PayPal Pay in 4: Flexible Payment Ease

In recent years, online payment systems have developed rapidly, providing consumers with a wide choice of payment methods that are safe and easy to use. One popular payment solution is PayPal, which offers a variety of features and services to make online transactions easier. One of PayPal’s most interesting features is PayPal Pay in 4, which allows users to pay for their purchases in four installments.

In this article, we’ll talk about PayPal Pay in 4, including how it works, the advantages and disadvantages, and whether PayPal Pay in 4 can be used anywhere.

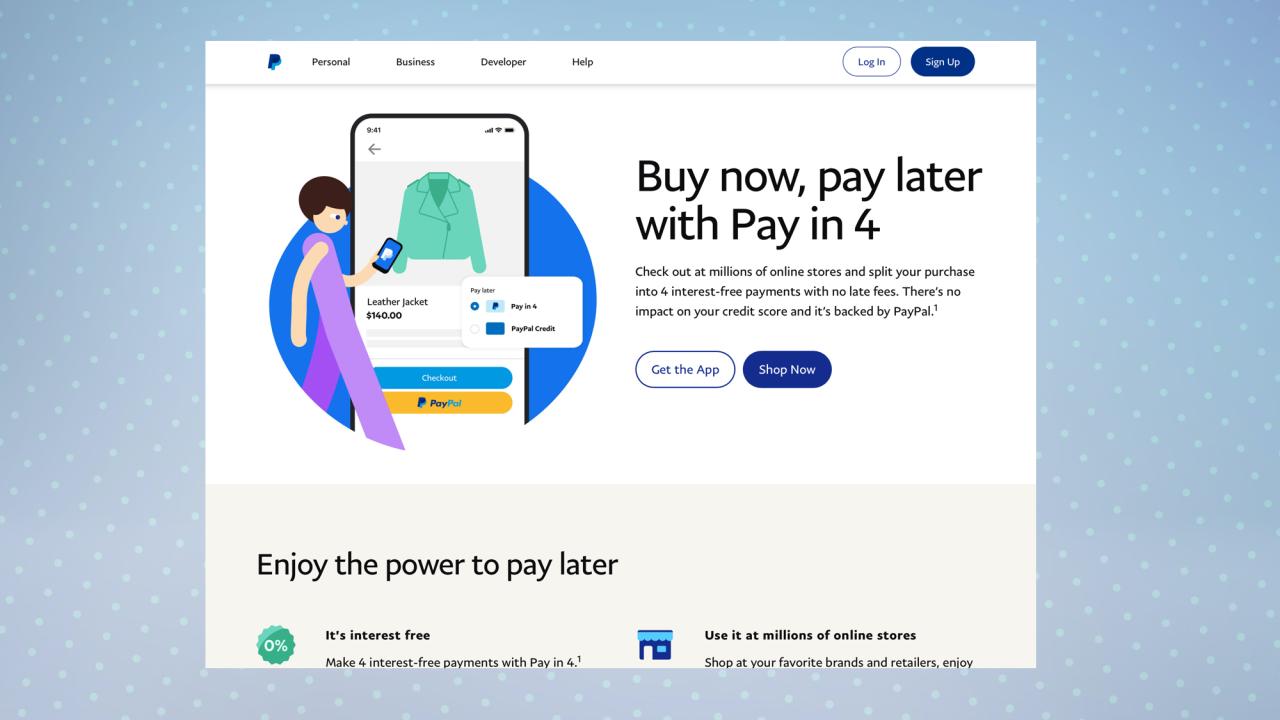

What is PayPal Pay in 4?

PayPal Pay in 4 is a payment feature that allows users to pay for their purchases in four installments. This feature is aimed at helping consumers better manage their budgets and allowing them to pay for their purchases over a longer period of time.

With PayPal Pay in 4, users can split their payments into four equal installments, with equal time intervals between installments. For example, if a user buys goods worth IDR 1,000,000, they can pay IDR 250,000 every month for four months.

