PayPal to PayPal Transfer Fees: Complete Guide

PayPal is one of the most popular online payment platforms in the world. With more than 400 million active users, PayPal has become the first choice for many people to make online transactions. However, like other payment services, PayPal also has transfer fees that users must pay. In this article, we will discuss PayPal to PayPal transfer fees and how to save on them.

What are PayPal Transfer Fees?

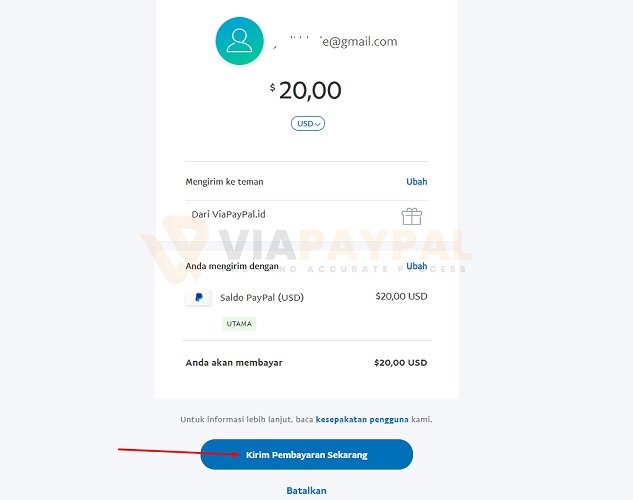

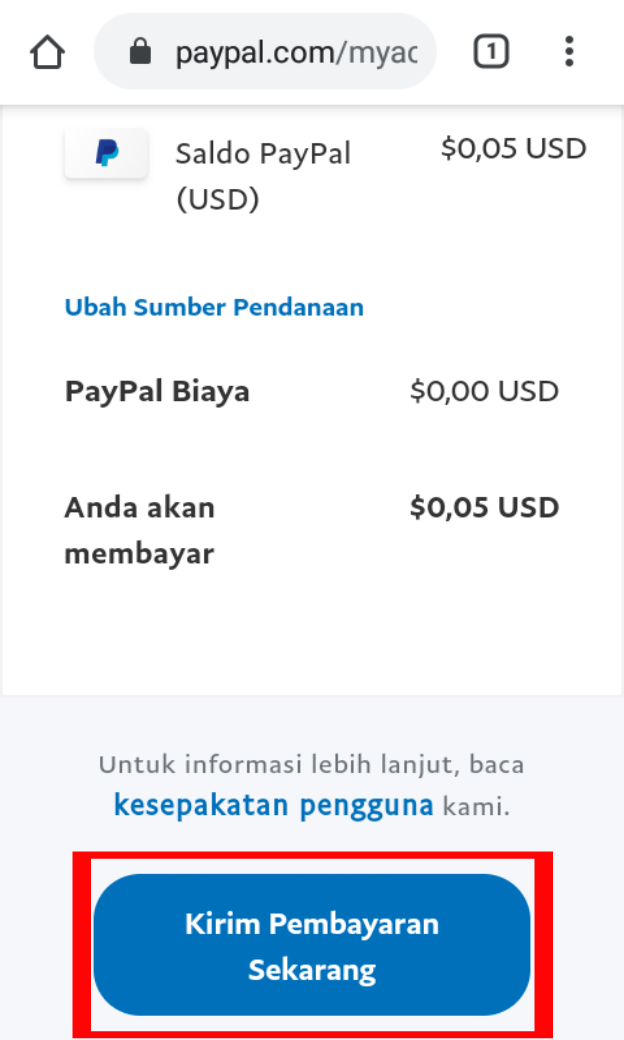

PayPal transfer fees are fees charged by PayPal when you transfer money from your PayPal account to another PayPal account. This fee is usually charged as a percentage of the transfer amount, but can also be a fixed fee.

Why Does PayPal Charge Transfer Fees?

PayPal charges transfer fees for several reasons:

- Operating costs : PayPal has operational costs that must be paid, such as server costs, personnel costs, and other costs.

- Transaction Risk : PayPal must also bear transaction risks, such as fraud risk and payment default risk.

- Commission : PayPal also charges a commission for making transactions.

How Much Does a PayPal to PayPal Transfer Cost?

PayPal to PayPal transfer fees vary depending on several factors, such as user location, account type, and transfer amount. Here are some examples of PayPal to PayPal transfer fees:

- Domestic Transfer Fee : PayPal domestic transfer fees are usually 2.9% + $0.30 per transaction.

- International Transfer Fees : PayPal international transfer fees are typically 4.4% + $0.30 per transaction.

- Cross-Border Transfer Fees : PayPal cross-border transfer fees are typically 3.4% + $0.30 per transaction.

How to Save on PayPal Transfer Fees

While PayPal transfer fees are unavoidable, there are several ways to save on them. Here are some tips for saving on PayPal transfer fees:

- Use PayPal Business : If you have a business, use PayPal Business to make transactions. PayPal Business has lower transfer fees compared to PayPal Personal.

- Use PayPal Premier : If you have a large balance, use PayPal Premier to make transactions. PayPal Premier has lower transfer fees compared to PayPal Personal.

- Use PayPal Standard : If you have a small balance, use PayPal Standard to make transactions. PayPal Standard has lower transfer fees compared to PayPal Personal.

- Use the Right Transfer Option : When making a transfer, use the correct transfer option. If you are making a transfer to another PayPal account, use the PayPal to PayPal transfer option.

- Avoid Small Transfers : Avoid making small transfers because the transfer fee will be greater than the transfer amount.

- Use a Debit Card : If you have a debit card, use the debit card to make transactions. Debit cards have lower transfer fees compared to credit cards.

- Use PayPal Rewards : If you have PayPal Rewards, use PayPal Rewards to make transactions. PayPal Rewards has lower transfer fees compared to PayPal Personal.

Conclusion

PayPal to PayPal transfer fees are fees charged by PayPal when you transfer money from your PayPal account to another PayPal account. These transfer fees vary depending on several factors, such as the user’s location, account type, and transfer amount. However, by using some of the tips mentioned above, you can save on PayPal transfer fees.

Recommendation

- Use PayPal Business to conduct business transactions.

- Use PayPal Premier to make transactions with large balances.

- Use PayPal Standard to make transactions with small balances.

- Use the correct transfer option when making a transfer.

- Avoid making small transfers.

- Use a debit card to make transactions.

- Use PayPal Rewards to make transactions.

This way, you can use PayPal more effectively and efficiently.