PayPal Fees for Business: What You Need to Know

PayPal is one of the world’s most popular online payment platforms, with more than 400 million active users worldwide. Apart from being used as a personal payment tool, PayPal also offers a special service for businesses, called PayPal for Business. In this article, we will discuss PayPal fees for businesses, so you can make an informed decision in choosing an online payment platform for your business.

What is PayPal for Business?

PayPal for Business is a special service offered by PayPal to help businesses process online payments. This service allows businesses to accept payments from customers via various payment methods, such as credit cards, debit and bank transfers. Apart from that, PayPal for Business also offers other features such as financial management, risk management, and integration with e-commerce platforms.

PayPal Fees for Business

PayPal fees for businesses vary depending on the type of transaction, number of transactions, and type of account used. Here are some common fees PayPal charges for businesses:

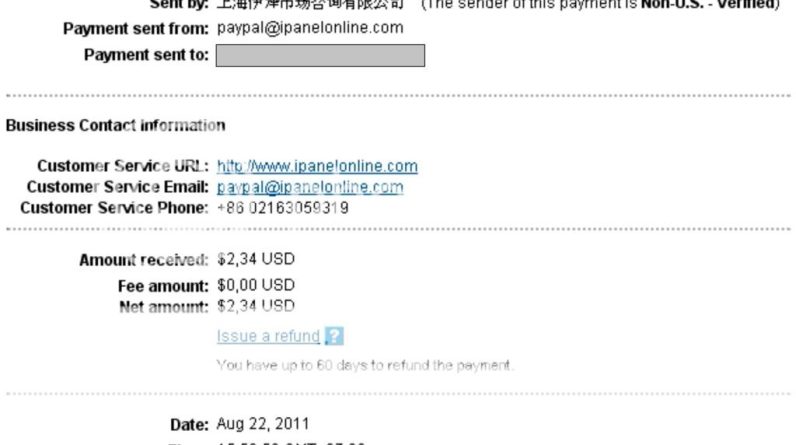

- Transaction Fees : Transaction fees are fees charged by PayPal for each transaction processed. This transaction fee is usually 2.9% of the transaction amount plus a fixed fee of IDR 3,000 (for transactions in Rupiah).

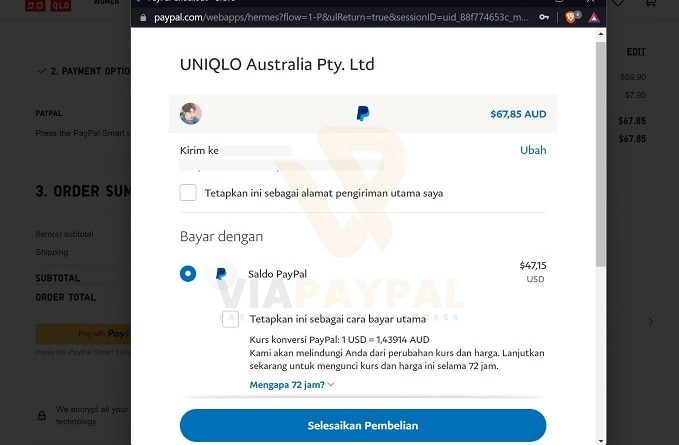

- Currency Conversion Fees : If you receive payment in a currency different from your account’s primary currency, a currency conversion fee will apply. This currency conversion fee is usually 4.5% of the transaction amount.

- Withdrawal Fees : If you wish to withdraw funds from your PayPal account to a bank account, a withdrawal fee will be charged. This withdrawal fee is usually IDR 10,000 (for transactions in Rupiah).

- Account Fees : If you want to use the PayPal for Business service with advanced features, such as financial management and risk management, an account fee will apply. This account fee is usually IDR 50,000 per month.

Tips to Save on PayPal Fees

Although PayPal fees for businesses may seem expensive, there are some tips you can do to save costs:

- Using a PayPal Premier or Business account : If you have a large business and do a lot of transactions, then using a PayPal Premier or Business account can help you save costs. These accounts have lower transaction fees than PayPal Personal accounts.

- Use cheaper payment methods : If you have customers who can make payments via bank transfer, then using this payment method can help you save costs.

- Manage your finances well : If you can manage your finances well, then you can save on withdrawal fees and account fees.

Advantages and Disadvantages of PayPal for Business

Here are some of the advantages and disadvantages of PayPal for business:

Excess:

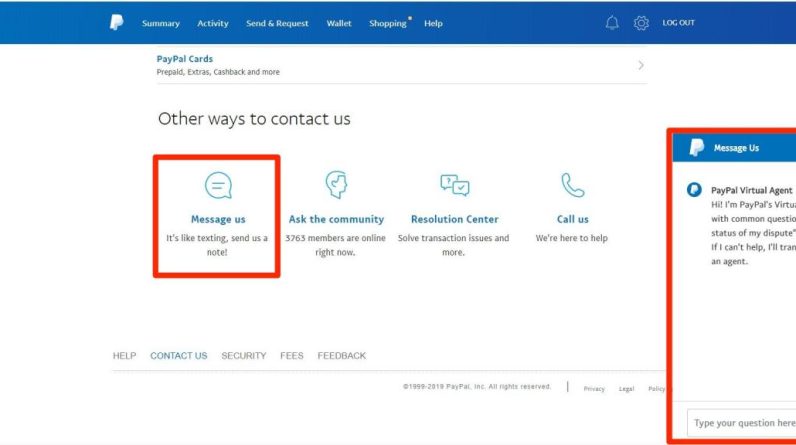

- Easy to use : PayPal is very easy to use, even for those with no technology experience.

- Safe : PayPal has an excellent security system, so you can be sure that your transactions are safe.

- Flexible : PayPal can be used for various types of transactions, including online and offline payments.

- Integration with e-commerce platforms : PayPal can be integrated with various e-commerce platforms, so you can easily accept payments from customers.

Lack:

- High costs : PayPal fees for businesses can seem expensive, especially if you do a lot of transactions.

- Feature limitations : If you have a large and complex business, then PayPal’s features may not be enough to meet your needs.

- Dependence on the internet : PayPal requires internet to function, so if you do not have internet access, then you cannot use PayPal services.

Conclusion

PayPal for business could be the right choice for your business, especially if you have a small to medium-sized business. However, PayPal fees for businesses can seem expensive, so you need to consider other options before making a decision. By understanding PayPal costs for business and using the tips mentioned above, you can save costs and increase your business profits.