PayPal Cash Withdrawal Fees at ATMs: What You Need to Know

PayPal is one of the world’s most popular online payment services, with more than 400 million active users. With PayPal, you can transfer money, pay bills, and even make cash withdrawals at ATMs. However, when you make a cash withdrawal at an ATM using your PayPal card, you may be charged a fee. In this article, we’ll talk about PayPal cash withdrawal fees at ATMs, what affects them, and how you can save on them.

What is the PayPal Cash Withdrawal Fee at an ATM?

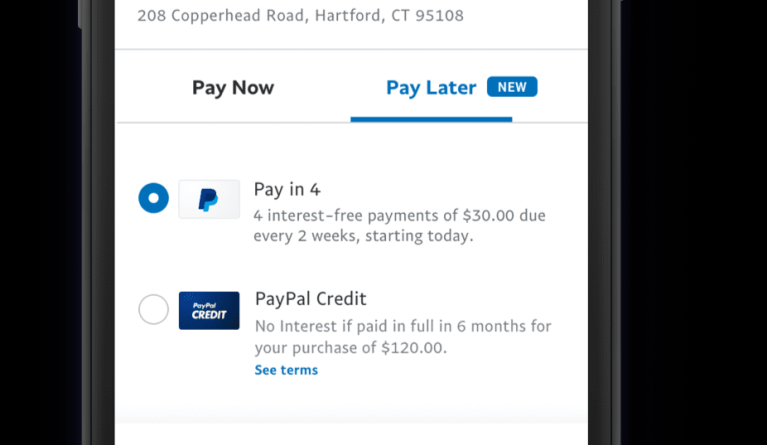

PayPal cash withdrawal fees at ATMs are fees charged by PayPal when you make a cash withdrawal using a PayPal card at an ATM. This fee is usually charged in the form of a percentage of the amount of cash withdrawal you make. These fees can vary depending on your location, the type of PayPal card you use, and the bank you account with.

How Much is the PayPal Cash Withdrawal Fee at an ATM?

PayPal cash withdrawal fees at ATMs can vary depending on your location and the type of PayPal card you use. Here are examples of PayPal cash withdrawal fees at ATMs for some locations:

- In the United States, PayPal cash withdrawal fees at ATMs are typically 2.5% of the cash withdrawal amount, with a minimum of $0.75.

- In Europe, PayPal cash withdrawal fees at ATMs are typically 2% of the cash withdrawal amount, with a minimum of €0.35.

- In Indonesia, PayPal cash withdrawal fees at ATMs are usually 2.5% of the cash withdrawal amount, with a minimum of IDR 2,500.

What Affects PayPal Cash Withdrawal Fees at ATMs?

PayPal cash withdrawal fees at ATMs can be affected by several factors, including:

- Location: PayPal cash withdrawal fees at ATMs may vary depending on location. Countries with higher inflation rates or a more expensive cost of living may have higher cash withdrawal fees.

- PayPal card type: PayPal cash withdrawal fees at ATMs can vary depending on the type of PayPal card you use. More premium PayPal cards may have lower cash advance fees.

- Bank you account with: PayPal cash withdrawal fees at ATMs can also be affected by the bank you account with. Some banks may have higher cash withdrawal fees than others.

How Can You Save on PayPal Cash Withdrawal Fees at ATMs?

Here are some tips for saving on PayPal cash withdrawal fees at ATMs:

- Use a more premium PayPal card: A more premium PayPal card may have lower cash advance fees.

- Choose the right bank: Choose a bank that has lower cash withdrawal fees.

- Make large cash withdrawals: Make large cash withdrawals to save on cash withdrawal fees.

- Use ATMs located in closer locations: Use ATMs located in closer locations to save on cash withdrawal fees.

- Check cash advance fees before making a cash withdrawal: Check cash advance fees before making a cash withdrawal to ensure that you have enough funds to pay the fee.

Conclusion

PayPal cash withdrawal fees at ATMs can be a significant expense if you don’t pay attention to them. However, by understanding what affects PayPal cash withdrawal fees at ATMs and saving on those fees, you can save money and optimize the use of your PayPal card. Make sure you pay attention to cash advance fees before making a cash withdrawal and to choose the right PayPal card for your needs.