PayPal Instant Transfer Fee: What You Need to Know

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal makes online transactions easy for merchants and consumers. However, as a payment service, PayPal also charges transaction fees that can impact your finances. One of the most frequently discussed types of transaction fees is the PayPal Instant Transfer Fee. In this article, we will discuss what you need to know about PayPal Instant Transfer Fee.

What is PayPal Instant Transfer Fee?

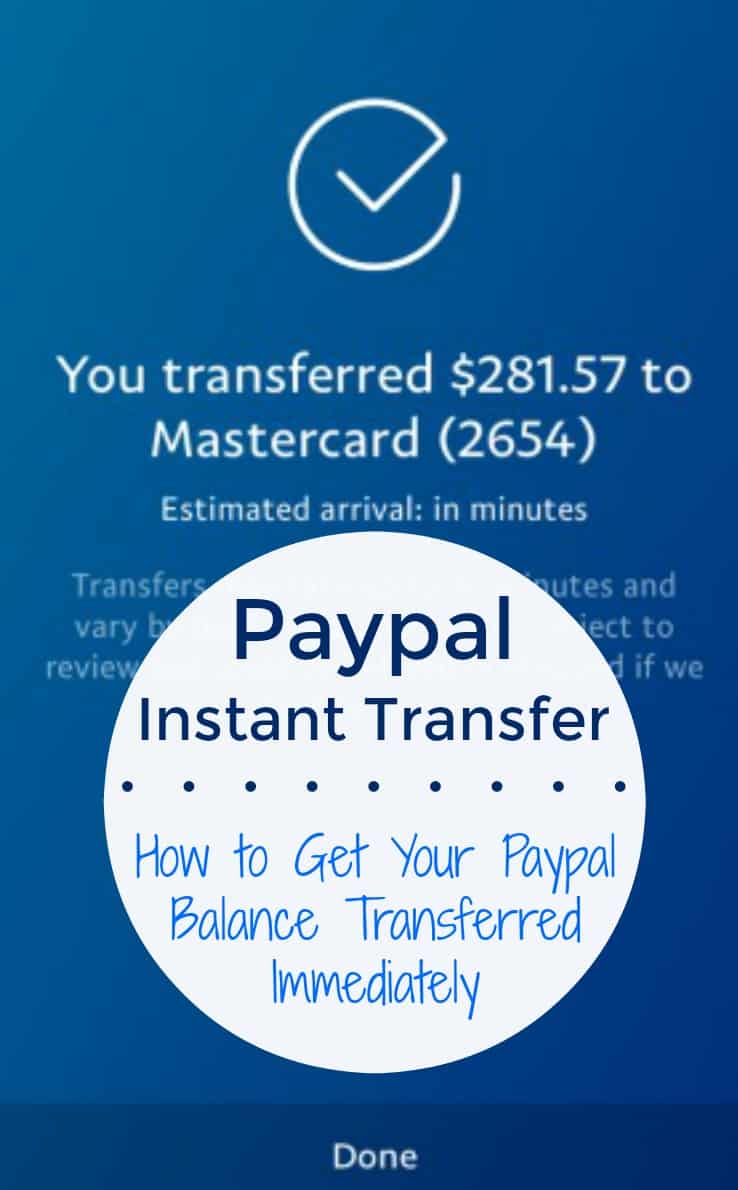

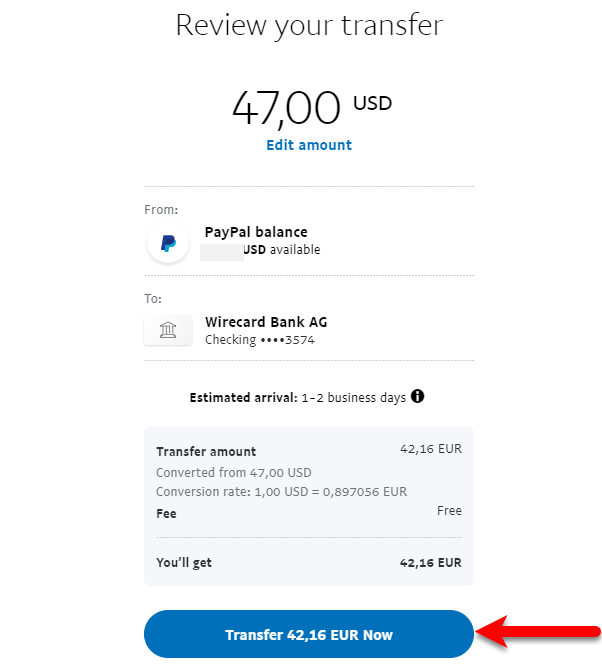

PayPal Instant Transfer Fee is a fee charged by PayPal when you transfer funds instantly from your PayPal balance to a bank account or credit card. These fees are usually charged when you want to have quick access to your funds, especially when you need cash quickly.

