PayPal: Digital Payments “Beyond Live” Into the Era of Integrated Finance

In the last few decades, developments in digital technology have changed the way we carry out financial transactions. One important example of this change is the emergence of digital payment systems such as PayPal. Since its founding in 1998, PayPal has become one of the world’s largest online payment platforms, with millions of users in more than 200 countries.

History of PayPal

PayPal was founded by Peter Thiel and Max Levchin, two Stanford University students who had a vision to create a digital payment system that was easier, faster, and more secure. Initially, PayPal was known as Confinity, a PDA payments platform that allowed users to carry out financial transactions using handheld devices. In 2000, Confinity merged with X.com, an online financial company founded by Elon Musk.

In 2002, PayPal was acquired by eBay, one of the world’s largest online marketplaces, and became a subsidiary of that company. In 2015, PayPal was separated from eBay and became an independent company again.

How PayPal Works

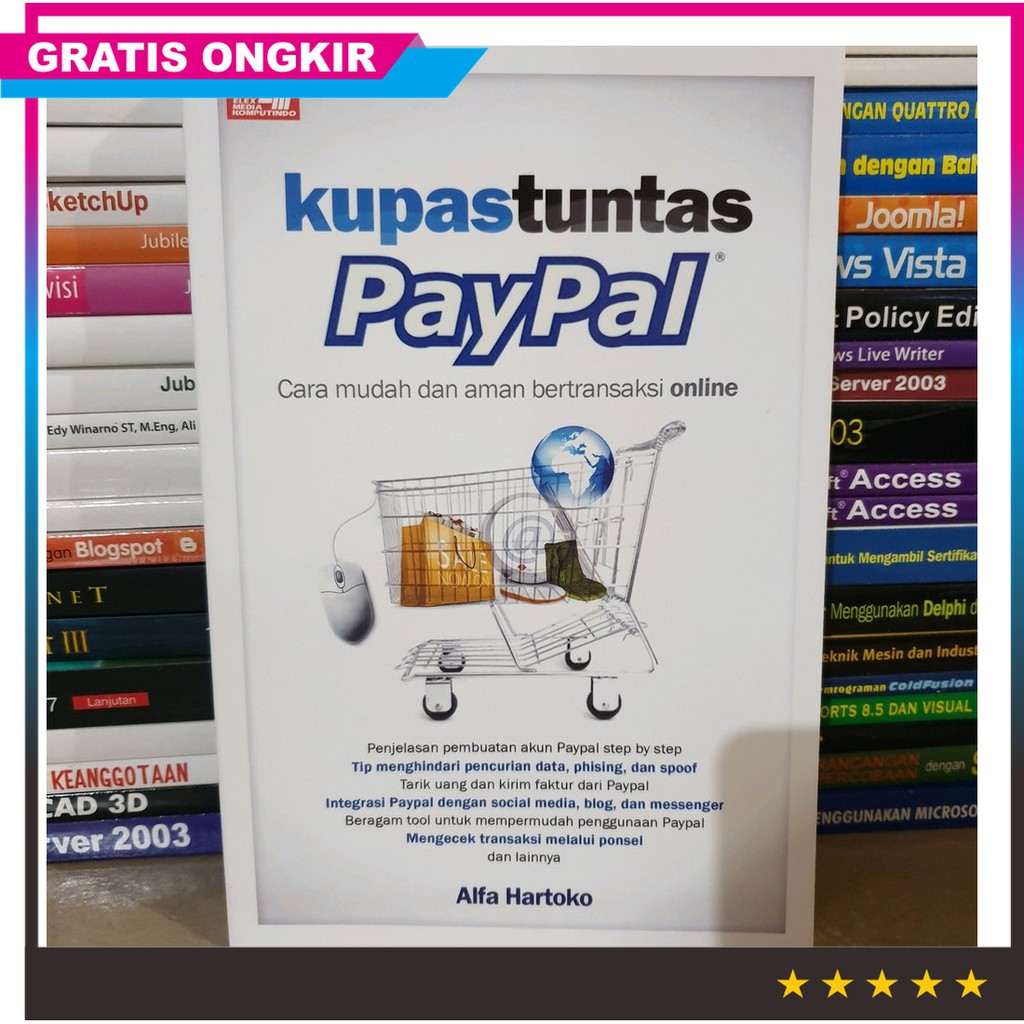

PayPal uses encryption technology to protect users’ financial transactions. Here’s how PayPal works:

