Using PayPal to Transfer Money from Canada to the US: Complete Guide

PayPal is one of the most popular online money transfer services in the world. With more than 400 million active users worldwide, PayPal makes it easy for users to send and receive money online. If you live in Canada and want to send money to the US, then PayPal could be a good option. However, keep in mind that there are some fees and limitations to consider before using this service.

How to Use PayPal to Transfer Money from Canada to the US

Here are the steps to use PayPal to transfer money from Canada to the US:

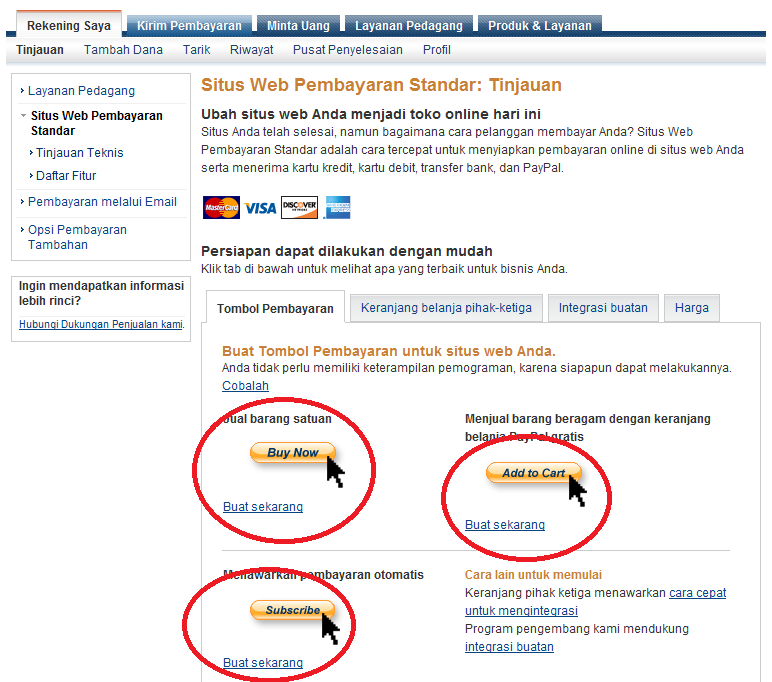

- Create a PayPal Account : If you don’t have a PayPal account, then you need to create one first. You can register for free on the PayPal website.

- Add a Credit Card or Bank Account : To send money, you need to add a credit card or bank account to your PayPal account.