How PayPal Pay in 4 Works

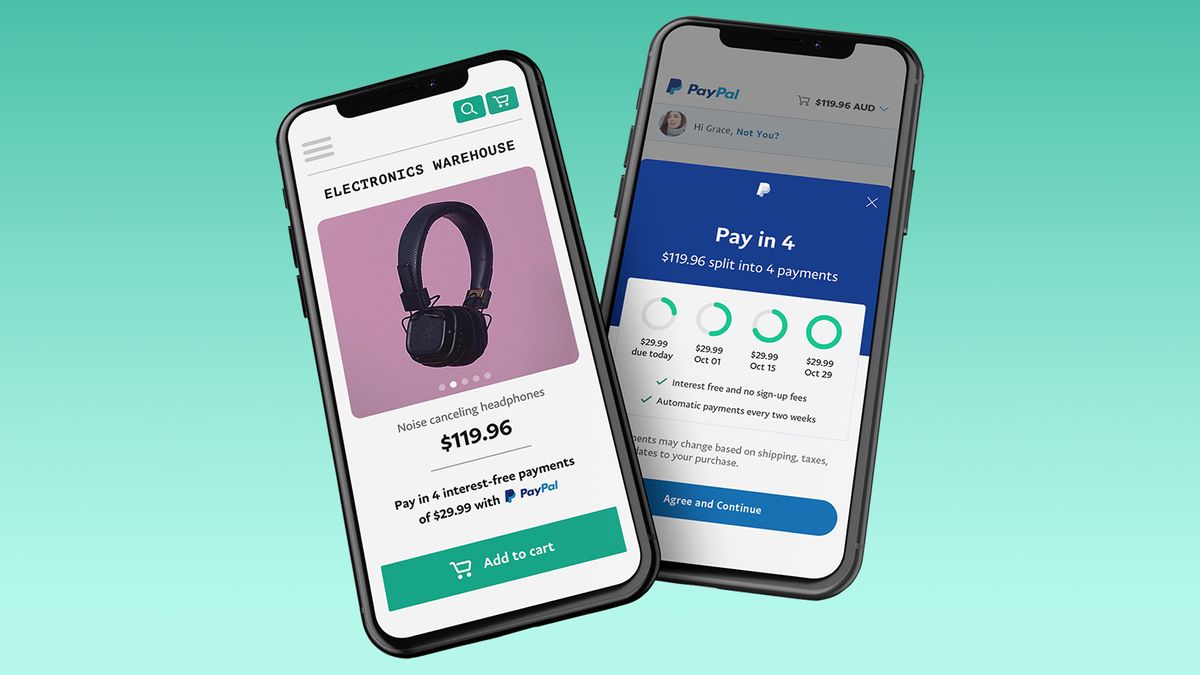

The way PayPal Pay in 4 works is very simple. Following are the steps that need to be followed:

- Users must have an active PayPal account and sufficient funds to make transactions.

- Users select the goods or services they wish to purchase and select PayPal as the payment method.

- On the payment page, users can select the “Pay in 4” option as the payment method.

- Users must agree to PayPal Pay in 4’s terms and conditions, including the payment schedule and associated fees.

- Users can choose the payment date for each installment and ensure that there are sufficient funds to carry out the transaction.

Advantages of PayPal Pay in 4

PayPal Pay in 4 has several advantages that make it an attractive choice for consumers. Here are some of the main advantages:

- Ease of payment : PayPal Pay in 4 allows users to pay for their purchases in four installments, making it easier to manage a budget.

- Flexible quality : Users can choose the payment date for each installment, making them more flexible in managing finances.

- There are no additional fees : PayPal does not charge any additional fees to use PayPal Pay in 4, making it a cost-effective option.

- Safe and reliable : PayPal is a trusted and secure brand, so users can feel confident that their transactions will be carried out safely.

Disadvantages of PayPal Pay in 4

While PayPal Pay in 4 has several advantages, there are also some disadvantages to consider. Here are some of the main drawbacks:

- Limitation on payment amount : PayPal Pay in 4 is only available for purchases of relatively small amounts, usually under IDR 10,000,000.

- Time limitations : Payment must be completed within 4 months, otherwise additional fees will apply.

- Need sufficient funds : Users must have sufficient funds to carry out transactions and pay installments.

Can PayPal Pay in 4 Be Used Anywhere?

PayPal Pay in 4 is available at various merchants that participate with PayPal, but not all merchants accept PayPal Pay in 4. Before making a transaction, make sure the merchant you choose accepts PayPal Pay in 4.

Additionally, PayPal Pay in 4 is also available in several countries, including the United States, Australia, Canada, and several European countries. However, some countries may have different terms and conditions for using PayPal Pay in 4.

Conclusion

PayPal Pay in 4 is a flexible and easy-to-use payment feature, making it an attractive option for consumers. With advantages such as ease of payment, flexibility, and no additional fees, PayPal Pay in 4 can help consumers better manage their budgets.

However, keep in mind that PayPal Pay in 4 has several drawbacks, such as limited payment amounts and time. Therefore, it is important to understand the terms and conditions before using PayPal Pay in 4.

As such, PayPal Pay in 4 may be a viable option for consumers who wish to pay for their purchases in four installments, provided they understand and comply with the applicable terms and conditions.