Sending Money from India to USA using PayPal: Complete Guide

PayPal is one of the world’s largest online payment platforms, allowing users to send and receive money easily. However, there are some regulations and fees to consider when sending money from India to the US using PayPal. In this article, we’ll talk about how to send money from India to the US using PayPal, the fees involved, and some tips to consider.

Why PayPal?

PayPal is a popular choice for sending money internationally for several reasons:

- Security : PayPal offers high security by using SSL encryption and two-factor authentication.

- Convenience : PayPal allows users to send and receive money easily, without needing to have a bank account or credit card.

- Flexibility : PayPal can be used to send money to over 200 countries, including the US.

How to Send Money from India to US using PayPal

Here are the steps to send money from India to US using PayPal:

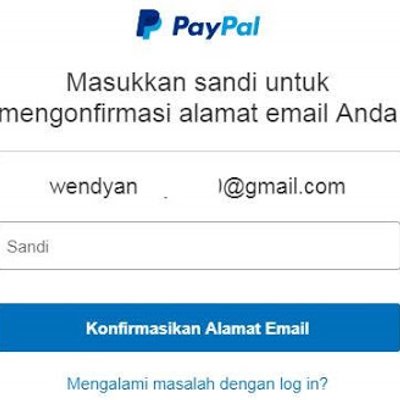

- Create a PayPal account : If you don’t have a PayPal account, please create a new account on the PayPal website.

