PayPal Stock: A Comprehensive Overview

PayPal is one of the world’s largest financial technology companies, providing online and offline payment services to billions of users worldwide. Since its founding in 1998, PayPal has grown into one of the leading financial technology companies, with a market value of more than $200 billion. In this article, we will discuss PayPal stock, including the company’s history, financial analysis, and future prospects.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin, with the aim of creating an online payment system that is safe and easy to use. The company was originally called Confinity, and then changed its name to PayPal in 2001. In 2002, PayPal was acquired by eBay for $1.5 billion. However, in 2015, eBay decided to spin off PayPal into an independent company.

Financial Analysis

PayPal has had excellent financial performance in recent years. Following are some financial data for this company:

- Revenue: $15.4 billion (2020)

- Net profit: $2.4 billion (2020)

- Total assets: $70.4 billion (2020)

- Total liabilities: $34.5 billion (2020)

- Price to earnings ratio (PE Ratio): 55.6 (2020)

PayPal had huge revenues, namely $15.4 billion in 2020. This company’s revenue increased by 22% from 2019. The company’s net profit also increased by 25% from 2019, namely $2.4 billion. The price to earnings ratio (PE Ratio) of this company is 55.6, which shows that this company has a high market value.

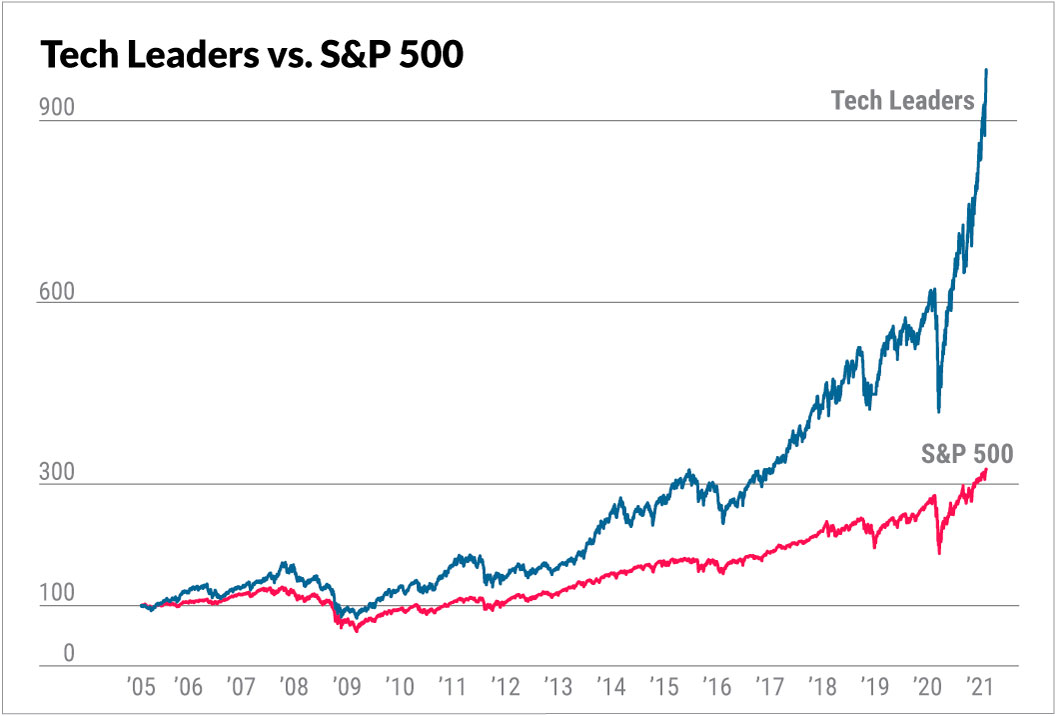

Sector and Industry

PayPal operates in the technology and financial services industry. The company provides online and offline payment services to billions of users worldwide. The technology and financial services sector is a very dynamic and fast-growing sector, so this company has enormous growth potential.

Competitors

PayPal has several major competitors in the financial services industry, including:

- Visa

- MasterCard

- American Express

- Stripe

- Square

However, PayPal has several advantages that make this company one of the largest financial technology companies in the world. One of the advantages of this company is its very large user network, namely more than 430 million active users. Another advantage is the company’s ability to offer secure and easy-to-use payment services.

Future Prospects

PayPal has very bright future prospects. Here are some factors that may influence the prospects of this company:

- Digital economic growth: The very fast growth of the digital economy can increase this company’s revenue.

- New service development: The company can develop new services to increase revenue and enhance the company’s capabilities.

- Technology development: Technology development can improve a company’s ability to offer safer and easier-to-use payment services.

However, the company also has several risks that could affect its future prospects, including:

- Industry competition: Very tight industry competition can affect the revenue of this company.

- Regulatory changes: Regulatory changes may impact a company’s ability to offer payment services.

Conclusion

PayPal is one of the world’s largest financial technology companies, with a market value of more than $200 billion. This company has a long history and has developed into one of the leading financial technology companies. Financial analysis of this company shows that this company has excellent financial performance, with large revenues and increasing net profits.

This company has a very dynamic and fast-growing sector and industry, so this company has enormous growth potential. This company’s competitors are some of the largest financial technology companies in the world, but this company has several advantages that make this company one of the largest financial technology companies in the world.

The future prospects for this company are very bright, with several factors that can influence the company’s prospects, including the growth of the digital economy, the development of new services, and technological development. However, the company also has several risks that could affect its future prospects, including industry competition and regulatory changes.

In conclusion, PayPal is one of the largest financial technology companies in the world, with very bright future prospects. This company has a long history and has developed into one of the leading financial technology companies. Financial analysis of this company shows that this company has excellent financial performance, with large revenues and increasing net profits.

Recommendation

Based on the above analysis, we recommend buying PayPal shares for the long term. This company has very bright future prospects, with several factors that can influence the prospects of this company. However, you need to remember that stock investment always has risks, so further analysis needs to be done before making an investment decision.

Risk

PayPal stock investments involve several risks, including:

- Market risk: Fluctuations in share values can affect investment value.

- Industrial risks: Changes in industrial policies can affect a company’s prospects.

- Company risk: Changes in company policies can affect the company’s prospects.

However, this company has been operating for more than 20 years and has grown into one of the largest financial technology companies in the world. Therefore, we believe that the risks of investing in PayPal shares can be managed well.

Final Conclusion

PayPal is one of the largest financial technology companies in the world, with very bright future prospects. This company has a long history and has developed into one of the leading financial technology companies. Financial analysis of this company shows that this company has excellent financial performance, with large revenues and increasing net profits.

We recommend purchasing PayPal shares for the long term, but keep in mind that stock investments always come with risks. Therefore, it is necessary to carry out further analysis before making an investment decision.