How Does PayPal Instant Transfer Fee Work?

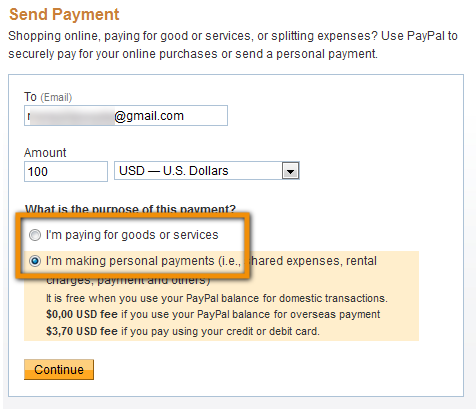

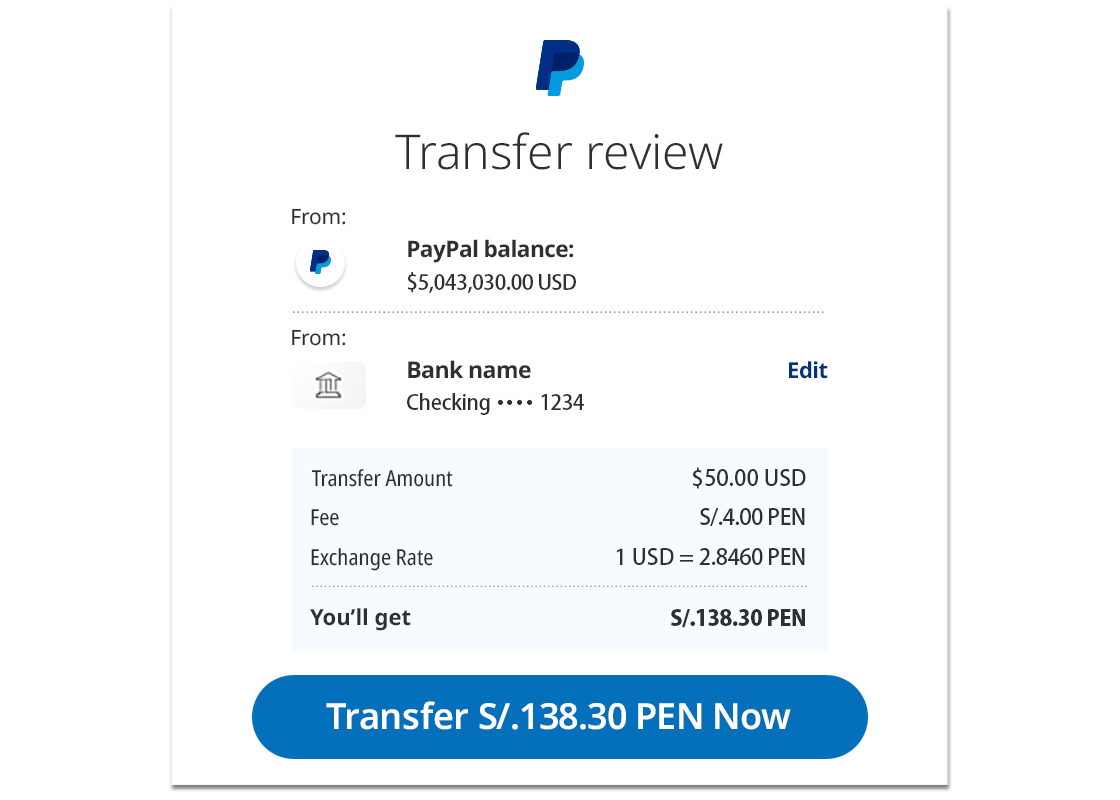

PayPal Instant Transfer Fee works in a simple way. When you have a PayPal balance that you want to transfer to a bank account or credit card, you can select the “Instant Transfer” option on the PayPal settings page. Once you select that option, PayPal will ask you to enter the bank account or credit card information you want to transfer to.

