PayPal ATM Fees: What You Need to Know

If you use PayPal as an online payment method, then you’ve probably heard about PayPal ATM fees. This fee is charged when you use your PayPal ATM card to withdraw cash from your PayPal account at an ATM machine. In this article, we’ll talk more about PayPal ATM fees, how they work, and what you can do to avoid them.

What are PayPal ATM Fees?

PayPal ATM fees are fees charged by PayPal when you use your PayPal ATM card to withdraw cash from your PayPal account at an ATM machine. This fee is usually charged as a percentage of the amount of money you withdraw, plus a fixed fee.

PayPal ATM fees may vary depending on your country and region. In Indonesia, PayPal ATM fees are usually around 2.5% of the amount of money you withdraw, plus a flat fee of IDR 5,000.

How Do PayPal ATM Fees Work?

When you use your PayPal ATM card to withdraw cash from your PayPal account at an ATM machine, PayPal ATM fees will be charged automatically. Here’s how PayPal ATM fees work:

- You use your PayPal ATM card to withdraw cash from your PayPal account at an ATM machine.

- The ATM machine will send a request to PayPal to ensure that you have sufficient balance in your PayPal account.

- If your balance is sufficient, then PayPal will allow the transaction and will charge a PayPal ATM fee.

- PayPal ATM fees will be charged as a percentage of the amount of money you withdraw, plus a flat fee.

- The money will be removed from the ATM machine and you will receive the remaining balance minus PayPal ATM fees.

Why Are PayPal ATM Fees Charged?

PayPal ATM fees are charged because PayPal has to pay transaction fees to the ATM machines and banks involved in the transaction process. These fees are also used to maintain the security and integrity of PayPal’s systems.

Apart from that, PayPal ATM fees are also used to cover PayPal’s operational costs, such as infrastructure costs, HR costs and other costs.

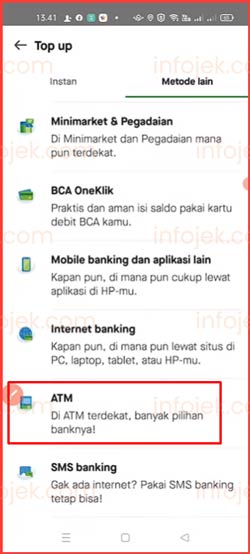

How to Avoid PayPal ATM Fees

While PayPal ATM fees cannot be avoided completely, there are several ways you can reduce these fees:

- Use a PayPal debit card : PayPal debit cards can be used to shop online and offline, as well as to withdraw cash from your PayPal account. PayPal ATM fees charged on PayPal debit cards are usually lower than PayPal ATM fees charged on PayPal credit cards.

- Use PayPal to shop online : If you only use PayPal for online shopping, then you don’t need to worry about PayPal ATM fees. You can use PayPal to pay bills online, buy goods online, and more.

- Use PayPal for money transfers : If you need to send money to someone, then you can use PayPal to make the money transfer. PayPal money transfer fees are usually lower than PayPal ATM fees.

- Use your PayPal ATM card wisely : If you have to use a PayPal ATM card, then make sure you use your PayPal ATM card wisely. You can withdraw larger amounts of cash to reduce PayPal ATM fees.

Conclusion

PayPal ATM fees are fees charged by PayPal when you use your PayPal ATM card to withdraw cash from your PayPal account at an ATM machine. These fees may vary depending on your country and region. You can reduce PayPal ATM fees by using a PayPal debit card, using PayPal for online shopping, using PayPal for money transfers, and using your PayPal ATM card wisely.

By understanding how PayPal ATM fees work and taking steps to reduce these fees, you can use PayPal more effectively and efficiently. Always make sure you read PayPal’s terms and conditions before making a transaction to avoid unexpected fees.