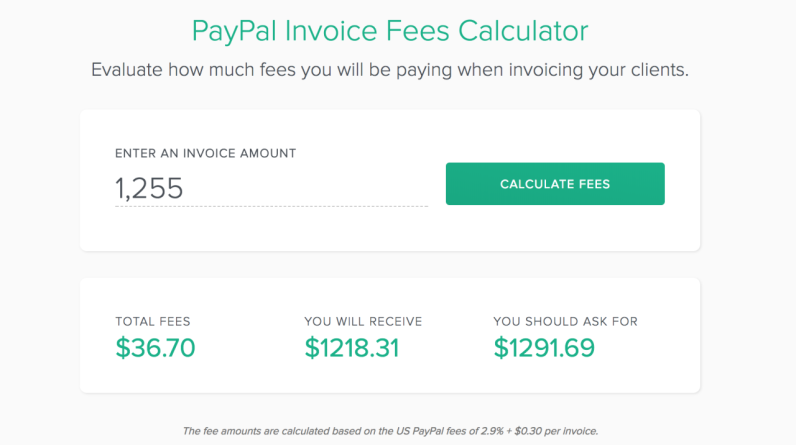

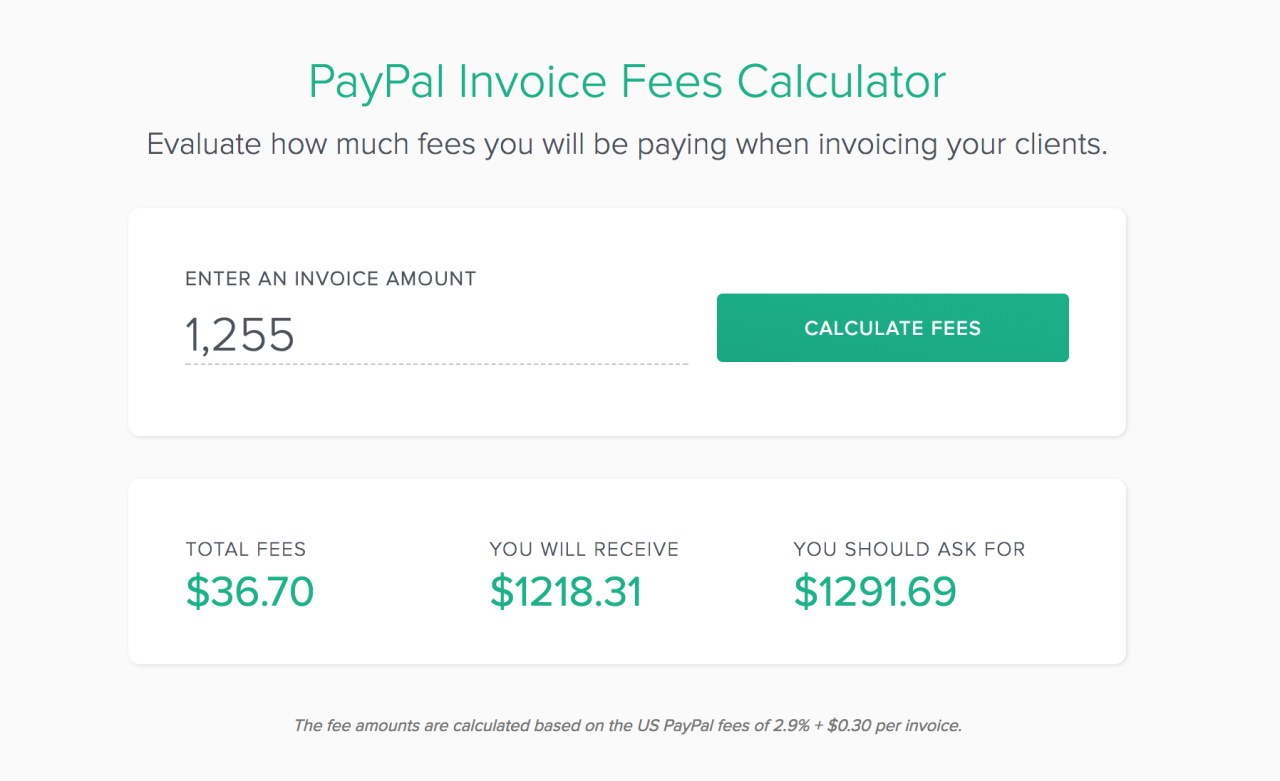

The 3.5% Paypal fee is a fee paid by Paypal users to make international transactions. This fee is charged on balances sent from one country to another. This 3.5% fee is calculated based on the amount of balance sent, and this fee must be paid by the user who sent the balance.

Example of 3.5% Paypal Fee

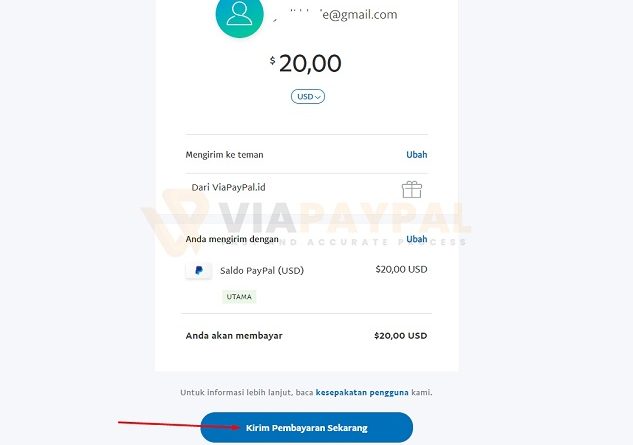

Suppose you want to send a balance of $100 from the United States to Indonesia. A 3.5% Paypal fee will be charged on the balance amount sent, which is $100 x 3.5% = $3.50. So, the total cost to be paid is $100 + $3.50 = $103.50.

Why is a 3.5% Paypal Fee Charged?

The 3.5% Paypal fee is charged for several reasons:

- Currency Conversion Fees : When you make international transactions, Paypal has to convert currency from one country to another. These currency conversion fees may vary depending on the type of transaction and country involved.

- Transfer Fees : Transfer fees are fees paid by Paypal to carry out international transactions. This fee is charged on balances sent from one country to another.

- Administrative costs : Administration fees are fees paid by Paypal to carry out transactions. This fee is charged on balances sent from one country to another.

How to Use Paypal Fee 3.5% Effectively

Here are some ways to use Paypal’s 3.5% fee effectively:

- Using a Business Account : If you have a business account on Paypal, you can deduct international transaction fees. A business account on Paypal allows you to make international transactions at lower fees.

