PayPal Invoice Fees: What You Need to Know

PayPal is one of the most popular online payment methods in the world. With more than 350 million active users, PayPal provides convenience and security in conducting online transactions. However, like other services, PayPal also charges fees in some cases, one of which is invoice fees.

In this article, we’ll talk about PayPal invoice fees, what affects them, and how you can save on them.

What are PayPal Invoice Fees?

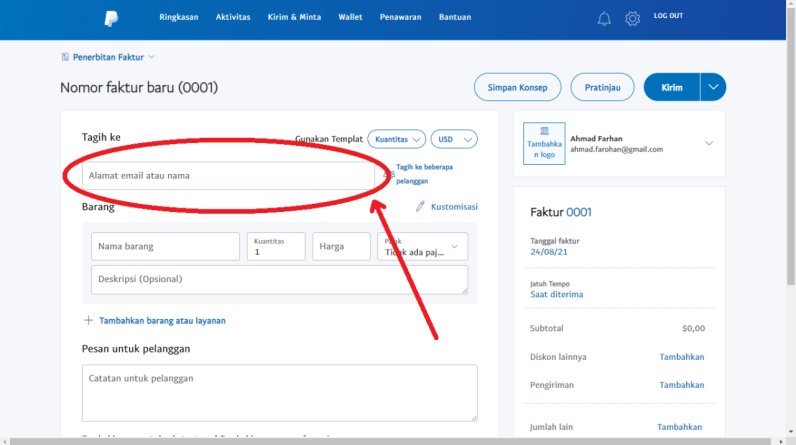

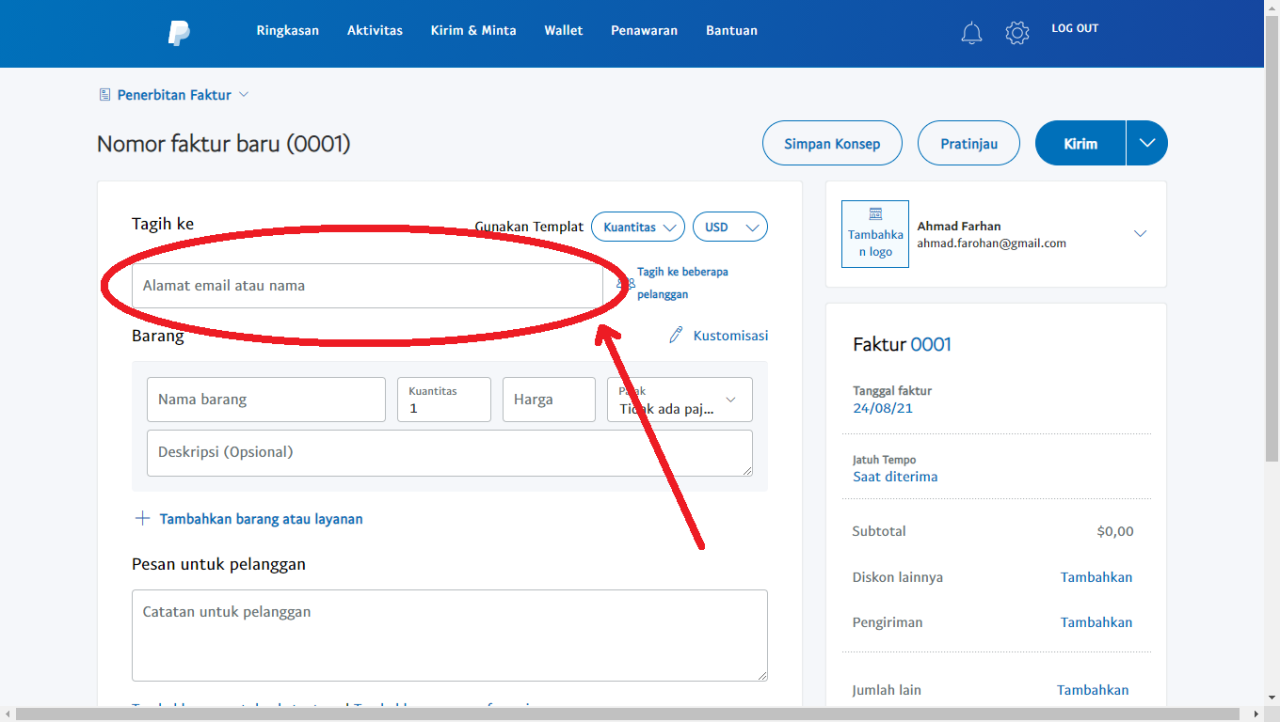

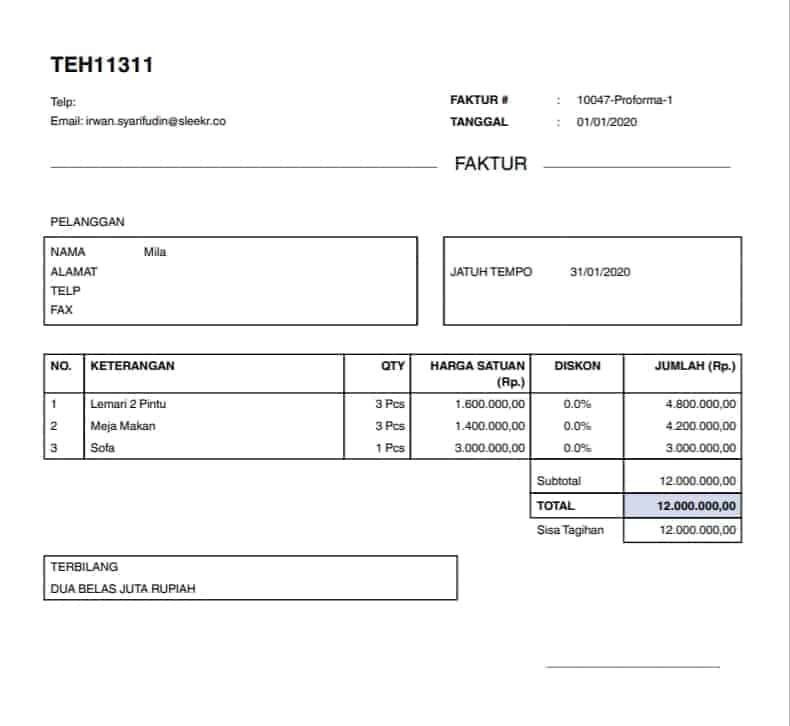

PayPal invoice fees are fees charged by PayPal to sellers or payees when they receive payment via invoice. An invoice is a document used to send bills to customers or buyers. In the case of PayPal, invoices can be sent via the PayPal platform.

How Are PayPal Invoice Fees Calculated?

PayPal invoice fees are calculated based on the number of payments received. The fee is usually charged as a percentage of the payment amount. Here is the PayPal invoice fee structure:

- For transactions in local currency (IDR), PayPal invoice fees are 3.4% of the payment amount + IDR 1,500 per transaction.

- For international transactions, PayPal invoice fees are 3.4% + 2% of the payment amount + currency conversion fee.

PayPal invoice fees may vary depending on the country and type of PayPal account used.

What Affects PayPal Invoice Fees?

Here are some factors that can affect PayPal invoice fees:

- Payment amount: The larger the payment amount, the greater the PayPal invoice fee will be.

- PayPal account types: Business PayPal accounts tend to have higher invoicing fees than personal PayPal accounts.

- Country: PayPal invoice fees can vary depending on the country.

