PayPal Above Balance Limit: Understanding the Limit and How to Work Around it

PayPal is one of the most popular online payment services in the world. With PayPal, you can make online transactions easily and safely. However, there are several limitations you need to know about PayPal, especially regarding balance limits. In this article, we will discuss PayPal above balance limits, including what balance limits are, how to overcome balance limit limits, and what the consequences are for exceeding these limits.

What is Balance Limit on PayPal?

The balance limit on PayPal is a limit on the amount of money you can keep in your PayPal account. These limits apply to all PayPal account types, including personal and business accounts. Balance limits may vary depending on account type, location, and security settings.

In general, the balance limits at PayPal are as follows:

- For personal PayPal accounts, the balance limit is $2,000 (around IDR 28,000,000) per month.

- For business PayPal accounts, balance limits may vary depending on the type of business and transaction volume.

What Happens If You Exceed the Balance Limit?

If you exceed the balance limit on PayPal, several things can happen:

- PayPal may block access to your account.

- You cannot make any more transactions until you reduce the balance in your account below the balance limit limit.

- PayPal may impose additional penalties or fees on you.

How to Overcome Balance Limit Limits on PayPal

If you have exceeded the balance limit on PayPal, then there are several ways to solve this problem:

- Reducing Balance : You can reduce the balance in your PayPal account by making a withdrawal or transfer to a bank account or credit card.

- Increases Balance Limit : You can apply to increase the balance limit limit on PayPal. However, this requires several terms and conditions that must be met.

- Using a Business PayPal Account : If you have a business that requires large online transactions, then you can use a business PayPal account which has a higher balance limit.

- Using Other Payment Services : If you want to avoid balance limits at PayPal, then you can use other payment services such as Stripe, Authorize.net, or local payment services such as DANA or OVO.

How to Increase the Balance Limit on PayPal

If you want to increase the balance limit on PayPal, then you can follow these steps:

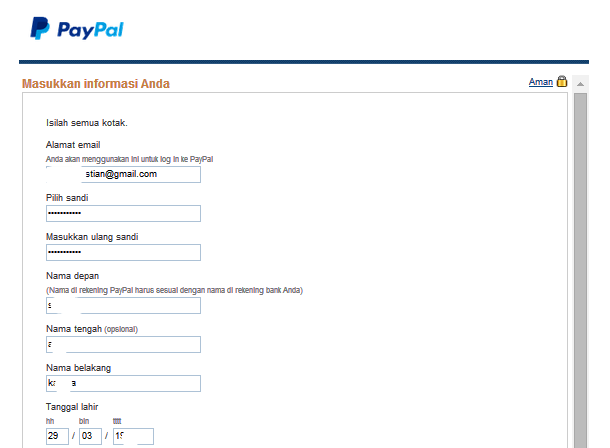

- Log in to your PayPal Account : Open your PayPal account and go to the “Settings” menu.

- Select “Balance Limit” : Select the “Balance Limit” option from the dropdown menu.

- Select “Increase Restrictions” : Select the “Increase Restrictions” option to start the application process.

- Complete the Form : Complete the application form with the required information, such as address, telephone number, and business information.

- Wait for Verification : Wait until PayPal verifies your information and processes your application.

Security and Privacy at PayPal

PayPal really cares about the security and privacy of its users. PayPal has several advanced security features to protect your information and transactions, such as:

- SSL/TLS encryption to protect your data.

- Two-factor authentication to increase login security.

- Transaction monitoring to detect suspicious activity.

Conclusion

PayPal above balance limit is an important topic for PayPal users to understand. By understanding balance limits and how to overcome these problems, you can use PayPal more effectively and safely. Don’t forget to pay attention to your security and privacy at PayPal by using advanced security features and adhering to the terms and conditions of service.