Is PayPal like Cash App? : Comparison and Consideration

In recent years, digital payment apps have become increasingly popular, especially among the younger generation. The two most popular digital payment applications are PayPal and Cash App. Although both offer digital payment services, there are several differences between the two. In this article, we’ll discuss whether PayPal is like Cash App, and some considerations to consider before choosing one of the two.

What is PayPal?

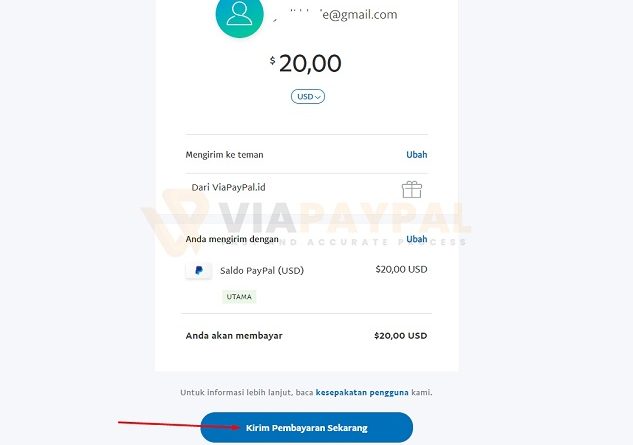

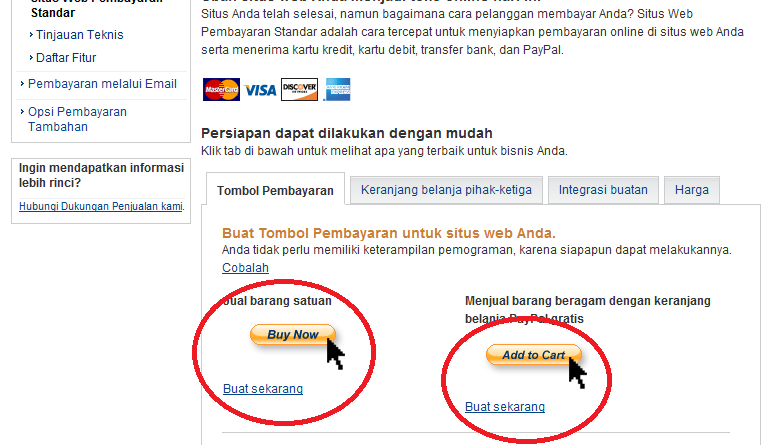

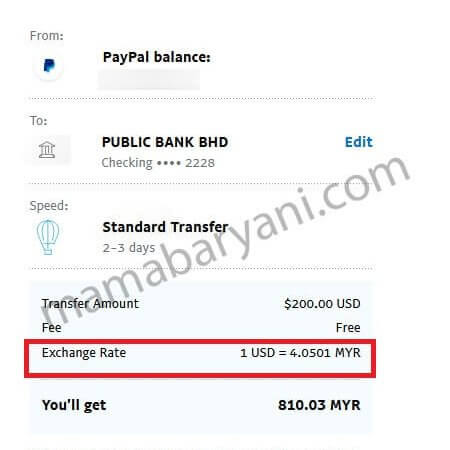

PayPal is a digital payments company founded in 1998 by Peter Thiel and Max Levchin. PayPal allows users to send and receive money online, as well as carry out other digital payment transactions. PayPal also offers other features such as credit card payments, international payments, and the ability to link bank accounts.

What is Cash App?

Cash App is a digital payment application launched in 2013 by Square, Inc. Cash App allows users to send and receive money, as well as carry out other digital payment transactions. Cash App also offers other features such as debit card payments, international payments, and the ability to link bank accounts.

Comparison between PayPal and Cash App

Here are some comparisons between PayPal and Cash App:

- Cost : PayPal has higher transaction fees compared to Cash App. PayPal charges a transaction fee of 2.9% + $0.30 per transaction, while Cash App only charges a transaction fee of 1.5% + $0.30 per transaction.

- Feature : PayPal has more complete features compared to Cash App. PayPal offers features such as international payments, credit card payments, and the ability to link bank accounts. Cash App only offers features like debit card payments and international payments.

- Security : Both apps have good security features, but PayPal has a better reputation when it comes to security. PayPal has a more advanced security system and has a larger security team.

- User : PayPal has more users compared to Cash App. PayPal has more than 300 million active users, while Cash App has around 40 million active users.

Consider before choosing either of the two

Here are some considerations to consider before choosing between PayPal and Cash App:

- Cost : If you are on a limited budget, then Cash App may be more suitable for you. However, if you have a bigger budget and need more complete features, then PayPal might be a better fit for you.

- Feature : If you need features like international payments, credit card payments, and the ability to link bank accounts, then PayPal may be a better fit for you. However, if you only need basic features like debit card payments and international payments, then Cash App may be more suitable for you.

- Security : If security is your priority, then PayPal may be a better fit for you. However, if you have other priorities such as lower fees, then Cash App may be a better fit for you.

- User : If you have friends or family who already use PayPal, then it may be more suitable for you. However, if you have friends or family who already use Cash App, then it may be more suitable for you.

Conclusion

PayPal and Cash App are two popular digital payment apps, but they have some differences. PayPal has higher transaction fees, more complete features, and better security. Cash App has lower transaction fees, simpler features, and better security. Before choosing any of the two, it is necessary to consider cost, features, security, and users. By considering these factors, you can choose a digital payment application that suits your needs.

Suggestion

- If you’re on a tight budget, then Cash App might be a better fit for you.

- If you need more complete features, then PayPal may be more suitable for you.

- If security is your priority, then PayPal may be a better fit for you.

- If you have friends or family who already use PayPal or Cash App, then it may be more suitable for you.

By considering these suggestions, you can choose a digital payment application that suits your needs.