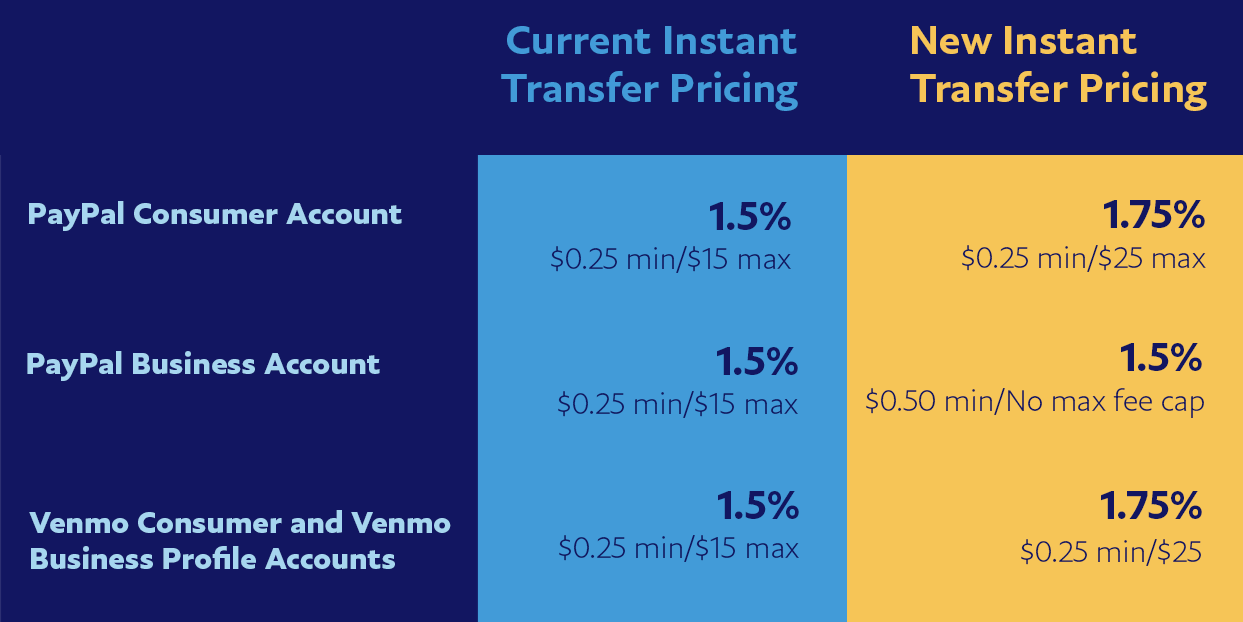

Once you enter the required information, PayPal will charge you an instant transfer fee that will be taken from your PayPal balance. This fee is usually 1% of the transfer amount, with a minimum limit of $0.25. This means that if you make a transfer of $100, you will be charged $1.

Why Does PayPal Charge Instant Transfer Fees?

PayPal charges instant transfer fees for several reasons. First, this fee is used to cover the costs of a fast and safe transfer process. Instant transfers require sophisticated infrastructure and complex processes to ensure that your funds are moved quickly and securely.

Second, instant transfer fees are also used to cover the risk costs associated with fast transfers. In some cases, fast transfers may increase the risk of fraud or transfer errors. Instant transfer fees help PayPal to cover these costs and ensure that your funds are moved safely.

How Can You Reduce Instant Transfer Fees?

If you want to reduce instant transfer fees, there are several ways you can do it. First, you can choose the standard transfer option which is slower, but has lower fees. Standard transfer options usually take a few days to process the transfer, but their fees are lower than instant transfer fees.

Second, you may consider using another PayPal transfer service, such as PayPal Transfer Balance. This service allows you to transfer your PayPal balance to a bank account or credit card for a lower fee than an instant transfer.

How Can You Avoid Instant Transfer Fees?

If you want to avoid instant transfer fees altogether, there are a few ways you can do it. First, you can choose not to use PayPal at all. However, this may not be practical if you already have a PayPal account and have used the service for various online transactions.

Second, you may consider using an alternative payment service that does not charge instant transfer fees. Some examples of alternative payment services that do not charge instant transfer fees are Stripe, Square, and Google Pay.

Conclusion

PayPal Instant Transfer Fee is a fee charged by PayPal when you transfer funds instantly from your PayPal balance to a bank account or credit card. This fee is usually 1% of the transfer amount, with a minimum limit of $0.25. You can reduce instant transfer fees by choosing a slower standard transfer option, using another PayPal transfer service, or considering using an alternative payment service that does not charge instant transfer fees.

By understanding how instant transfer fees work and how you can reduce or avoid these fees, you can make wiser decisions when making online transactions with PayPal.

FAQs

Q: What is PayPal Instant Transfer Fee?

A: PayPal Instant Transfer Fee is a fee charged by PayPal when you transfer funds instantly from your PayPal balance to a bank account or credit card.

Q: How much does an instant transfer cost?

A: Instant transfer fees are typically 1% of the transfer amount, with a minimum limit of $0.25.

Q: Why does PayPal charge instant transfer fees?

A: PayPal charges instant transfer fees to cover the costs of a fast and secure transfer process, as well as to cover the costs of risks associated with fast transfers.

Q: How can I reduce instant transfer fees?

A: You can choose the slower standard transfer option, use another PayPal transfer service, or consider using an alternative payment service that does not charge instant transfer fees.

Q: How can I avoid instant transfer fees?

A: You might consider not using PayPal at all, or using an alternative payment service that doesn’t charge instant transfer fees.