PayPal and the Future of Digital Payments

In recent decades, digital payment technology has advanced rapidly, changing the way we conduct financial transactions. One successful example of digital payment technology is PayPal, an online payments company founded in 1998. In this article, we will discuss PayPal and how the company has transformed over the years, as well as look at the future of digital payments.

What is PayPal?

PayPal is an online payments company that allows users to send and receive money electronically. Starting as a small company based in California, United States, PayPal has grown to become one of the largest digital payments companies in the world. With more than 440 million active users worldwide, PayPal has become one of the most popular and secure payment options.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, this company was called Confinity, a company that focused on mobile payments. In 2000, Confinity merged with X.com, an online financial company founded by Elon Musk. After a few years, X.com was renamed PayPal and focused on online payments.

In 2002, PayPal was acquired by eBay, the world’s largest e-commerce company at the time. After 13 years under eBay, PayPal returned to being an independent company in 2015.

How PayPal Works?

PayPal allows users to send and receive money electronically using a credit, debit card, or bank account. Here are the steps for how PayPal works:

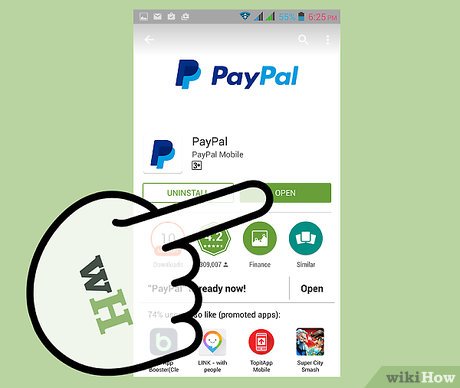

- Users register on PayPal and create an account.

- Users add credit, debit cards, or bank accounts to their PayPal account.

- Users can send money to others or make online payments.

- The money sent will be received by the recipient in the form of PayPal balance.

- Recipients can withdraw money from their PayPal balance to a bank account or use it to make online payments.

Advantages and Disadvantages of PayPal

Advantages of PayPal:

- Easy to use and integrate with websites and apps.

- Offers a high level of security with features such as SSL encryption and two-factor authentication.

- Can be used worldwide with more than 200 supported currencies.

- Offers other features such as international money transfers and recurring payments.

Disadvantages of PayPal:

- High transaction fees, especially for international transactions.

- Balance and transaction limits for new or unverified accounts.

- The money withdrawal process is slow and takes several days.

PayPal and the Future of Digital Payments

In recent years, PayPal has transformed into a broader digital payments company. With the acquisition of several digital payment companies, such as Braintree and Venmo, PayPal has increased its digital payment capabilities.

PayPal has also introduced several new features, such as PayPal One Touch, which allows users to make payments with just one click. Apart from this, PayPal has also introduced features like international money transfers and recurring payments.

Future Trends in Digital Payments

Here are some future trends in digital payments that can be predicted:

- Blockchain Based Payments : Blockchain-based payments, such as Bitcoin and Ethereum, will become increasingly popular in the next few years.

- Mobile Based Payments : Mobile-based payments, such as Apple Pay and Samsung Pay, will become increasingly popular in the next few years.

- Biometric Based Payments : Biometric-based payments, such as facial and fingerprint recognition, will become increasingly popular in the next few years.

- Internet of Things (IoT) Based Payments : IoT-based payments, such as payments with smart devices, will become increasingly popular in the next few years.

Conclusion

PayPal has become one of the world’s largest digital payments companies, with more than 440 million active users worldwide. In recent years, PayPal has transformed into a broader digital payments company, with the acquisition of several digital payments companies and the introduction of new features.

In the future, digital payments will become increasingly popular and diverse, with trends such as blockchain-based payments, mobile, biometrics and IoT. As one of the world’s largest digital payments companies, PayPal is strategically positioned to face the future of digital payments.