- Currency: International transactions may be subject to higher currency conversion fees.

How to Save on PayPal Invoice Fees?

Here are some tips for saving on PayPal invoice fees:

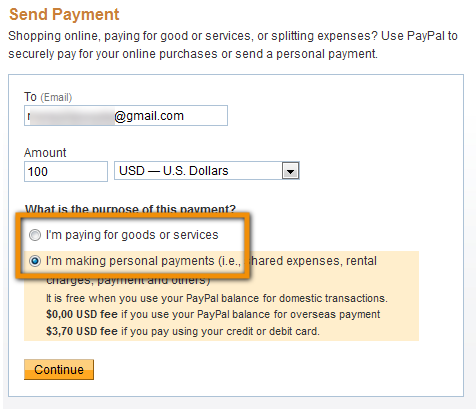

- Use a personal PayPal account: If you only make small transactions, then using a personal PayPal account can help save on invoicing costs.

- Reduce the number of transactions: If you have multiple customers, then reducing the number of transactions can help save on invoicing costs.

- Choose the right payment method: PayPal has several different payment methods. Choose the payment method that best suits your needs.

- Use recurring payment features: Recurring payment features can help save on invoicing costs by reducing the number of transactions.

Advantages and Disadvantages of PayPal Invoice Fees

Here are some advantages and disadvantages of PayPal invoice fees:

Excess:

- PayPal invoicing fees are relatively low compared to other services.

- PayPal provides convenience and security in carrying out online transactions.

- PayPal invoice fees can be calculated easily and transparently.

Lack:

- PayPal invoice fees can be charged cumulatively, which can impact your business bottom line.

- PayPal invoice fees may vary depending on the country and type of PayPal account used.

- PayPal invoice fees cannot be eliminated, but can be saved in several ways.

Conclusion

PayPal invoice fees are fees charged by PayPal to sellers or payees when they receive payment via invoice. These fees are calculated based on the number of payments received and may vary depending on the country and type of PayPal account used.

By understanding PayPal invoice fees and some tips for saving on them, you can increase your business profits and conduct online transactions more effectively.