Difference between PayPal and Venmo: Which is Better?

In an increasingly advanced digital world, online payments are becoming increasingly popular. Two of the most popular online payment services are PayPal and Venmo. Even though both are owned by the same company, namely PayPal Holdings, Inc., they both have different features and functions. In this article, we’ll discuss the differences between PayPal and Venmo, and which one is better for you.

What is PayPal?

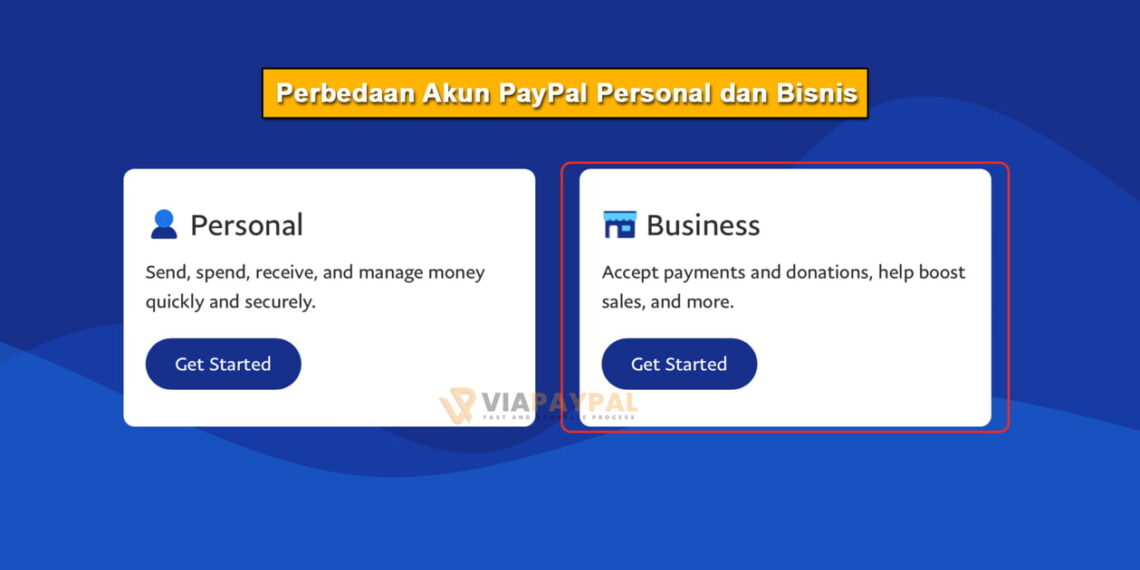

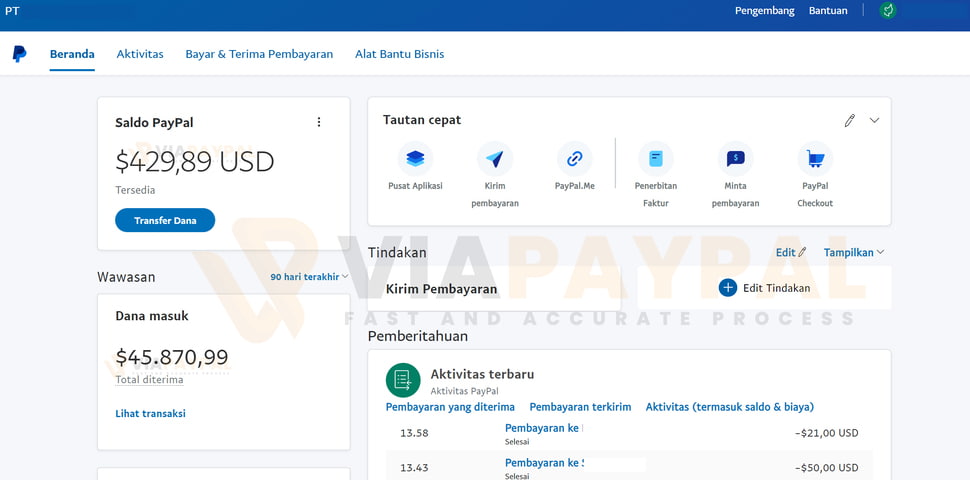

PayPal is an online payment service launched in 1998. PayPal allows users to make online payments using a bank account, credit card, or PayPal balance. PayPal also allows users to accept payments from other people, either directly or via invoice.

PayPal has a variety of features, including:

- Online payments using a bank account, credit card or PayPal balance

- Receive payments from others

- Sending invoices to other people

- Manage PayPal balance

- Using PayPal for online payments on various websites

What is Venmo?

Venmo is an online payment service launched in 2009. Venmo allows users to make online payments using a bank account, credit card, or Venmo balance. However, Venmo focuses more on social payments, where users can share their transactions with friends on social media.

Venmo has a variety of features, including:

- Pay online using a bank account, credit card, or Venmo balance

- Share transactions with friends on social media

- Use emotions and comments to add context to transactions

- Using Venmo for online payments on various websites

- Manage Venmo balance

Difference between PayPal and Venmo

Here are some differences between PayPal and Venmo:

- Focus : PayPal focuses more on safe and easy online payments, while Venmo focuses more on social payments that allow users to share their transactions with friends on social media.

- Feature : PayPal has more features, including sending invoices and managing balances. Venmo is simpler and only has a few basic features.

- Cost : PayPal has higher fees than Venmo. PayPal charges 2.9% + $0.30 for each transaction, while Venmo only charges 3% for credit card transactions.

- Social media connections : Venmo has stronger social media connections than PayPal. Venmo allows users to share their transactions with friends on social media, while PayPal does not have this feature.

- Security : Both have equally good security. PayPal and Venmo both have SSL encryption and other safeguards to protect user transactions.

Which one is better?

The choice between PayPal and Venmo depends on your needs. If you want to make safe and easy online payments, then PayPal might be better for you. However, if you want to make social payments that allow you to share transactions with friends on social media, then Venmo may be better for you.

Here are some situations where you might want to use PayPal:

- You want to make safe and easy online payments.

- You want to receive payments from other people.

- You want to send an invoice to someone else.

- You want to manage your balance.

Here are some situations where you might want to use Venmo:

- You want to make social payments that allow you to share transactions with friends on social media.

- You want to make an online payment using a bank account or credit card.

- You want to use emotions and comments to add context to the transaction.

Conclusion

PayPal and Venmo are two popular online payment services. Even though they both have different features and functions, they both have equally good security. The choice between PayPal and Venmo depends on your needs. If you want to make safe and easy online payments, then PayPal might be better for you. However, if you want to make social payments that allow you to share transactions with friends on social media, then Venmo may be better for you.