Online Payments for Nonprofits with PayPal

In recent decades, online payment technology has advanced rapidly, making it easier for nonprofits to raise funds and conduct financial transactions online. One of the most popular online payment platforms used by nonprofits is PayPal. In this article, we’ll talk about how PayPal can help nonprofits raise funds and conduct online financial transactions.

What is PayPal?

PayPal is an online payment platform that allows users to send and receive money online. The platform was founded in 1998 and has grown to become one of the largest online payment platforms in the world. PayPal has more than 400 million active users worldwide and supports more than 100 currencies.

Advantages of PayPal for Nonprofits

PayPal has several advantages that make it an ideal choice for nonprofits. Here are some of them:

- Easy to use : PayPal has a simple, easy-to-use interface, making it easy for nonprofit staff and volunteers to raise funds and conduct financial transactions online.

- Safe and secure : PayPal has a sophisticated security system to protect users’ financial information, ensuring that online financial transactions are safe and secure.

- Support for more than 100 currencies : PayPal supports more than 100 currencies, allowing nonprofits to accept donations from all over the world.

- Low transaction fees : PayPal has low transaction fees, allowing nonprofits to save on costs and increase financial efficiency.

How to Use PayPal for Nonprofits

Here are the steps nonprofits can follow to use PayPal:

- Create a PayPal account : First, nonprofit staff or volunteers must create a PayPal account. An account can be created online by visiting the PayPal website.

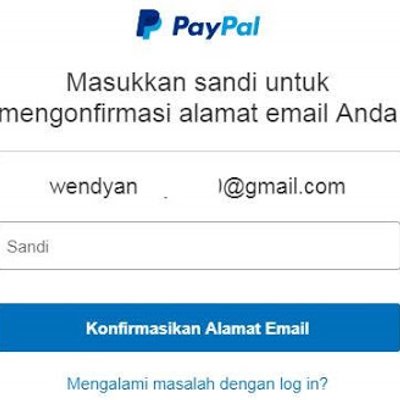

- Account verification : After creating an account, nonprofit staff or volunteers must verify the account by submitting required documents, such as identification documents and financial documents.

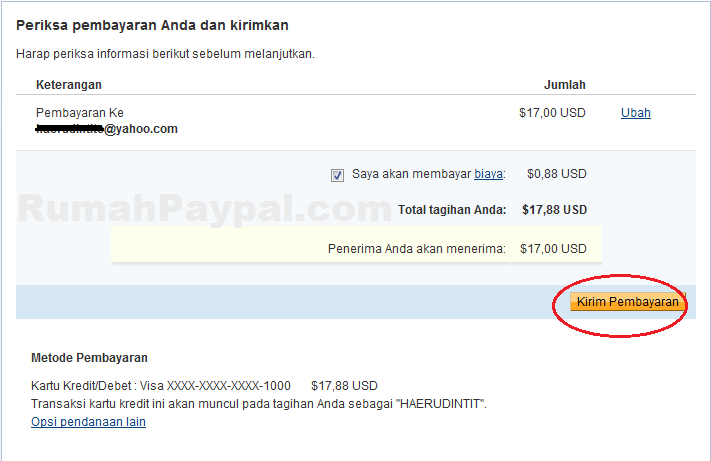

- Set up a PayPal account : Once an account is verified, nonprofit staff or volunteers can set up a PayPal account by adding financial information, such as bank account and credit card numbers.

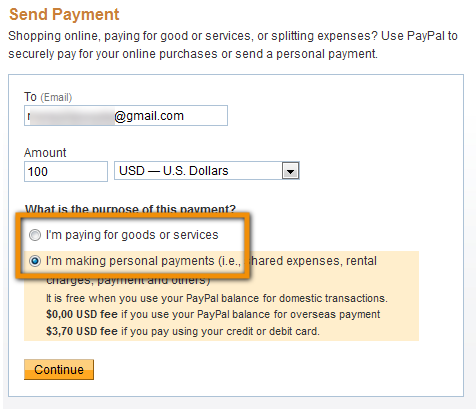

- Collect donations : Once a PayPal account is set up, nonprofit staff or volunteers can collect donations by sending a PayPal link to website visitors or via email.

- Manage transactions : Nonprofit staff or volunteers can manage online financial transactions using the PayPal interface.

Tips for Using PayPal for Nonprofits

Here are some tips that can help nonprofits use PayPal:

- Use the PayPal logo : Adding the PayPal logo to your website or marketing materials can help increase visitor trust and increase donations.

- Create a donate button : Creating clickable donation buttons can help make it easier for visitors to make donations.

- Use email campaigns : Using email campaigns can help increase donations by sending a PayPal link to website visitors or potential donors.

- Manage transactions well : Managing online financial transactions well can help increase financial efficiency and reduce costs.

PayPal Security for Nonprofits

PayPal has several security features that can help protect nonprofits’ online financial transactions. Here are some of them:

- Encryption : PayPal uses SSL/TLS encryption to protect users’ financial information.

- Two-factor authentication : PayPal offers two-factor authentication to increase the security of user accounts.

- Transaction monitoring : PayPal has a sophisticated transaction monitoring system to detect and prevent suspicious transactions.

- Insurance : PayPal offers insurance to protect users from financial loss.

Conclusion

PayPal can be an ideal solution for nonprofits looking to raise funds and conduct financial transactions online. With advanced security features and low transaction fees, PayPal can help increase financial efficiency and reduce costs. By following the right steps and using the right tips, nonprofits can leverage PayPal to increase donations and reach financial goals.