- Create an Account : Users create a PayPal account by filling out an online registration form.

- Linking a Credit or Debit Card : Users connect a credit or debit card to a PayPal account to make transactions.

- Sending Money : Users can send money to other users via email address or phone number.

- Receiving Money : Users can receive money from other users via email address or phone number.

PayPal Security Features

PayPal uses several security features to protect users’ financial transactions, including:

- Encryption : PayPal uses encryption technology to protect users’ financial transactions.

- Two Factor Authentication : PayPal offers two-factor authentication to increase transaction security.

- Activity Monitoring : PayPal monitors user account activity to detect suspicious transactions.

Benefits of Using PayPal

Using PayPal has several benefits, including:

- Easy and Fast : PayPal allows users to make financial transactions easily and quickly.

- Safe and Reliable : PayPal uses encryption technology to protect users’ financial transactions.

- Global Access : PayPal can be accessed from more than 200 countries in the world.

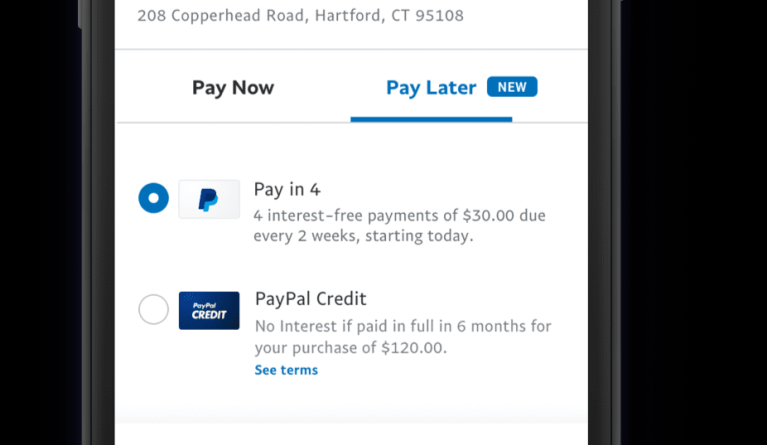

- Various Payment Options : PayPal offers a variety of payment options, including credit card, debit, and bank transfer.

Disadvantages of Using PayPal

Using PayPal also has some drawbacks, including:

- Transaction Fees : PayPal charges transaction fees for some types of transactions.

- Deadline : PayPal has a time limit for making transactions, which can limit user flexibility.

- Dependence on Technology : PayPal requires a stable internet connection to work properly.

The Future of PayPal

In recent years, PayPal has made significant changes to improve services and features. Some examples of these changes include:

- Integration with Blockchain : PayPal has announced integration with blockchain to increase transaction security and efficiency.

- “Beyond Live” Digital Payments : PayPal has announced plans to launch a “Beyond Live” digital payment system that can carry out financial transactions in real-time.

- Partnership with Fintech Companies : PayPal has partnered with several fintech companies to improve services and features.

Conclusion

PayPal has become one of the world’s largest online payment platforms, with millions of users in more than 200 countries. With strong security features and a variety of payment options, PayPal has become the top choice for many people. Despite some shortcomings, PayPal continues to make changes to improve services and features. In recent years, PayPal has announced several significant changes, including integration with blockchain and “Beyond Live” digital payments. In doing so, PayPal continues towards an era of integrated finance that is safer, faster and easier.