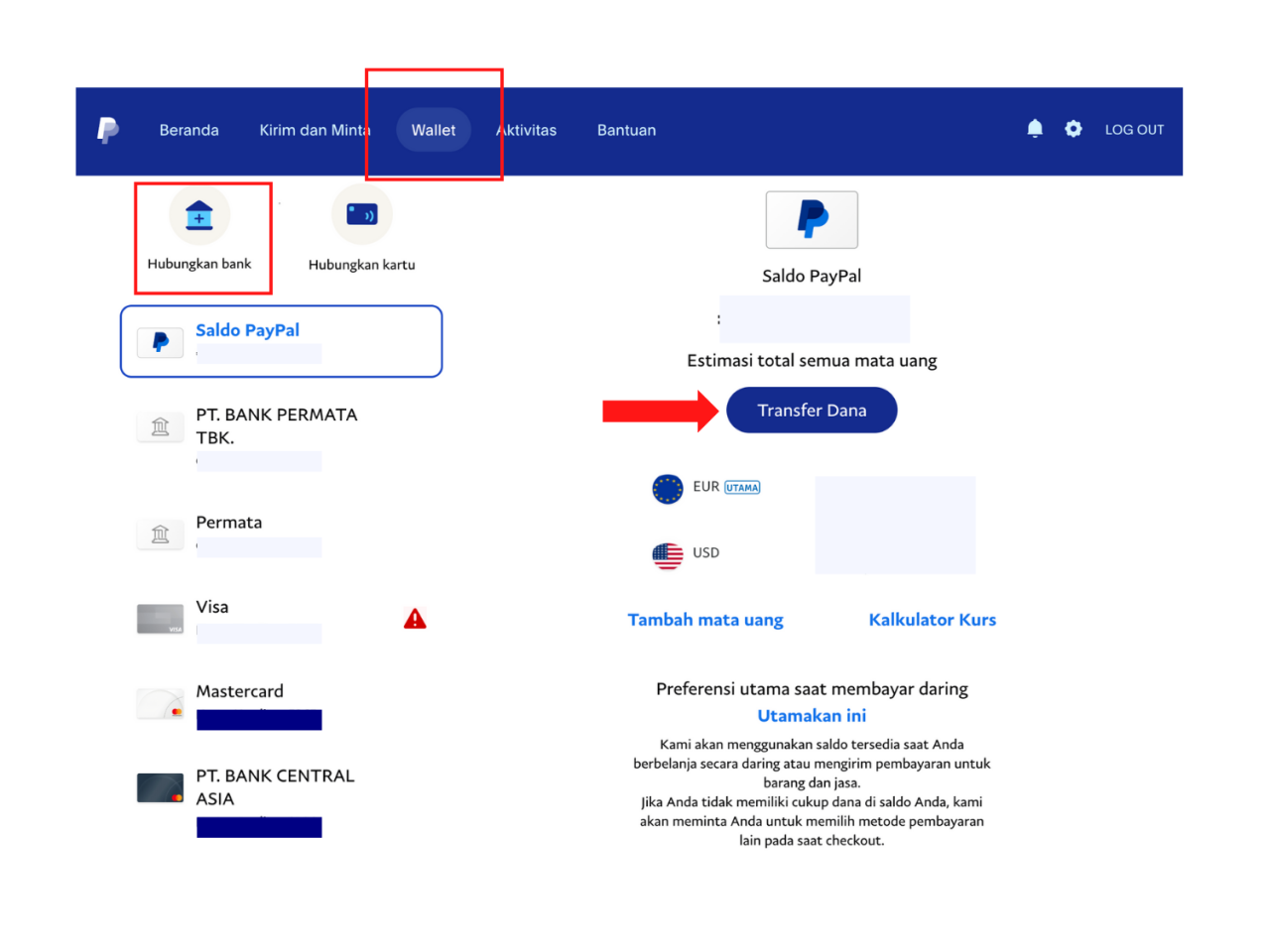

- Add balance : You can add balance to your PayPal account using a debit or credit card, or by making a bank transfer.

