Online Payment Services like PayPal in India

In the last few years, India has seen major developments in terms of online payments. With the increasing use of internet and mobile technology, many people in India have started using online payment services to carry out transactions. However, there are still some limitations when it comes to using PayPal, a popular online payment service, in India. Therefore, several companies in India have started offering services similar to PayPal to meet the needs of users.

In this article, we will discuss some online payment services like PayPal in India, their features, and how they can help users make online transactions more easily.

What is PayPal?

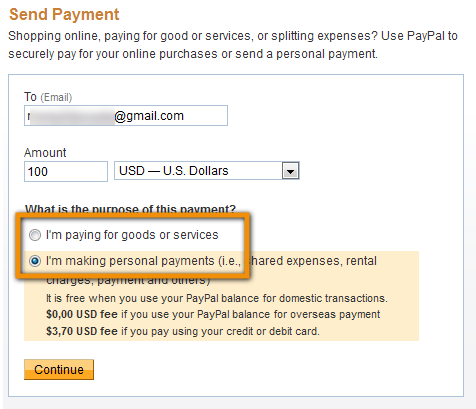

PayPal is one of the largest and most popular online payment services in the world. PayPal allows users to make online transactions using a credit, debit card, or bank account. PayPal also offers features such as money transfer, online payments, and high transaction security.

Online Payment Services like PayPal in India

Here are some online payment services like PayPal in India:

- Paytm : Paytm is one of the largest online payment services in India. Paytm offers features like money transfer, online payments and high transaction security. Paytm also has features like Paytm Wallet, which allows users to carry out online transactions without having to use a credit or debit card.

- Google Pay : Google Pay is an online payment service offered by Google in India. Google Pay allows users to make online transactions using a credit, debit card or bank account. Google Pay also offers features such as money transfer and online payments.

- AmazonPay : Amazon Pay is an online payment service offered by Amazon in India. Amazon Pay allows users to make online transactions using a credit, debit card, or bank account. Amazon Pay also offers features such as money transfer and online payments.

- PhonePe : PhonePe is an online payment service offered by Flipkart in India. PhonePe allows users to carry out online transactions using credit, debit cards, or bank accounts. PhonePe also offers features like money transfer and online payments.

- BHIM : BHIM (Bharat Interface for Money) is an online payment service offered by the Government of India. BHIM allows users to carry out online transactions using credit, debit cards, or bank accounts. BHIM also offers features like money transfer and online payments.

Online Payment Service Features

Following are some of the features offered by online payment services like PayPal in India:

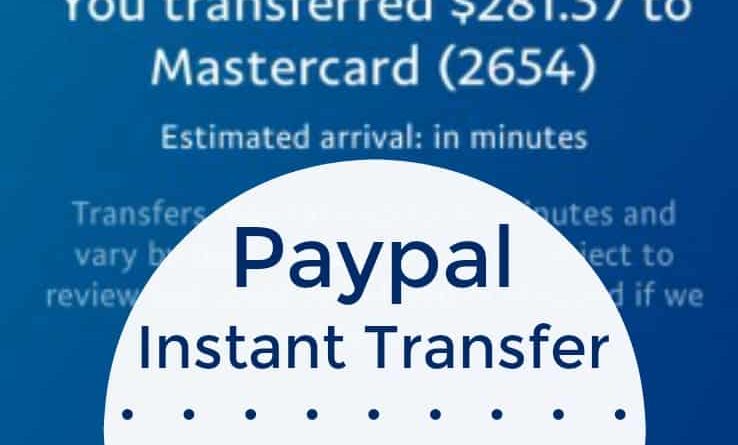

- Money Transfer : This feature allows users to send money to other people via the internet.

- Online Payment : This feature allows users to make online transactions using a credit, debit card or bank account.

- Transaction Security : This feature allows users to carry out online transactions more safely and securely.

- Recurring Payments : This feature allows users to make recurring payments, such as paying electricity or water bills.

- Financial Management : This feature allows users to better manage their finances, such as viewing transaction history and account balances.

Benefits of Online Payment Services

Here are some of the benefits that can be gained from using online payment services like PayPal in India:

- Ease of Transactions : Online payment services allow users to carry out online transactions more easily and quickly.

- Transaction Security : Online payment services provide high transaction security, so users can carry out online transactions more safely.

- Ease of Financial Management : Online payment services allow users to better manage their finances.

- Time Savings : Online payment services allow users to carry out online transactions more quickly and efficiently.

- Economic Development : Online payment services can help increase economic growth by enabling more people to make online transactions.

Conclusion

Online payment services like PayPal in India have become very popular in recent years. These services enable users to carry out online transactions more easily, safely and efficiently. With features such as money transfers, online payments, and high transaction security, these services can help increase economic growth and make it easier for users to carry out online transactions.