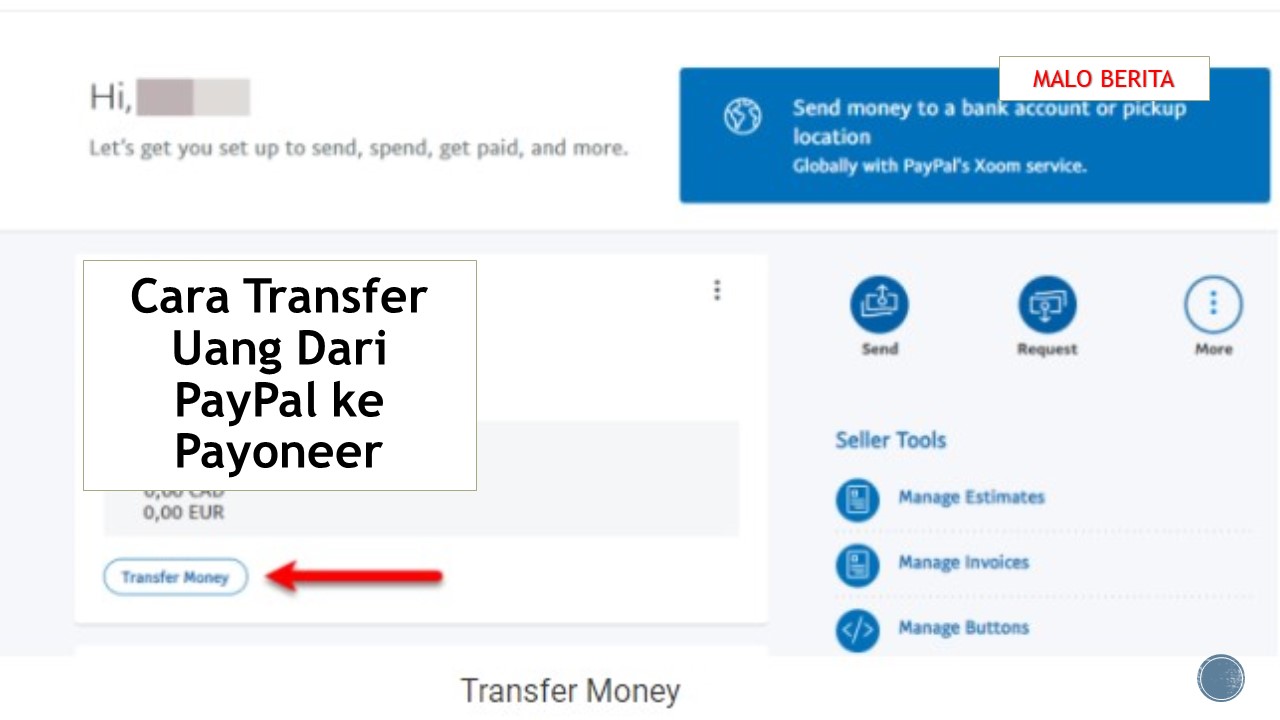

- Select Recipient : Enter the recipient’s US email address or phone number.

- Enter the Amount of Money : Enter the amount of money you want to send.

- Select Payment Method : Select the payment method you want to use. You can use a credit card, bank account, or PayPal balance.

- Transaction Confirmation : Confirm the transaction and wait for the transfer process to complete.

Fees for Transferring Money from Canada to the US

The cost of transferring money from Canada to the US using PayPal depends on the payment method you use. Here are some costs you need to consider:

- Transfer Fees : Transfer fees using PayPal start at 2.9% + $0.30 CAD per transaction.

- Currency Conversion Fees : If you send money in a different currency from CAD to USD, then you need to pay a currency conversion fee which starts from 4.5% to 6.5% of the transaction amount.

- Credit Card Fees : If you use a credit card to send money, then you will need to pay a credit card fee which starts at 2.9% + $0.30 CAD per transaction.

Restrictions on Money Transfers from Canada to the US

PayPal has several restrictions on transferring money from Canada to the US, including:

- Transaction Limits : PayPal transaction limits are $10,000 CAD per transaction.

- Daily Limits : PayPal’s daily limit is $10,000 CAD per day.

- Monthly Limits : PayPal’s monthly limit is $50,000 CAD per month.

Pros of Using PayPal to Transfer Money from Canada to the US

Here are some of the advantages of using PayPal to transfer money from Canada to the US:

- Easy to use : PayPal is very easy to use and has a simple interface.

- Safe : PayPal has a sophisticated security system to protect your transactions.

- Fast : PayPal allows you to send money quickly and easily.

- Available Worldwide : PayPal is available worldwide and can be used in over 200 countries.

Disadvantages of Using PayPal to Transfer Money from Canada to the US

Here are some disadvantages of using PayPal to transfer money from Canada to the US:

- Expensive Costs : Money transfer fees using PayPal can be expensive, especially if you send money in a different currency.

- Transaction Limits : PayPal has some transaction limits that may limit the amount of money you can send.

- Cannot Be Used for All Purposes : PayPal cannot be used for all purposes, such as paying taxes or school fees.

PayPal Alternative for Money Transfer from Canada to USA

If you don’t want to use PayPal, then there are some other alternatives you can consider, such as:

- TransferWise : TransferWise is an online money transfer service that offers lower fees than PayPal.

- Western Union : Western Union is a money transfer service that has been around for over 160 years and offers lower fees than PayPal.

- MoneyGram : MoneyGram is a money transfer service that offers lower fees than PayPal and has a wide network worldwide.

Conclusion

PayPal is one of the most popular online money transfer services in the world. However, keep in mind that there are some fees and limitations to consider before using this service. If you want to send money from Canada to the US, then PayPal may be a good option, but make sure you compare the fees and limitations with other alternatives before making a decision.