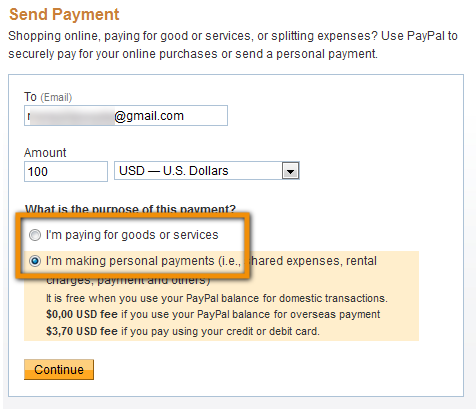

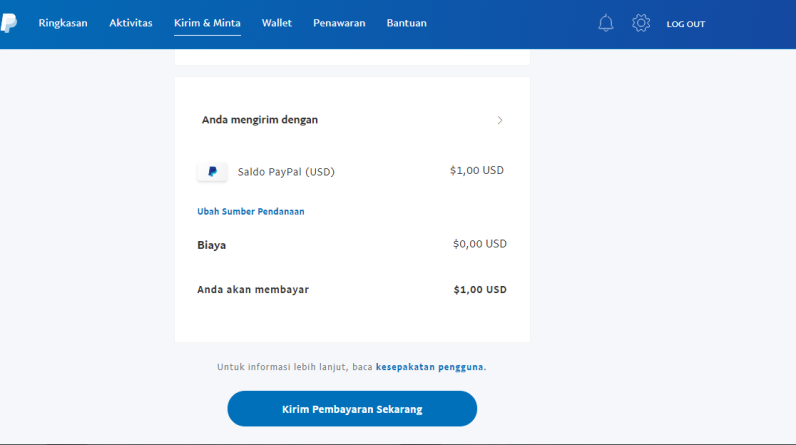

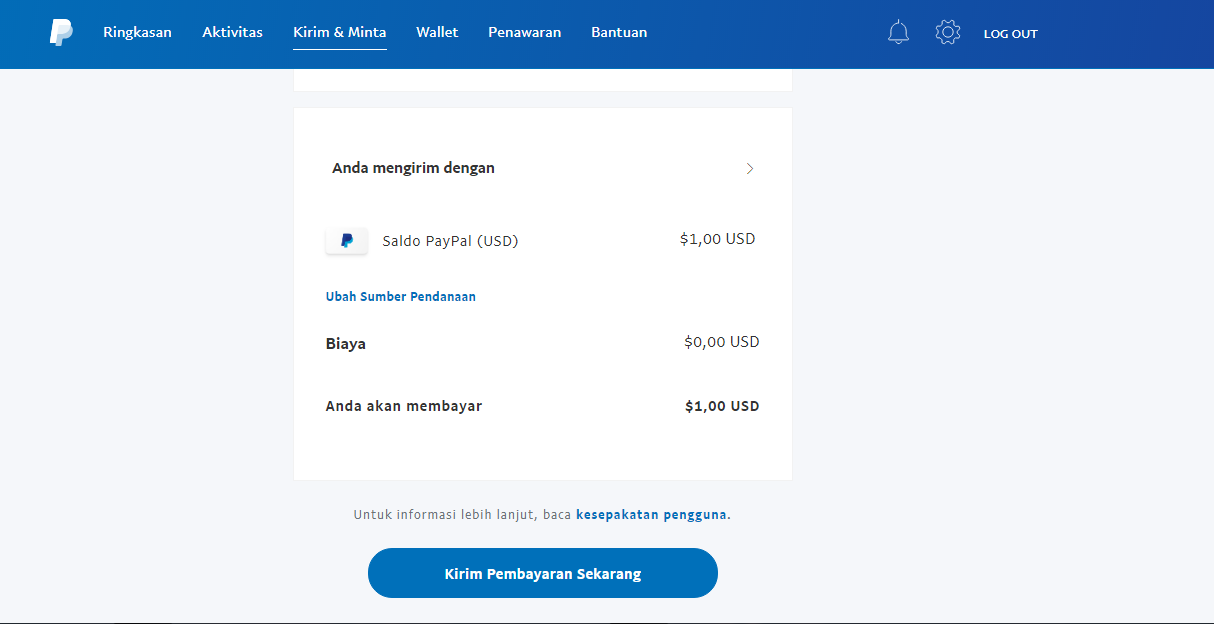

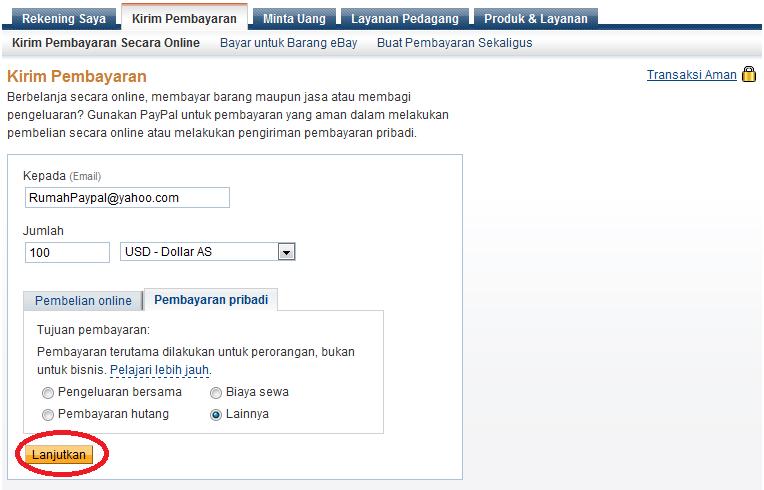

- Select recipient : Enter the recipient’s US email address or phone number.

- Enter amount : Enter the amount of money you want to send.

- Select currency : Select US currency (USD) as the destination currency.

- Confirmation : Confirm money transfer and associated fees.

Cost of Sending Money from India to US using PayPal

The cost of sending money from India to the US using PayPal may vary depending on several factors, such as:

- Transaction fees : PayPal charges a transaction fee of 0.5% to 2% of the amount of money sent, depending on the destination country.

- Currency conversion fees : If you send money in a currency different from the destination currency, PayPal will charge a currency conversion fee of 2.5% to 4.5%.

- Shipping costs : PayPal also charges a shipping fee of $0.30 to $4.99, depending on the shipping method selected.

Example of Cost of Sending Money from India to US using PayPal

Here is an example of the cost of sending money from India to the US using PayPal:

- Amount of money sent: $100

- Destination currency: USD

- Transaction fee: 1% (=$1)

- Currency conversion fee: 3% (=$3)

- Shipping cost: $2

- Total cost: $6

- Amount of money received: $94

Tips for Sending Money from India to US using PayPal

Here are some tips to consider when sending money from India to the US using PayPal:

- Check costs : Make sure you check the fees involved before sending money.

- Use the right currency : If you are sending money in a different currency than the destination currency, make sure you consider currency conversion fees.

- Choose the right shipping method : Choose the right shipping method to save costs.

- Check transaction status : Make sure you check the transaction status to ensure that the money has been received safely.

Conclusion

Sending money from India to the US using PayPal can be done easily and safely. However, it is worth considering the costs involved and some tips to consider. By choosing the right shipping method and considering the associated costs, you can save money and ensure that your money is received safely.

Frequently Asked Questions

Here are some frequently asked questions about sending money from India to US using PayPal:

- What is PayPal?

PayPal is an online payment platform that allows users to send and receive money easily. - How to send money from India to US using PayPal?

You can send money from India to the US using PayPal by selecting the recipient, entering the amount of money, and selecting the destination currency. - How much does it cost to send money from India to US using PayPal?

The cost of sending money from India to the US using PayPal can vary depending on several factors, such as transaction fees, currency conversion fees, and shipping charges. - What to consider when sending money from India to US using PayPal?

You need to consider the costs involved, choose the right shipping method, and check the transaction status.