PayPal Before Earnings: Will PayPal Shares Rise?

PayPal Holdings, Inc. (PYPL) is one of the world’s largest online payment technology companies. The company was founded in 1998 by Peter Thiel and Max Levchin, and is now one of the main ways for people to make online transactions. With more than 400 million active accounts, PayPal is one of the largest online payment platforms in the world.

In this article, we will discuss PayPal before earnings, namely about market hopes and expectations for this company’s financial performance. We will also discuss the factors that can influence PayPal’s stock price and how investors can utilize this information to make informed investment decisions.

Latest Financial Reports

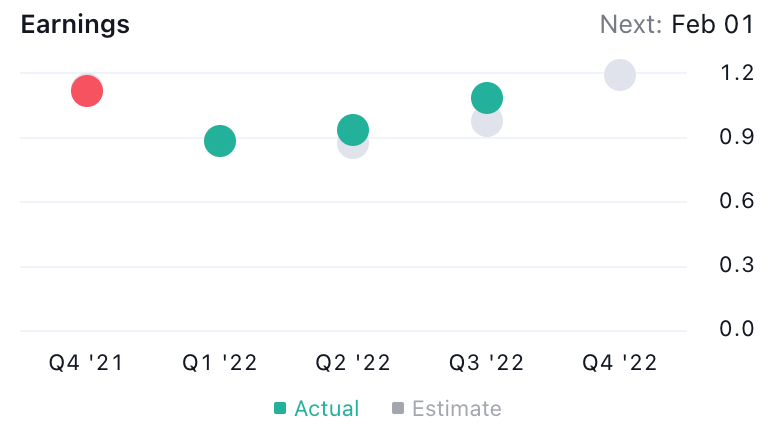

On October 26, 2022, PayPal reported its third quarter 2022 financial results. Here are some key points from the report:

- Revenue: $6.84 billion, an 11% increase over the previous year

- Net profit: $1.04 billion, an increase of 31% compared to the previous year

- Active accounts: 426 million, an increase of 13% compared to the previous year

- Online transactions: 5.3 billion, an increase of 10% compared to the previous year

This financial report shows that PayPal is still growing strongly, with revenue and net income increasing. However, the company also faces several challenges, such as increasing competition in the online payments industry.

Market Expectations

The market has high expectations for PayPal’s financial performance, especially after the company reported strong third-quarter 2022 financial results. Following are some market expectations regarding PayPal’s financial performance:

- Revenue: $7.27 billion, a 12% increase over the previous year

- Net profit: $1.13 billion, an increase of 35% over the previous year

- Active accounts: 432 million, an increase of 15% compared to the previous year

- Online transactions: 5.6 billion, an increase of 12% compared to the previous year

However, please remember that these market expectations are only predictions, and actual financial performance may differ from expectations.

Factors that Can Influence Stock Prices

PayPal’s share price can be influenced by several factors, including:

- Financial performance: PayPal’s financial reports can influence the share price of this company. If PayPal’s financial performance exceeds market expectations, the share price may increase.

- Competition: The online payments industry is highly competitive, and other companies such as Square, Stripe, and Venmo can impact PayPal’s financial performance.

- Regulation: Stricter regulation of the online payments industry could impact PayPal’s financial performance.

- Macroeconomics: Global economic conditions may affect PayPal’s financial performance.

How Investors Can Make the Right Investment Decisions

Investors can make the right investment decisions by considering the following factors:

- Financial performance: PayPal’s financial reports can provide an overview of the financial performance of this company.

- Market expectations: Market expectations can provide an idea of how the market assesses PayPal’s financial performance.

- Factors that may influence share price: Factors such as financial performance, competition, regulation, and macroeconomics may influence PayPal’s share price.

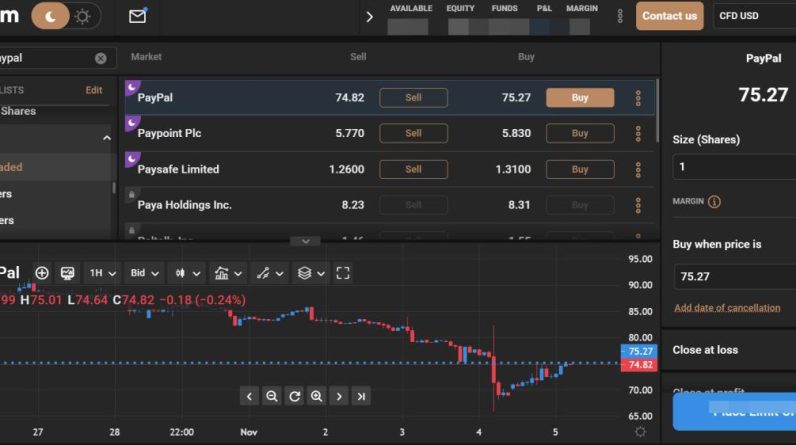

- Technical analysis: Technical analysis can provide an overview of PayPal share price trends.

Conclusion

PayPal is a very large online payment technology company and has strong growth potential. PayPal’s strong financial performance and high market expectations can make this company’s share price increase. However, please remember that these market expectations are only predictions, and actual financial performance may differ from expectations. Investors can make informed investment decisions by considering several factors, including financial performance, market expectations, and factors that may influence stock prices.

Recommendation

Based on the analysis that has been carried out, investment recommendations for PayPal are as follows:

- Short term: The recommendation for the short term is “HOLD”, because PayPal’s strong financial performance and high market expectations can make this company’s share price increase.

- Long term: The recommendation for the long term is “Buy”, because PayPal has strong growth potential and strong financial performance can make this company’s share price increase.

However, please remember that these recommendations are based only on analysis that has been conducted, and investors should conduct further research before making an investment decision.