- Using Local Currency : If you make international transactions, you can use local currency to reduce currency conversion fees.

- Using Another Payment Method : If you make international transactions, you can use other payment methods such as bank transfer or credit card to reduce transaction fees.

- Using Other Paypal Services : Paypal has several services that can help you reduce international transaction fees, such as Paypal Borderless, which allows you to make international transactions with lower fees.

Advantages and Disadvantages of 3.5% Paypal Fees

Here are some of the advantages and disadvantages of the 3.5% Paypal fee:

Excess:

- Easy to use : Paypal Fee 3.5% is easy to use and understand by users.

- Flexible : Paypal fee 3.5% can be used to make international transactions flexibly.

- Safe : Paypal fee 3.5% is guaranteed safe by Paypal, so you don’t need to worry about transaction security.

Lack:

- Expensive : The 3.5% Paypal fee can be expensive if you are making large international transactions.

- Limited : The 3.5% Paypal fee can only be used to make international transactions, so you cannot use this fee to make local transactions.

- Not Flexible : Paypal’s 3.5% fee is not flexible in terms of fees, so you cannot change international transaction fees.

Conclusion

The 3.5% Paypal fee is a fee paid by Paypal users to make international transactions. This fee is charged on balances sent from one country to another, and this fee must be paid by the user sending the balance. Paypal’s 3.5% fee has some advantages and disadvantages, but if you use this fee effectively, you can reduce international transaction costs.