PayPal ATM: A New Revolution in Financial Transactions

As one of the largest online payment services in the world, PayPal continues to innovate to increase comfort and convenience in carrying out financial transactions. One of the latest innovations from PayPal is PayPal ATM, a service that allows users to carry out financial transactions directly through ATM machines.

In this article, we will discuss PayPal ATM, starting from the definition, how it works, benefits, and the risks associated with this service.

What is PayPal ATM?

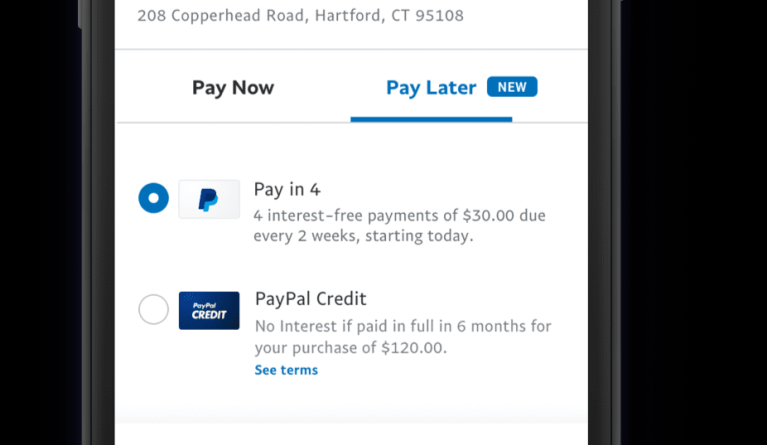

PayPal ATM is a service that allows users to carry out financial transactions directly through ATM machines. By using a debit card or credit card linked to a PayPal account, users can carry out transactions such as cash withdrawals, payments and check balances.

How PayPal ATM Works

The way PayPal ATM works is very easy. Following are the steps to follow:

- Make sure you have an active PayPal account and a debit or credit card linked to the account.

- Look for an ATM machine that supports PayPal ATM services. You can use a bank’s ATM machine or an independent ATM machine.

- Insert your debit or credit card into the ATM machine.

- Select the “PayPal” or “E-Wallet” menu on the ATM machine screen.

- Enter your PayPal PIN for verification.

- Select the transaction you want to perform, such as cash withdrawal, payment, or balance check.

- Follow the instructions on the ATM machine screen to complete the transaction.

Benefits of PayPal ATM

PayPal ATM has several significant benefits, including:

- Comfort : PayPal ATM allows users to carry out financial transactions directly and easily, without the need to use a computer or smartphone.

- Flexibility : PayPal ATM can be accessed anywhere and at any time, even outside bank working hours.

- Security : PayPal ATM uses advanced security technology to protect your transactions.

- Low cost : PayPal ATM has low transaction fees compared to other payment methods.

PayPal ATM Risks

Although PayPal ATM has many benefits, there are also some risks associated with this service. Here are some examples:

- Lost cards : If your debit or credit card is lost or stolen, your PayPal account can be accessed by someone else.

- Phishing : PayPal ATMs can be vulnerable to phishing attacks, which could result in users disclosing sensitive information.

- Technical glitches : ATM machines may experience technical problems, which may hinder your transactions.

How to Avoid PayPal ATM Risks

Here are some ways to avoid PayPal ATM risks:

- Take good care of your debit or credit card : Make sure you keep your debit or credit card in a safe place and not accessed by other people.

- Use a strong PIN : Make sure you use a strong PIN that no one else can guess.

- Check the ATM machine before use : Make sure you check the ATM machine before use to ensure that there are no technical problems.

- Use the PayPal app : Make sure you use the PayPal app to monitor your transactions and receive notifications if there is any unusual activity.

Conclusion

PayPal ATM is a service that allows users to carry out financial transactions directly through ATM machines. By using a debit card or credit card linked to a PayPal account, users can carry out transactions such as cash withdrawals, payments and check balances.

Although PayPal ATM has many benefits, there are also some risks associated with this service. Therefore, it is important to take appropriate steps to avoid such risks.

Thus, PayPal ATM can be a useful tool to increase comfort and ease in carrying out financial transactions.